The recent U.S. Producer Price Index (PPI) data significantly fell short of expectations, yet anticipated movements in cryptocurrencies were not observed. Consumer sentiment also registered lower than expected at 50.8 compared to the anticipated 53.8. With markets grappling with fears of economic recession or worse, China has retaliated today, adding further strain. Consequently, high volatility in cryptocurrencies persists.

Insights on BONK and BABY Coin

BTC price hovered around the $82,000 mark while altcoins continue to exhibit weakness. The PPI data, which should have supported a price increase like the Consumer Price Index (CPI) of the previous day, failed to do so. Inflation forecasts were recently announced at 6.7%, contrary to the expected 5.2%. China’s tax retaliation, coupled with the U.S.’s stubborn stance, suggests that this chaos may last for several months.

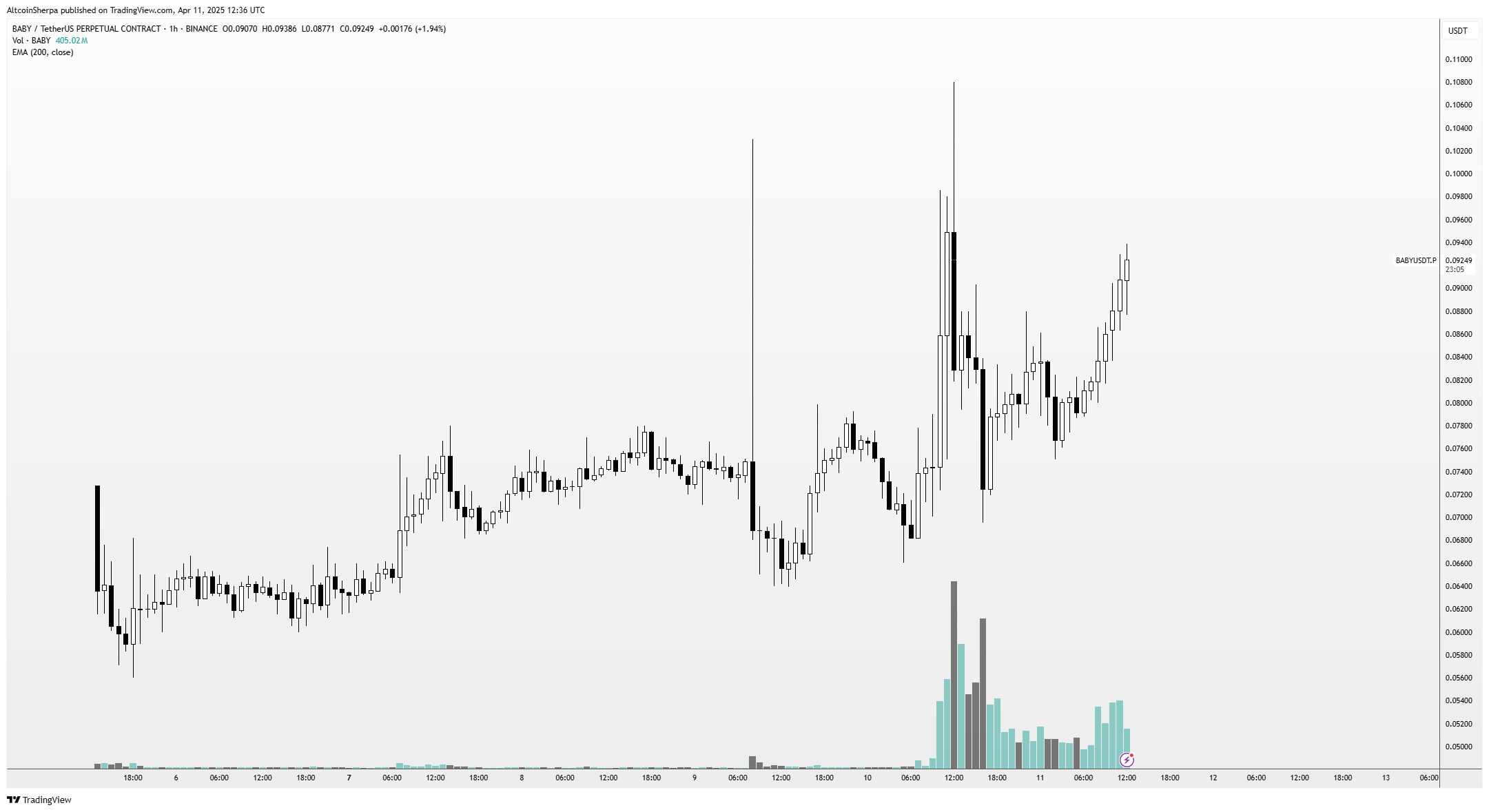

These developments, which dampen risk appetite, indicate that cryptocurrencies may remain stagnant or decline further, similar to the first quarter. An analyst known as Altcoin Sherpa shared his thoughts on altcoins today. He provided the following chart for BABY Coin:

“BABY is a wildly volatile coin listed in most places. To be honest, I don’t even know how to trade this thing; it has a strange operation at the moment. This is a major VC project, so there might be some odd activities behind the scenes (“pumping” in some way)… Think about the story. I might buy a little.”

BONK Coin, on the other hand, is anticipated to rise in the short term:

“BONK looks strong in the short term and should go higher. There should be a pullback around the 200 EMA on the 4-hour chart.”

Bitcoin (BTC) Analysis

The BTC price surged to $83,333 yet continued to ignore positive developments while factoring in negative news. Former President Trump’s crypto-friendly policies may have resolved many fundamental issues, but global trade war concerns have negated all supportive developments and pushed the price into the negative.

Jelle, in his assessment a few hours ago, wrote:

“Previously, these dips were quick and severe, perfect for shaking you up. Then people figured out how this works – now they are boring you instead. Yet, the essence of the story hasn’t changed: dips are often for buying.”

Türkçe

Türkçe Español

Español