The price of BTC reached its all-time high about 2 years ago and then entered a period of extreme selling. Last year, around this time, we witnessed BTC dropping below the previous peak level of the bull season and reaching the $15,500 range. In the past year, BTC has doubled and continues to rise. So, has the crypto bull begun?

When is the Crypto Bull Season?

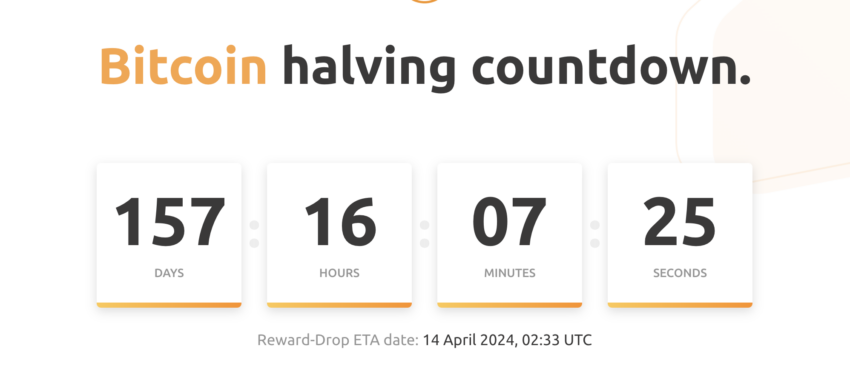

Historical data revolves around four-year cycles, and the halving event that occurs every 210,000 blocks is crucial for cryptocurrencies. This halving triggers significant movements in the BTC price. According to NiceHash, the next <a href="https://en.coin-turk.com/what-is-happening-in-the-bitcoin-market/”>Bitcoin halving will occur in 157 days. This means that the bull season, with significant and stable rallies, is just around the corner.

Secondly, according to the latest data from Glassnode, whales are still actively accumulating. Investors with smaller amounts of funds in their accounts are also doing the same. For example, wallets holding less than 10 BTC accumulated 191,600 BTC worth $3.1 billion in the past month.

ETF Approval and the Crypto Bull

The third significant evidence that indicates the beginning of the bull season is the competition among trillion-dollar giants like BlackRock to launch spot Bitcoin ETFs. This race is expected to conclude no later than the first quarter of next year. The upcoming halving, the return to accumulation by investor groups, and the ETF trio suggest that next year is preparing for a real bull season.

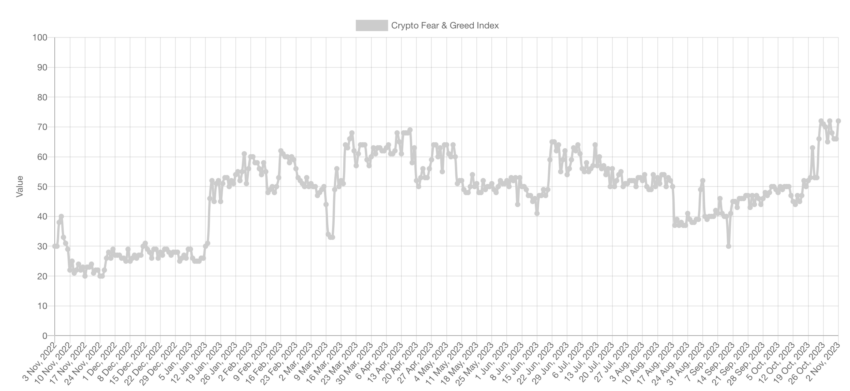

Lastly, on November 6th, the Bitcoin Fear and Greed Index reached 74 out of 100, which is a record high for investors. The fact that risk appetite is increasing to such an extent after challenging periods of extreme selling is the fourth evidence that the bull season is about to begin.

During these enthusiastic periods in the market, investors tend to sell, and in the past two years, we have experienced similar times with interim rises. However, the current upward period is different. Despite the high enthusiasm, investors who continue to accumulate believe that the rally will continue.

In summary, the four strong signals indicate that the crypto bull season has begun or is about to begin. However, if ETF applications are rejected, the US imposes broad bans on cryptocurrencies, the Fed demonstrates its intention to raise interest rates to 7%, and global inflation continues to rise, the four bullish signals mentioned above can be turned upside down. It should be noted that BTC is still very young, and the accuracy of historical data is being tested for the first time in such a challenging environment.