Pepe’s (PEPE) recent price movements seem to indicate the end of a consolidation phase. However, a breakout confirmation appears necessary for PEPE to start rising. Although the prospects of an increase are promising, there are several important points investors should consider before purchasing this meme coin. Let’s take a look.

Pepe’s Price Indicates a Potential Turnaround

For the past seven weeks, the cryptocurrency Pepe has been trading within a stable range. Prices have fluctuated between approximately $0.00000581 and $0.0000109. During this period, prices consolidated near the lower boundaries of the range and then experienced a rapid recovery. Now, investors are waiting for this range’s lower boundary to remain as a support level and for a new upward wave to begin.

So far, Pepe’s price has been trending above the lowest levels, and buying pressure seems to be increasing. If this upward momentum continues, investors can expect Pepe to test and surpass the decreasing resistance levels that connect the recent lower peaks. This breakout could initiate a rally towards the middle point of the range, considered to be around $0.00000835, which would confirm the upward price movement.

If Whales Continue Buying Frenzy, Watch These Levels

If the buying frenzy by PEPE whales continues, the meme coin Pepe’s price could likely rise to the highest level of the range at $0.0000109, achieving a 56% gain. However, in some cases, this high range deviation could push Pepe’s price beyond the anticipated level and reach a new annual high.

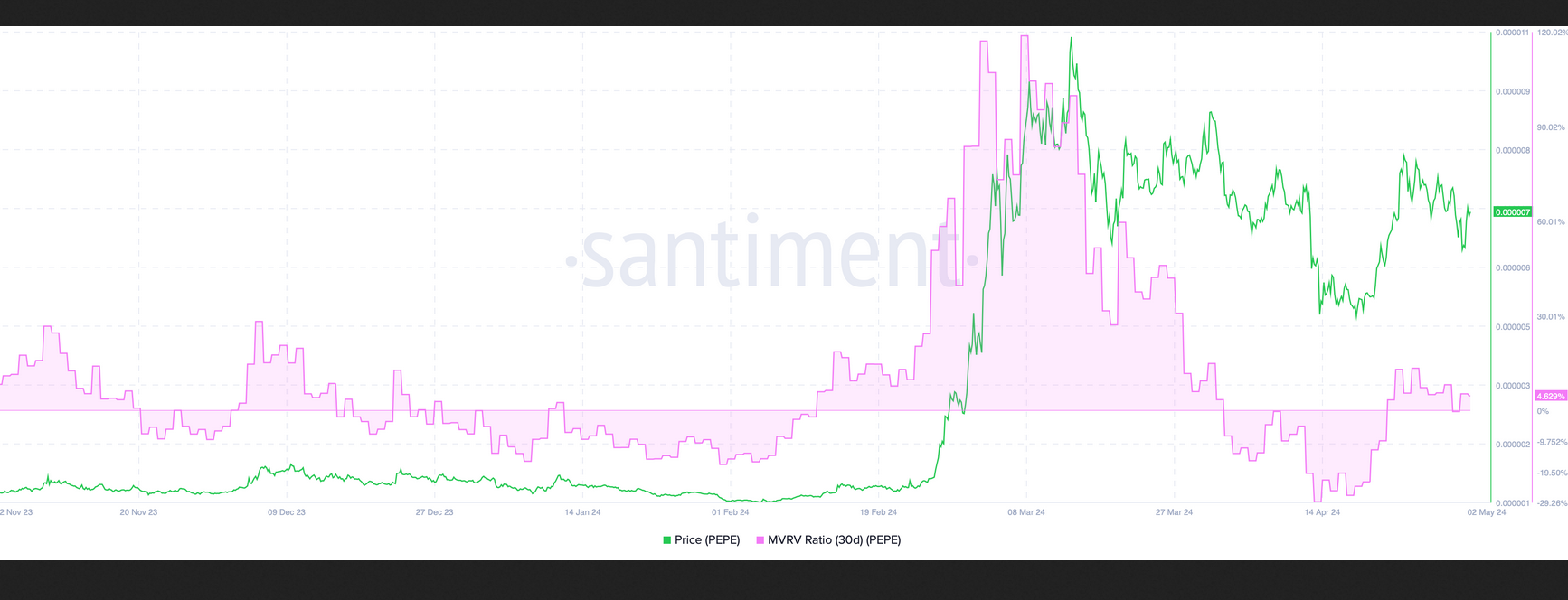

One of the factors supporting this potential upward movement is Santiment’s Market Value to Realized Value (MVRV) ratio indicator. This indicator is used to track the average profit or loss of investors who purchased Pepe.

