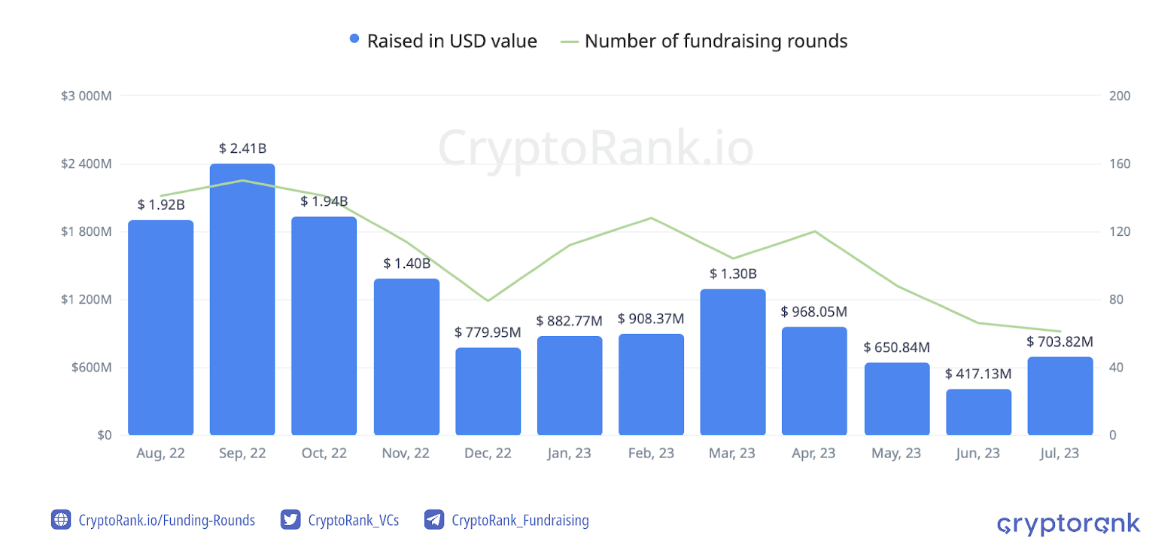

The cryptocurrency market showed relatively low volatility in July, while crypto ventures had a moderately successful month. According to CryptoRank’s data, although there was a slight decrease in the number of investment tours throughout the month, the amount of funds raised for the cryptocurrency sector increased by 64% in July 2023.

