The DeFi world has experienced a notable slowdown in recent months, with decreased interest and activity across the sector. However, MakerDAO, one of the leading players in the DeFi space, seems poised for a significant increase in earnings.

MakerDAO Comments

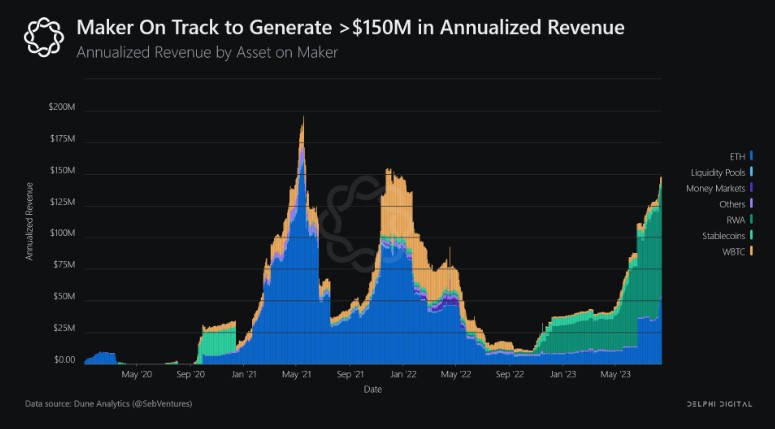

An important factor contributing to MakerDAO’s expected revenue increase is its strategic focus on Real-World Assets (RWAs). According to Delphi Digital analyst Ashwath, MakerDAO is on track to generate significant earnings, reaching around $150 million.

RWAs offer a new way for traditional asset managers to tokenize their portfolios and leverage protocols like MakerDAO for enhanced liquidity access. While this development opens up new credit channels for asset managers, caution must be exercised regarding potential adverse selection risks.

Maker generates a significant portion of its revenue, around 70-80%, from stability fees associated with RWAs. Maker’s RWA portfolio includes various asset managers and debt instruments, including investment-grade bonds, short-term Treasury bond ETFs, business loans, and more.

However, it is important to acknowledge the presence of risk factors associated with default risks. The majority of RWAs held in Maker’s vaults consist of credit instruments, making them susceptible to non-negligible default risks. Essentially, all RWAs used as collateral for Maker’s services are exposed to potential default.

Ashwath emphasized that all RWAs held in Maker’s vaults are currently rated BBB or higher, indicating an “investment-grade” credit quality. However, given the current interest rate environment, the risk-reward profile of this opportunity may not be highly favorable.

MakerDAO’s Future Outlook

Despite the overall slowdown in the DeFi sector, MakerDAO continues its journey with strong development activities. Last week, code commits increased by 47.9%, while the number of core developers actively contributing to the protocol increased by 9.1%.

The performance of Maker’s native token, MKR, has remained relatively stable in the past few days. At the time of writing, MKR was trading at $1099.68, accompanied by a minimum price movement recorded in the previous week.

While the number of MKR token holders remains steady, a significant decrease in whale interest could potentially exert downward pressure on MKR’s price. However, with its strategic focus on RWAs and a vibrant development ecosystem, MakerDAO may be well-positioned to capitalize on opportunities in the evolving DeFi landscape.

Türkçe

Türkçe Español

Español