Over the weekend, market volatility overshadowed the excitement surrounding the Bitcoin‘s halving event. With only four days left until the event, investors are more focused on the price rather than the long-anticipated network event. On April 15, regulators in Hong Kong approved Bitcoin and Ethereum ETFs. Here are two significant developments this week in Bitcoin’s agenda.

Final Days Before Halving

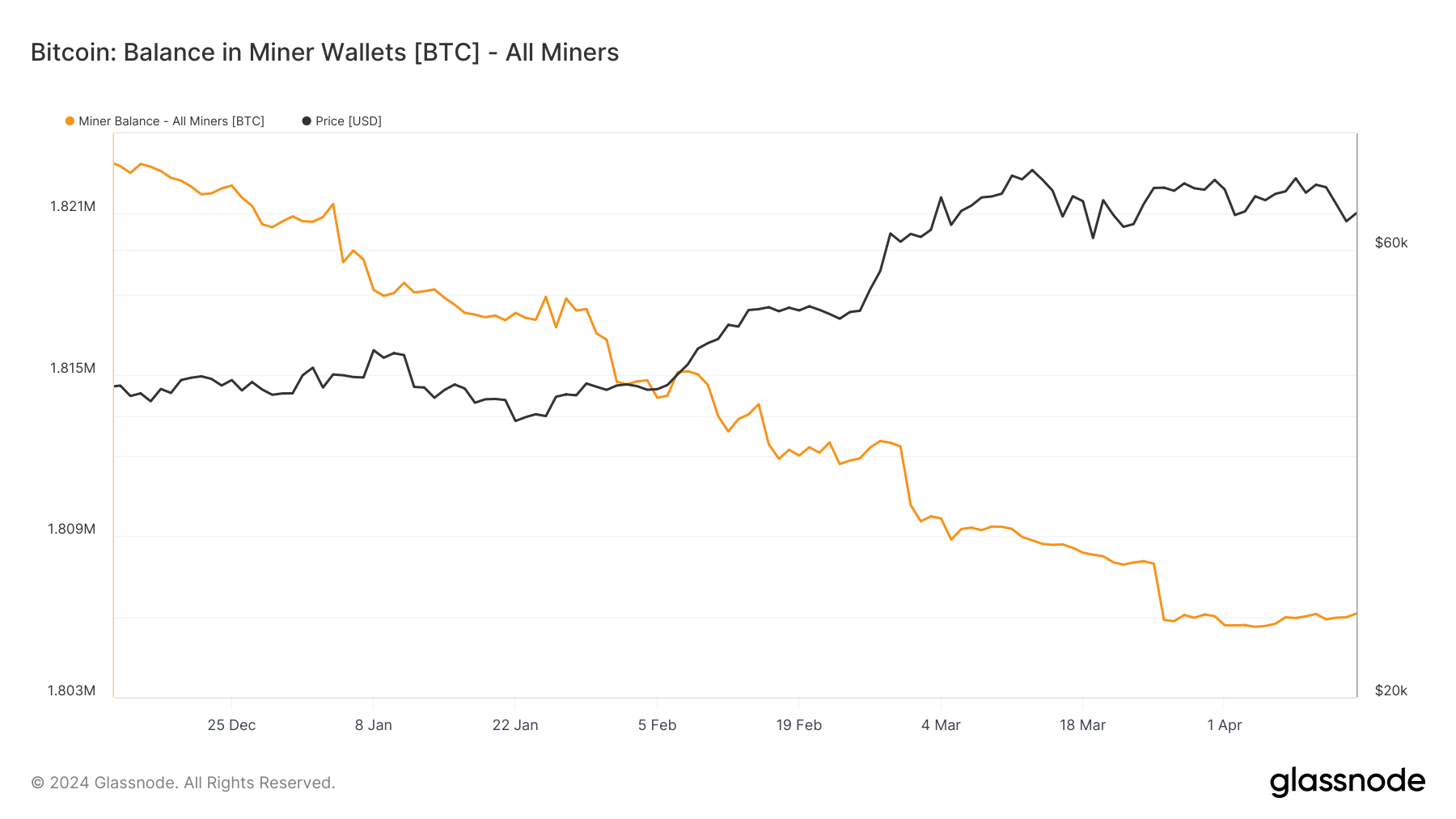

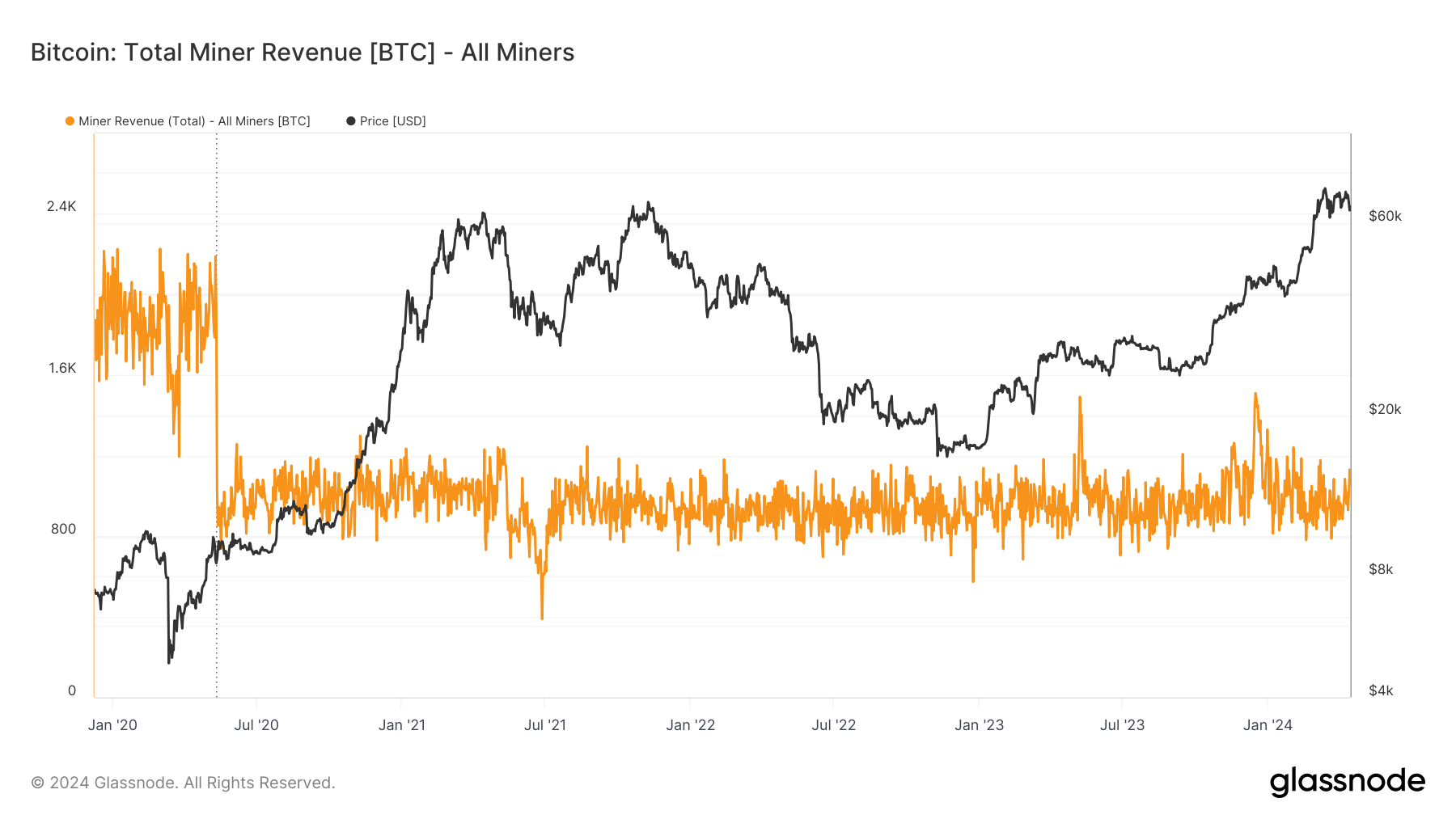

Miners are at the forefront of changes, facing an immediate reshaping of their revenue streams with a 50% reduction in new Bitcoin rewards per mined block to 3.125 Bitcoins. Recent studies show that miners have increased their selling pressure related to the event.

However, the latest data from the on-chain analysis firm Glassnode shows that the Bitcoin balance in known miner wallets has remained mostly stable since the end of March.

Meanwhile, revenues, including transaction fees, continue to operate at familiar levels. The current halving cycle’s sudden rises were last seen at the end of 2023 during the Ordinal increase.

New Development in the ETF Space

It is still unclear how US spot Bitcoin exchange-traded funds will react to the weekend’s volatility, but good news is starting to emerge. Reports indicate that regulators in Hong Kong have approved Bitcoin and Ethereum ETFs, exciting observers about China’s future participation. Popular commentator WhalePanda commented via X:

“More ETFs will allow China easier access through Hong Kong.”

Reports suggest that operators like China Asset Management, Harvest Global Investments, and Bosera Asset Management will launch spot crypto products. A part of a press release shared on social media stated:

“China Asset Management has received approval from the Hong Kong Securities and Futures Commission to provide crypto asset management services to investors. They now plan to launch ETF products investing in spot Bitcoin and spot Ethereum.”

This move comes at a time when US ETF products, after a rapid acceleration in March, faced a broad slowdown in entries following Bitcoin’s price reaching all-time highs. However, US products continue to be among the most successful ETF launches in history; the largest two offerings by BlackRock and Fidelity Investments see net entries every day since their debut.

Türkçe

Türkçe Español

Español