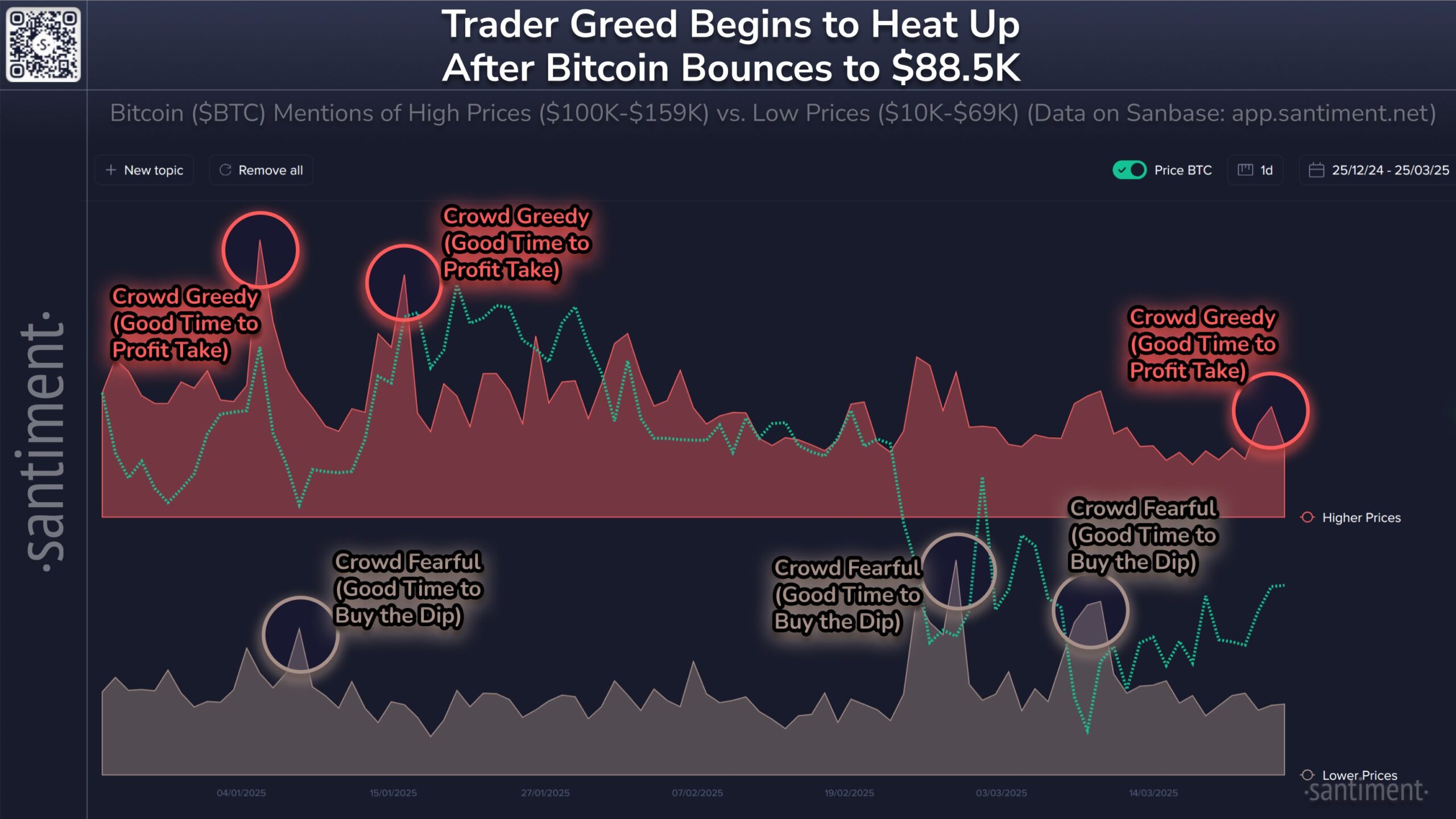

The price of Bitcoin  $108,168 experienced a resurgence in the latter half of March, climbing to $88,500, which has shifted investor sentiment back into the “slightly greedy” territory. The crypto market faced significant fear when Bitcoin prices plummeted to $78,000 twice in late February and early March. This recent price increase has restored optimism among individual investors, leading to notable activity in price predictions on social media. However, it is historically recognized that investors often make incorrect forecasts and that prices tend to move contrary to expectations.

$108,168 experienced a resurgence in the latter half of March, climbing to $88,500, which has shifted investor sentiment back into the “slightly greedy” territory. The crypto market faced significant fear when Bitcoin prices plummeted to $78,000 twice in late February and early March. This recent price increase has restored optimism among individual investors, leading to notable activity in price predictions on social media. However, it is historically recognized that investors often make incorrect forecasts and that prices tend to move contrary to expectations.

What Does Social Media Think About Bitcoin?

Recent predictions about Bitcoin on social media reflect the overall market psychology. There has been a noticeable uptick in posts forecasting Bitcoin prices ranging between $100,000 and $159,000. According to Santiment analysts, such overly optimistic price expectations typically indicate a market downturn, as widespread belief in a price peak leads to “excessive optimism” and the risk of profit-taking.

Conversely, there have also been periodic increases in low price forecasts for Bitcoin, ranging from $10,000 to $69,000. Historical data suggests that such pessimistic predictions may serve as a positive signal for price rises. When negative comments about Bitcoin, such as “crypto is dead” or “Bitcoin is a scam,” increase, prices typically react by rising instead.

How Does Investor Sentiment Cycle Affect Prices?

The cryptocurrency market is significantly influenced by investor sentiment regarding price movements. According to Santiment’s analysis, periods of investor “greed” are often seen as good opportunities for profit-taking. Overly positive expectations from investors increase the risk of sudden price drops. The recent rise in Bitcoin’s price and the characterization of investors as “greedy” signal a time for caution in the market.

On the other hand, periods of investor fear generally present buying opportunities. When Bitcoin’s price declines and investor morale drops, purchases made during these times often yield more profitable outcomes in the long run.

Türkçe

Türkçe Español

Español