The leading cryptocurrency Bitcoin (BTC) underwent substantial volatility yesterday. The BTC price briefly dipped below $25,000, only to later swiftly surge above $27,000. Lawsuits filed against crypto exchanges Binance and Coinbase by the SEC were seen as the primary cause, while several possibilities are speculated behind the surge. A renowned crypto analyst and BTC investor provided crucial insights into the BTC price trend.

New Target for Bitcoin Price

Looking at the current data, it’s observed that the BTC price reached its highest point this month at $27,888 on Bitstamp. Despite the significant volatility of the BTC/USD pair, renowned BTC analyst Michael van de Poppe advised investors to avoid falling into the trap of panic selling:

We have returned to $27,000. A great bounce occurred from the 200-week MA point. Now it’s time to start a new trend, and a move towards the $38,000 to $42,000 band could start for BTC.

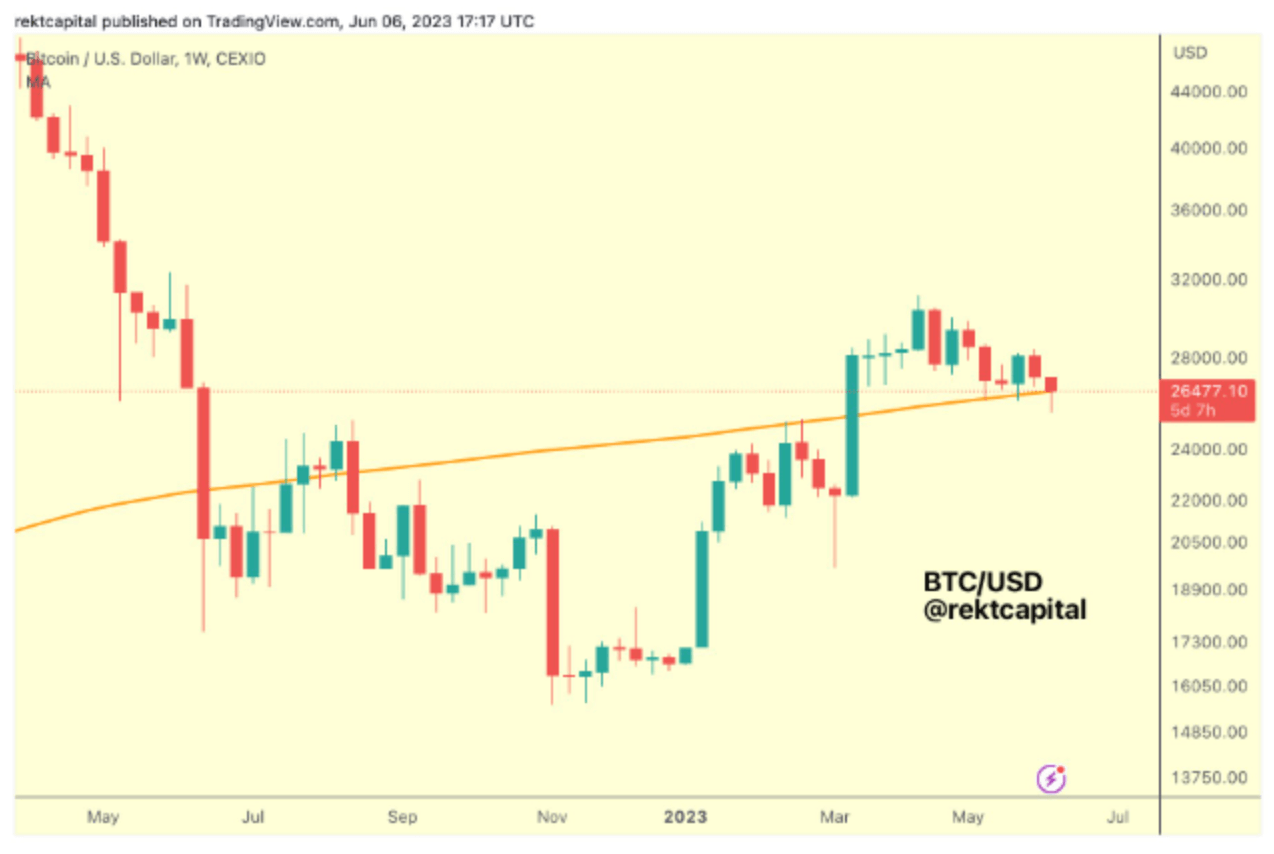

Van de Poppe drew attention to the 200-week moving average and reminded about the $26,400 support. Despite being lost within a few hours, this support level remained influential according to Poppe and reinforced purchases at lower levels. The famous analyst had previously suggested that the BTC price correction had ended, eliciting similar comments from other investors.

BTC Price Targets $38,000

Another expert crypto analyst, RektCapital, echoed a similar sentiment. He emphasized that the dip has ended and the market has reacted well to the downturn. While some experts have anticipated a turbulent period for BTC due to the lawsuits, both analysts agree on the general conclusion that the downturn has ended.

RektCapital had previously suggested that if the 200-week MA is clearly lost, the price could drop to $20,000. According to these two experts’ predictions, BTC could continue its uptrend and move beyond the $25,000 to $27,000 range to settle in the $38,000 bracket. Of course, for this to occur, a substantial closure above $30,000 in BTC price is needed. Bitcoin’s future could significantly impact altcoins, making the upcoming week crucial. New data coming from the U.S. could also influence BTC.