As every Sunday, today we examine significant developments awaiting cryptocurrency investors. Recent tariff announcements and other market changes have had substantial impacts. What major developments related to cryptocurrencies might trigger volatility in the coming days?

Crucial Updates in Cryptocurrency

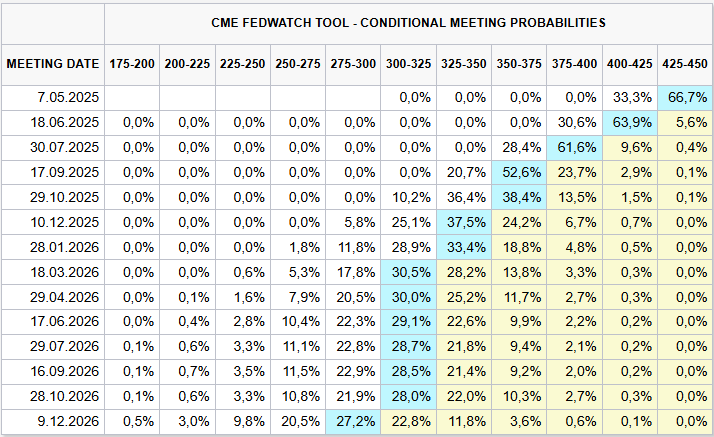

In his statements on Friday, Powell did not provide clear signals regarding interest rate cuts. At some point, recession fears may compel the Fed to take action. However, recalling 2021, we note that even months before initiating one of the fastest interest rate hikes in history, the Fed claimed “inflation is temporary.” Today, they appear unconcerned about a recession and might implement five rate cuts before the year ends.

Indeed, particularly following Friday’s data, markets strengthened their expectation of five interest rate cuts by year-end due to China’s retaliation. A few months ago, discussions focused on one or two cuts at best.

Market expectations had dwindled to a maximum of two or three rate cuts by the end of 2026. Today, the situation is markedly different. Global trade balances are deteriorating, and like China, the U.S. is compelled to inject liquidity to sustain domestic market demand during this chaotic phase.

Now, let’s look at the upcoming events with detailed dates and times that await us.

Tuesday, April 8

- 21:00 Fed/Daly will speak

- Paris Blockchain Week

Wednesday, April 9

- 18:00 Fed/Barkin

- 21:00 Fed Minutes

Thursday, April 10

- 15:30 U.S. CPI (Expectation: 2.6% Previous: 2.8%)

- U.S. Core CPI (Expectation: 3% Previous: 3.1%)

- 18:30 Fed/Logan

- 19:30 Fed/Harker

- Do Kwon U.S. Court Hearing

Friday, April 11

- 15:30 U.S. PPI (Expectation: 3.3% Previous: 3%)

- U.S. Core PPI (Expectation: 3.6% Previous: 3.4%)

Attention for Investors

The impact of U.S. tariffs on indicators such as inflation, PMI, and producer costs will take three months to materialize. Current data is expected to respond to rising prices even before tariffs hit. In three months, the upcoming data should reveal an increase in inflation and producer costs due to the tariffs.

Last week, we examined the ECB Minutes regarding tariffs. This week, we will observe the Fed Minutes for expectations and comments on tariffs, as well as seeking indications for interest rate cuts in the upcoming meeting in 30 days.