The consecutive applications for Spot Bitcoin ETF by major asset management companies like BlackRock and the lawsuits filed by the Securities and Exchange Commission (SEC) against Binance and Coinbase for violating securities laws have had a significant impact on the cryptocurrency ecosystem in June. However, after a volatile period, the cryptocurrency market has started to follow a sideways trend in recent weeks.

Low Volatility in the Cryptocurrency Market

The volatility in the cryptocurrency market, influenced by the Spot Bitcoin ETF applications made by major asset management companies like BlackRock and WisdomTree, as well as the lawsuits filed by the US Securities and Exchange Commission (SEC) against cryptocurrency exchanges Binance and Coinbase for violating securities laws, led to a volatile period in June.

However, the volatility in the cryptocurrency market, which has been relatively stable since mid-July, has significantly decreased in recent weeks.

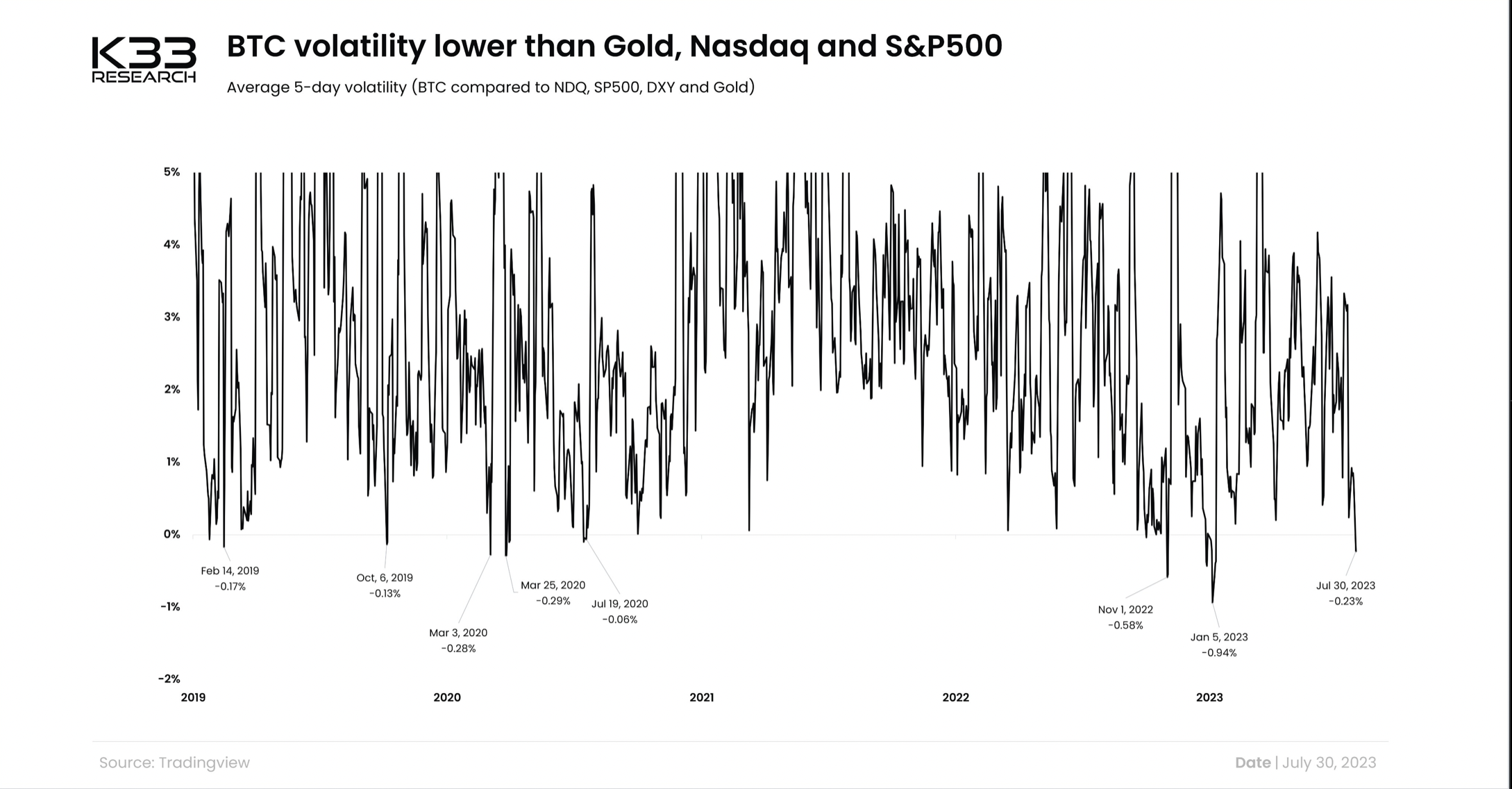

Bitcoin’s Volatility Drops Below S&P500

The cryptocurrency market has started to follow a relatively sideways trend as the leading cryptocurrency Bitcoin consolidated between the price levels of $28,500 and $31,500 in recent weeks. The leading cryptocurrency, which dropped below the $30,000 price level at the beginning of the week, started trading around the $29,000 price level throughout the week.

Meanwhile, K33 Research highlighted the current data on market volatility in a Twitter post and stated that the volatility of the leading cryptocurrency Bitcoin dropped below Gold, Nasdaq, and S&P500 last week. Additionally, the crypto analysis platform K33 Research suggested that low volatility could indicate sharp price movements in the future and stated the following:

“Bitcoin’s volatility dropped below Gold, Nasdaq, and S&P500 last week. Historically, fluctuations in BTC volatility have often followed these periods of low volatility. Could this indicate a near price movement for bitcoin?”