While the uncertainties in cryptocurrencies have been troubling investors for months, Bitcoin price experienced a complete crash after its ATH in March. Generally, this situation is associated with halving and its aftermath, while the efforts of MT. GOX exchange to make payments to creditors and the sales decisions taken by governments are also believed to be related to this process. Amidst all this, significant institutions worldwide continue to make statements about the future of BTC.

JP Morgan’s View on Cryptocurrency

A recent cryptocurrency statement by JP Morgan, one of the world’s largest banks, has reassured investors. According to the statement by JP Morgan, one of the cornerstones of the world economy and the largest bank in the US, a price recovery in cryptocurrencies may begin in August.

In an environment where there is no development regarding the uncertainties in the US economy and when interest rate cuts will occur, investors are also seen to be anxious. Considering the general upward trend covering the end of the year and the year after the 4-year halving cycles, JP Morgan’s statement may become more meaningful.

On the other hand, considering how the US elections will result, Trump’s approach to cryptocurrency, and the role the US may assume in the future, the view that cryptocurrencies, especially BTC, may indeed experience a recovery in the coming months could gain more strength, although it remains just a view for now.

Current Status of Bitcoin and Ethereum

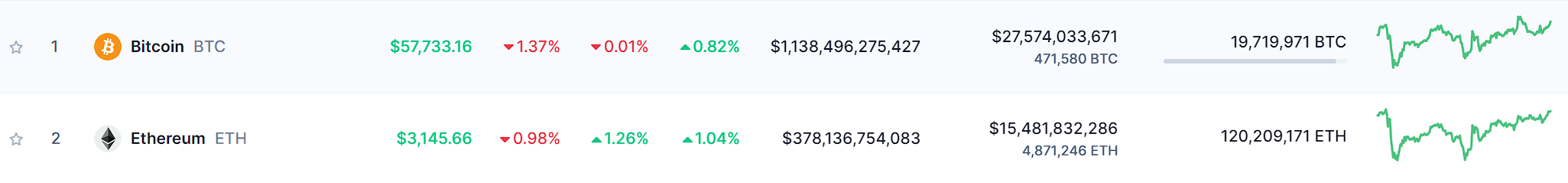

While all this was happening, BTC price was also under the watch of investors. After the US data announced in the past hours, BTC, which rose above $59,000, seems to have returned to the negative zone. Following a 0.01% drop in the last 24 hours, BTC is at $57,733.

On the other hand, a stronger outlook was noted in Ethereum, where questions about when ETFs will start trading are increasing. After a 1.26% rise in the last 24 hours, ETH is trading at $3,145. This rise has pushed ETH’s market cap above $378 billion.