Funding Amount Decreased Despite Increased Activity in July

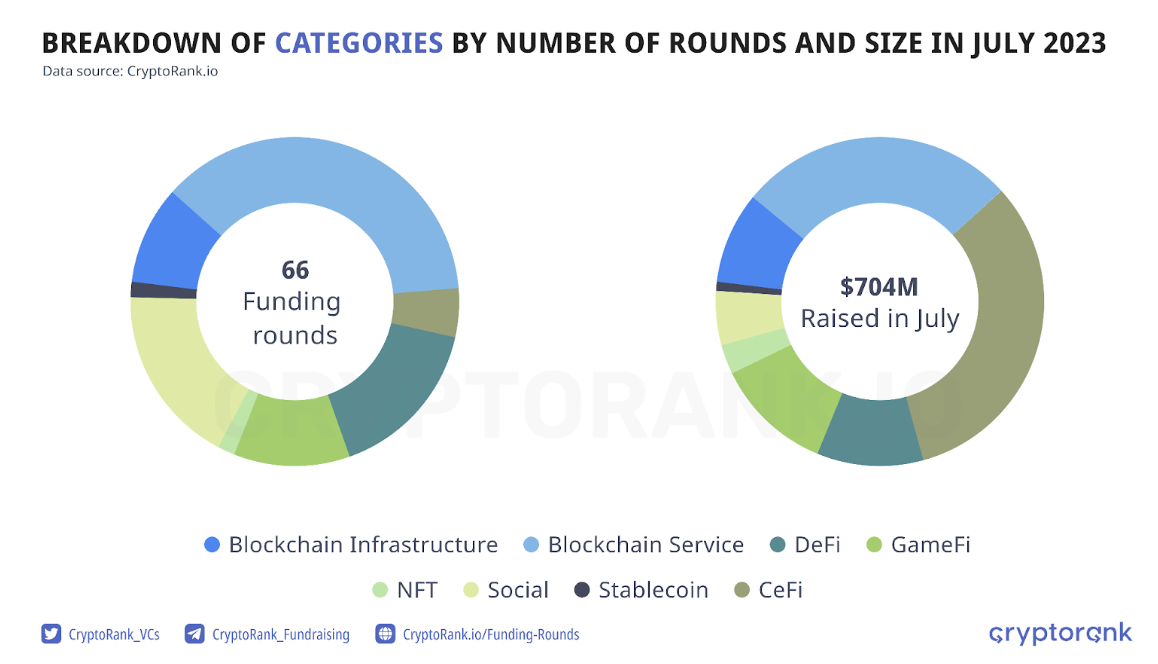

Despite the downward trend in commercial activity during the summer, data compiled by CryptoRank indicates a significant number of investments announced in July for crypto investments. Although the trading volume of the cryptocurrency market has significantly decreased, funds have invested a reasonable amount of money in ventures. Investments in crypto ventures reached $704 million, an increase of 68.8% throughout the month. Projects have raised over $5.8 billion in funds since the beginning of the year.

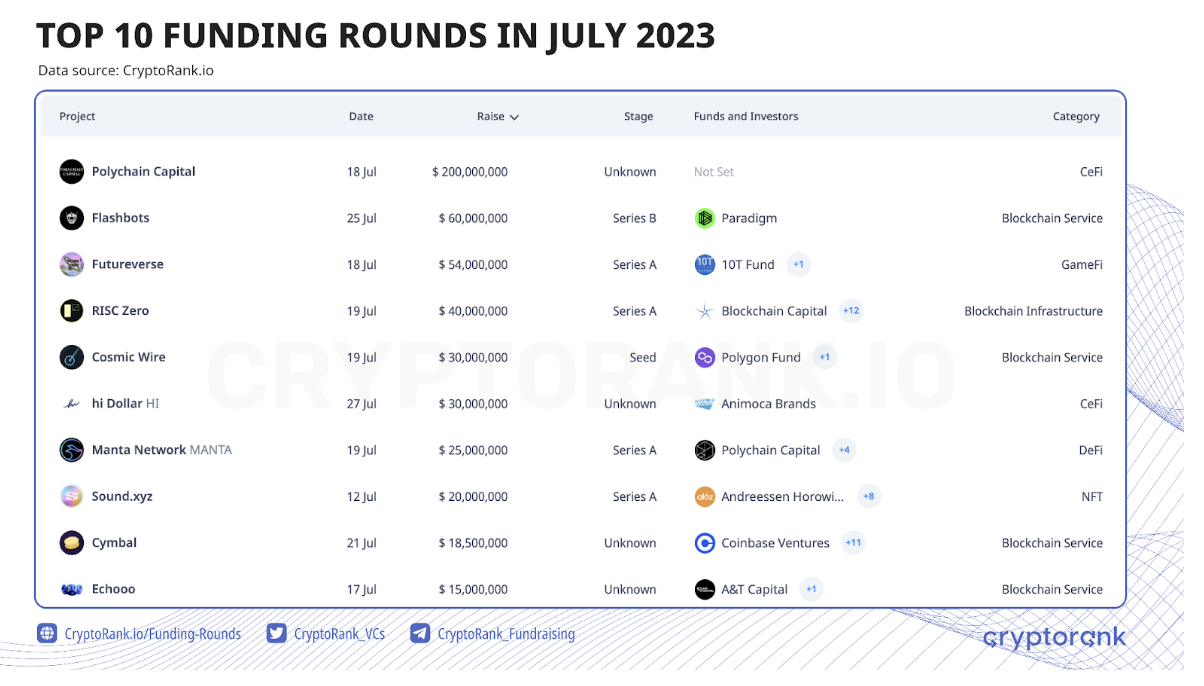

Meanwhile, the number of investment tours reached its lowest level since November 2020. The decrease in activity is believed to be seasonal, while the correlation between Bitcoin‘s price and the total funds raised has reversed. While the total amount of funds raised remained moderate in July, only one project was able to raise over $100 million. Traditionally, high-value funding tours are mostly directed towards later stage investments.