Currently, the 30-day MVRV at 4.86% indicates that investors who bought Pepe last month have an average profit of 4.86%. This is a relatively neutral figure. Since the PEPE price rallied from a lower level on April 13, showing a 28% recovery, it indicates that short-term buyers incurred losses. Typically, long-term or value investors tend to accumulate altcoins sold at a discount by short-term investors.

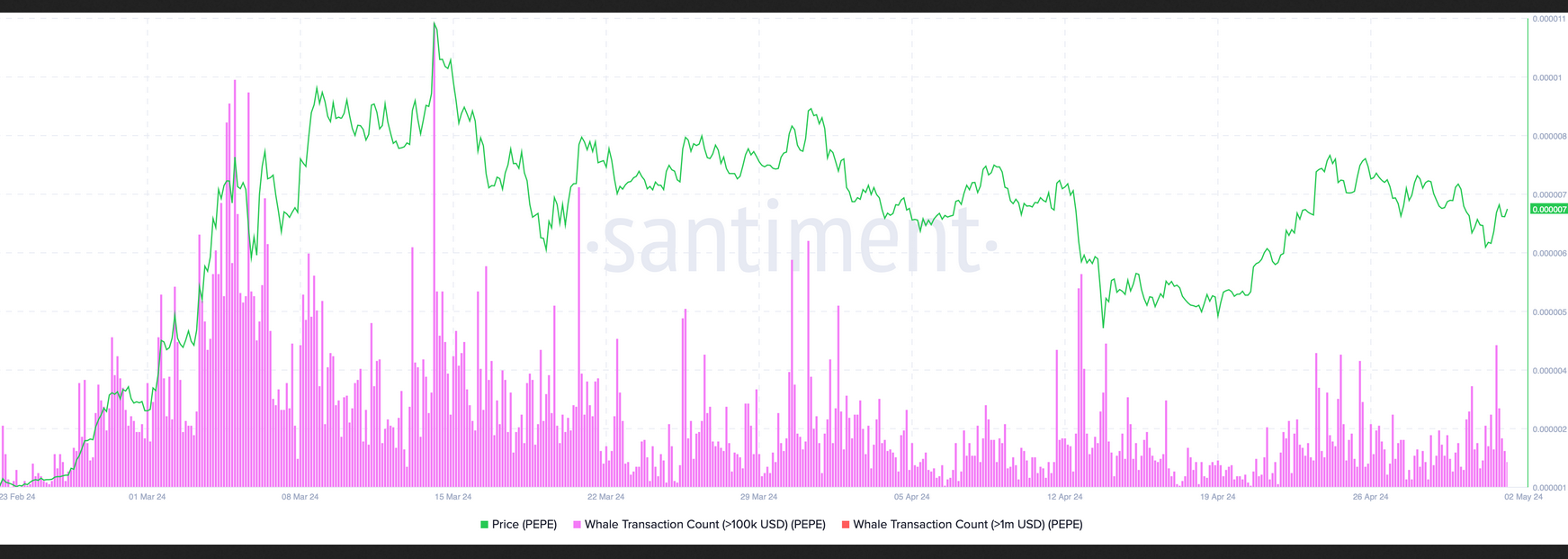

PEPE Bags Are Being Filled

Since the drop on April 13, PEPE has gained about 40% in value, indicating that long-term investors have been filling their PEPE bags. This accumulation has been further strengthened with the contribution of whales. Around April 13, when the PEPE price dropped to double digits, there was a clear increase in Whale Transaction Count (WTC). This situation shows that whales or smart money investors took advantage of the drop on April 13 and followed a similar strategy during the drop on May 1.

In summary, the future looks promising for PEPE’s price. However, this situation is entirely dependent on Bitcoin‘s performance. If PEPE falls below the $0.00000581 level, it could signal the start of a lower trend under bear control. In such a case, PEPE could experience a 15% drop and either visit the support point at $0.00000490 or test the April 13 low of $0.00000381 with a more severe correction.

Türkçe

Türkçe Español

Español