Today is a dark day in the cryptocurrency market. The declines were extremely deep and impactful. This downturn caused the market to lose hundreds of billions of dollars in value. The first reaction to the declines came from Tron founder Justin Sun. Sun announced the steps he would take in response to this negative situation.

Justin Sun’s Move Against FUD

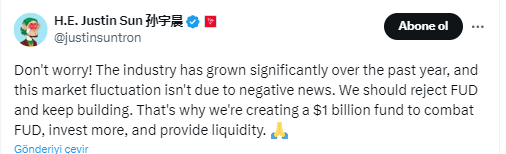

During turbulent times in the cryptocurrency market, Justin Sun decided to create a $1 billion fund. This step will help investors regain their confidence during periods of fear and uncertainty (FUD).

At the beginning of the week, early in Asian hours, rumors emerged that Justin Sun’s cryptocurrency positions were liquidated during a major market drop. These rumors spread after an X account shared liquidation details. However, Sun stated that these claims were “false” and emphasized that Tron rarely uses leveraged trading strategies.

Sun’s Statements

Sun stated that Tron focuses on activities that support the industry and innovators rather than leveraged trading. He mentioned that his company prioritizes activities such as developing projects and providing liquidity to teams. Additionally, he expressed that the $1 billion fund created against FUD would continue to support the industry.

Although Sun did not disclose the details of the fund, he emphasized that the Blockchain industry has shown significant growth over the past year. Sun’s statement resonated within the cryptocurrency community. Some individuals questioned Sun’s use of the word “rarely” and demanded more information. A Bitcoin investor, Jeff Kirdeikis, expressed his doubts by saying, “Buy $1 billion worth of BTC or you’re bluffing.”

Source of Rumors and Market Reactions

The tweet that started the liquidation rumors included a screenshot allegedly showing Sun’s crypto assets. However, this image was shared by the decentralized analysis platform Parsec and did not reference Sun.

Bitcoin fell by 14% in the last 24 hours, dropping to $52,400. The market value of the cryptocurrency decreased by 13% during the same period, falling to $1.03 trillion. Ethereum also dropped by 20.5%, falling to $2,300. At the same time, tech giants like Nasdaq and Amazon lost 3.4% in value last week following disappointing quarterly reports.

Last month, in response to the German government’s Bitcoin sales, Sun offered to buy all BTC in the country off-market. Additionally, he came back into the spotlight by purchasing 1,614 Ethereum ahead of the launch of spot Ethereum exchange-traded funds (ETFs). Sun stated that he would continue to maintain his belief and commitment to the Blockchain ecosystem.