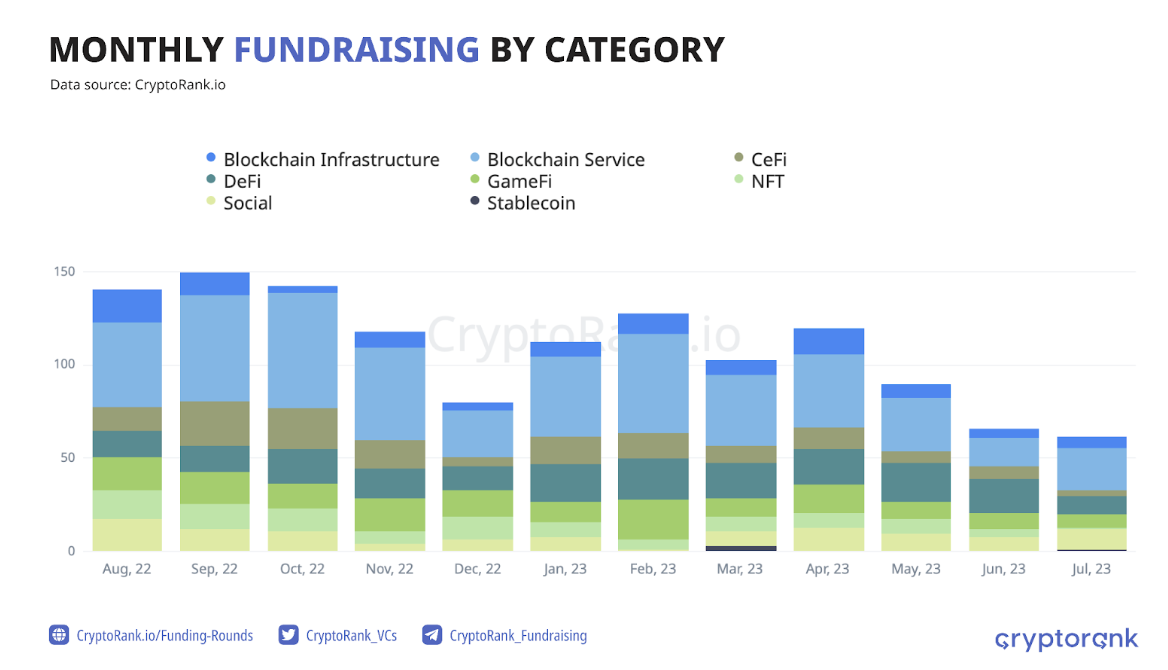

Trends in Crypto Investment Tours Categories

Data shows that the category of Blockchain Services, which includes various projects, continues to be the most popular category in crypto investment tours for the past few months. Overall, the distribution of investment tours by categories is not significantly different from previous months. The majority of projects in the Blockchain Services category aim to improve the usability of Blockchain infrastructure, which has recently become a significant trend.

The highest-profile investment tour among Blockchain Services was the B-Series investment tour of Flashbots, supported by Paradigm. The company, currently valued at $1 billion, has become the new unicorn of the Blockchain industry.

On the other hand, CeFi ventures attracted the most investments in July. Notably, Polychain Capital raised $200 million for a new fund.

