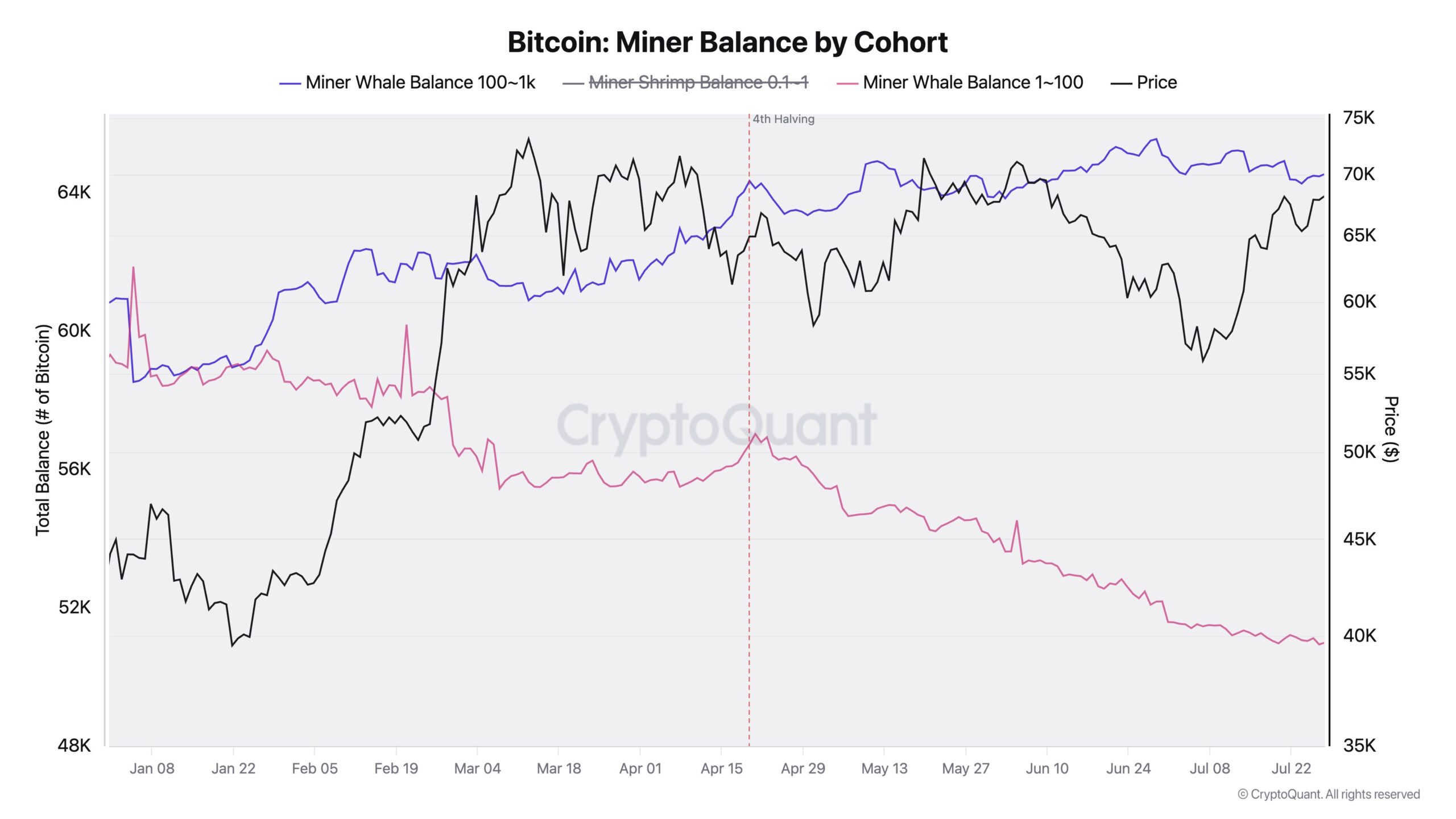

According to Julio Moreno, head of research at leading crypto analysis firm CryptoQuant, major cryptocurrency miners are currently in accumulation mode. This is in stark contrast to the approach of small crypto miners who have continued to sell since Bitcoin’s (BTC) last, fourth block reward halving event.

Large Miners Accumulate, Small Miners Sell

Moreno noted that large mining companies reported higher reserves and, in some cases, purchased Bitcoin. He added that small crypto miners tend to sell off their BTC holdings.

As a reminder, crypto mining giant Marathon Digital recently purchased $100 million worth of BTC and announced a “full HODL” strategy. The company plans to hold all the BTC it produces and make additional purchases. This step serves as a significant reference confirming the trend of large crypto miners accumulating Bitcoin.

Some Bitcoin Miners Turn to Artificial Intelligence

Meanwhile, according to the Financial Times, some Bitcoin miners have turned to artificial intelligence technology due to a significant drop in profitability. This indicates a major shift in the dynamics of the mining sector. The substantial decline in mining earnings has pushed miners to seek new revenue sources.

At the time of writing, Bitcoin’s price is trading around $66,500 after testing $70,000. The price came under renewed selling pressure, particularly due to the U.S. government’s movement of its BTC holdings on July 29. This situation demonstrates how regulatory pressure and the actions of major players can impact Bitcoin’s price.

As expected, the selling pressure on Bitcoin’s price also affected the altcoin market. Many altcoins fell sharply after the largest cryptocurrency tested $70,000 and then pulled back.

Türkçe

Türkçe Español

Español