After the approval of spot Bitcoin ETFs in the US last week, the price of Bitcoin (BTC) fell, and the largest cryptocurrency has been following a quiet trend around the $42,000 levels for the past few days. Bitcoin had risen to $49,000 during the ETF approval but was followed by a period of increased selling pressure.

Large Bitcoin Wallet Addresses Are Moving Old BTC

On-chain data provider Santiment revealed a significant trend following the approval of the spot Bitcoin ETF last Wednesday. Accordingly, large Bitcoin wallet addresses are actively and rapidly moving old BTC. As a result, there has been a significant decrease in the average age of BTCs in wallet addresses.

There are some indicators that the movement of old BTC may have temporarily halted, which could potentially lead to a pause in the ongoing downturn in the cryptocurrency market. However, the movement of old BTCs is generally a negative situation for the largest cryptocurrency.

On the other hand, Santiment added that the actions of a few large cryptocurrency whales could revive the market, lead to further decreases in the average dollar investment age of Bitcoin, and potentially trigger another rally by testing levels around $45,000 and maybe even reaching $50,000 once again.

A Look at Option Data and ETF Impact

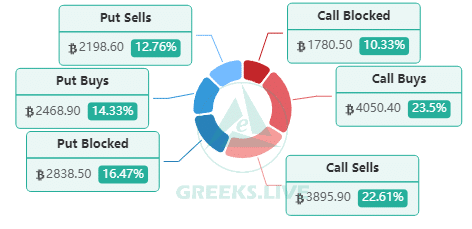

According to option data provided by Greeks.Live, the dominant focus in the financial world today revolves around the impact of spot ETF trading in the US on cryptocurrency prices. When examining today’s block trades, a significant amount of $120 million, which constitutes 16% of the total, was traded in large sell options, an unusually high volume compared to typical trading days.

Among individual block trades exceeding five million dollars, a notable trend emerged with the prevalence of short-term put options as short sales. Smaller orders also tend to buy short-term put options.

Despite logical concerns surrounding the current market outlook, there is a growing belief among large traders that the market may have found stability. This situation offers a glimmer of optimism amidst the uncertainties in the market overall.

So far, the impact of the spot Bitcoin ETF approval has not been observed, but many market analysts believe that this effect will be seen in the long term and will be extremely strong. Michael van de Poppe, closely followed by crypto investors, stated that the spot Bitcoin ETF is significant in the long term, saying, “The Bitcoin ETF has provided a negative return from the beginning. The Bitcoin ETF had a large net inflow in the first few days. Over $600 million on the first day. The real effect of the ETF will be shown over the next few years. A mega bull event.”

Türkçe

Türkçe Español

Español