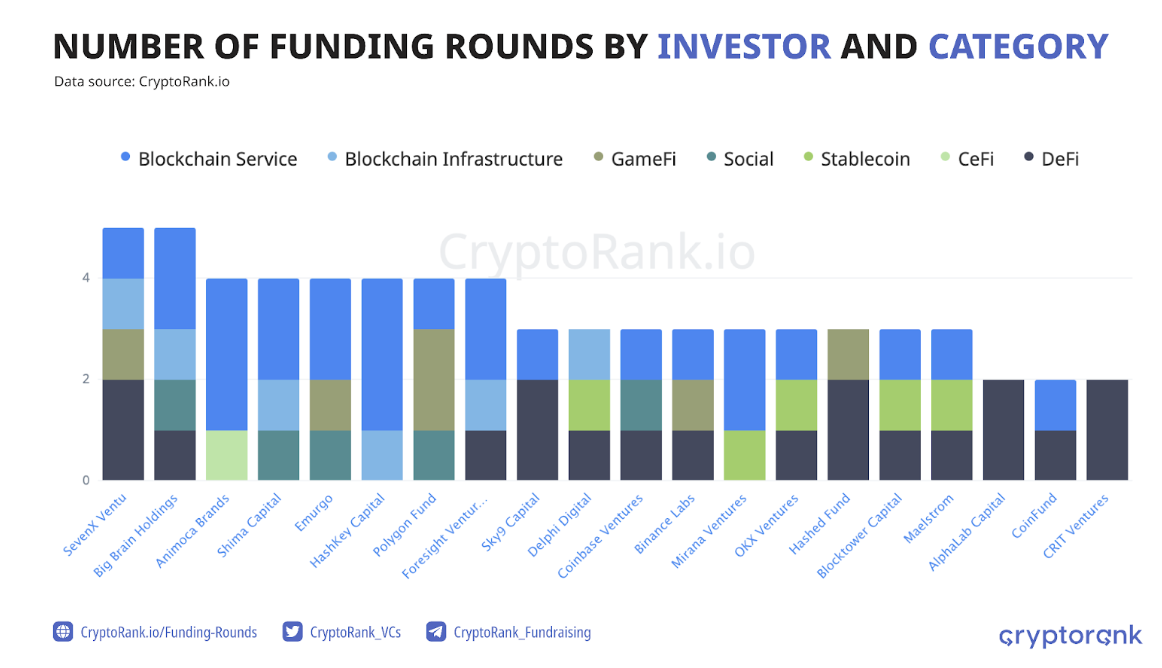

In the list of most active investors in July, major names such as Animoca Brands, HashKey Capital, Coinbase Venture, Delphi Digital, and Binance Labs are included. The data shows that active investors significantly invested in projects in the Blockchain Services category, with DeFi ranking second on the list.

According to current data, several cryptocurrency exchanges are among the most active investors in July. These centralized institutions are now an integral part of the Blockchain and regularly support young projects.

Geographical Distribution

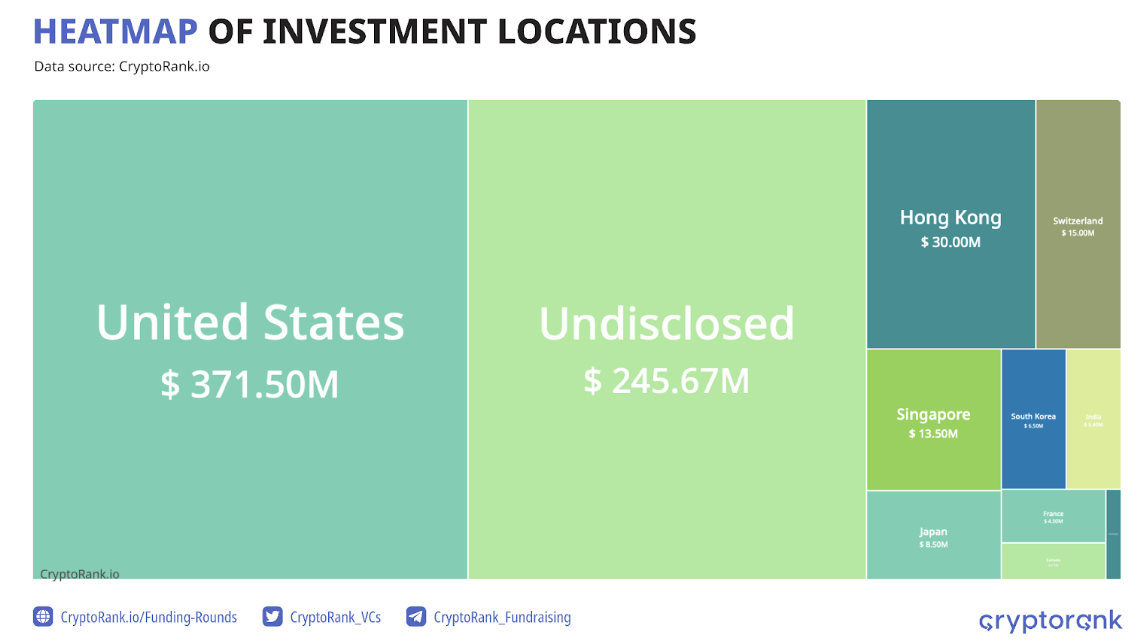

US-based ventures attracted the highest amount of investment in July, with an impressive $371 million. US-based ventures were followed by projects based in Hong Kong, Switzerland, and Singapore, excluding projects with undisclosed countries.

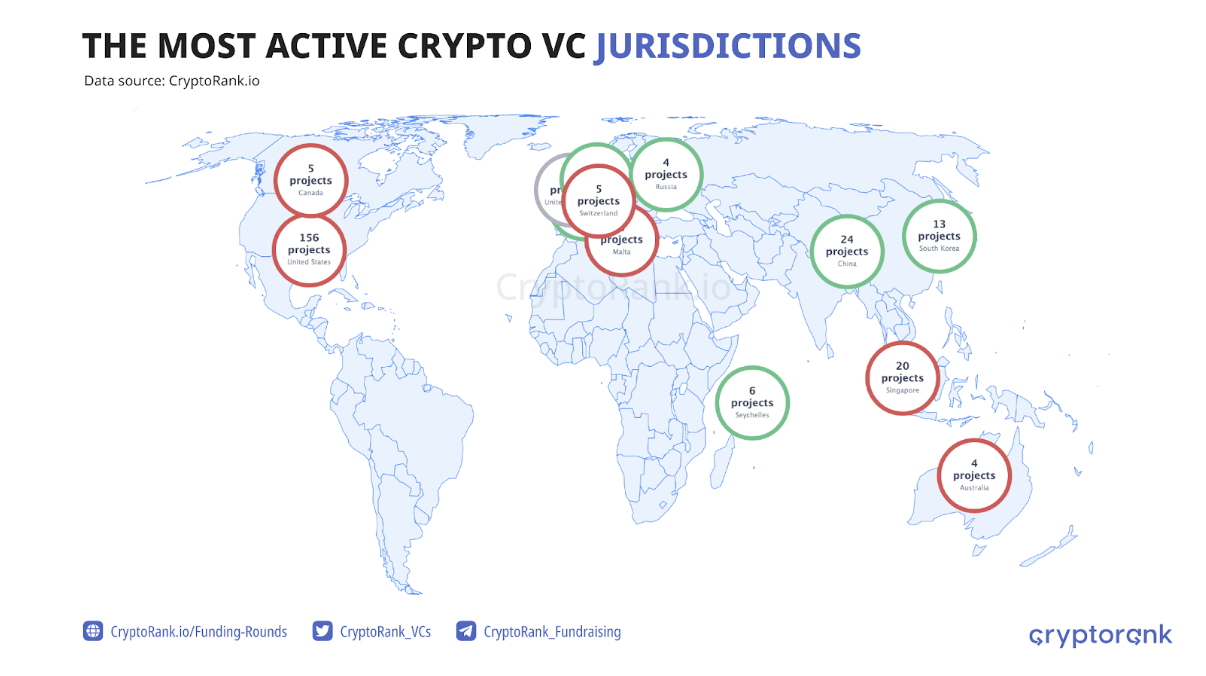

The most active investors in the cryptocurrency market in July were US-based funds, followed by funds from China, Singapore, and South Korea. Especially, Asian countries are currently among the most favorable markets for crypto projects.

It has been observed that project founders and developers in Asian countries have shown increasing interest in Blockchain. This trend continues to gain momentum, particularly due to the legal uncertainties faced by the US and European countries, further strengthening the position of Asian countries.

In summary, the cryptocurrency market did not experience a significant shock in July. Most projects continued to develop, and investors started to adopt a wait-and-see approach, taking more cautious steps. While a similar report on the first half of the year indicates a recovery in the growth of activity in the crypto fund-raising market, the slight increase observed in July indicates that the expected recovery has not yet begun. As long as market uncertainty continues, investors are not ready to take decisive steps in this direction. The introduction of clearer regulations and resolution of urgent issues in the market are expected to bring about a change.