BlackRock’s iShares Bitcoin  $91,081 Trust ETF (IBIT) experienced a record net outflow of $332.6 million on Thursday, marking the largest daily cash exit in its history. This unprecedented outflow surpasses the previous record of $188.7 million seen on Christmas Eve. On the same day, the trading volume for IBIT reached an impressive $2.26 billion. Experts suggest that these outflows may be attributed to market conditions or portfolio adjustments by participants.

$91,081 Trust ETF (IBIT) experienced a record net outflow of $332.6 million on Thursday, marking the largest daily cash exit in its history. This unprecedented outflow surpasses the previous record of $188.7 million seen on Christmas Eve. On the same day, the trading volume for IBIT reached an impressive $2.26 billion. Experts suggest that these outflows may be attributed to market conditions or portfolio adjustments by participants.

Differentiating Trends Among Spot Bitcoin ETFs

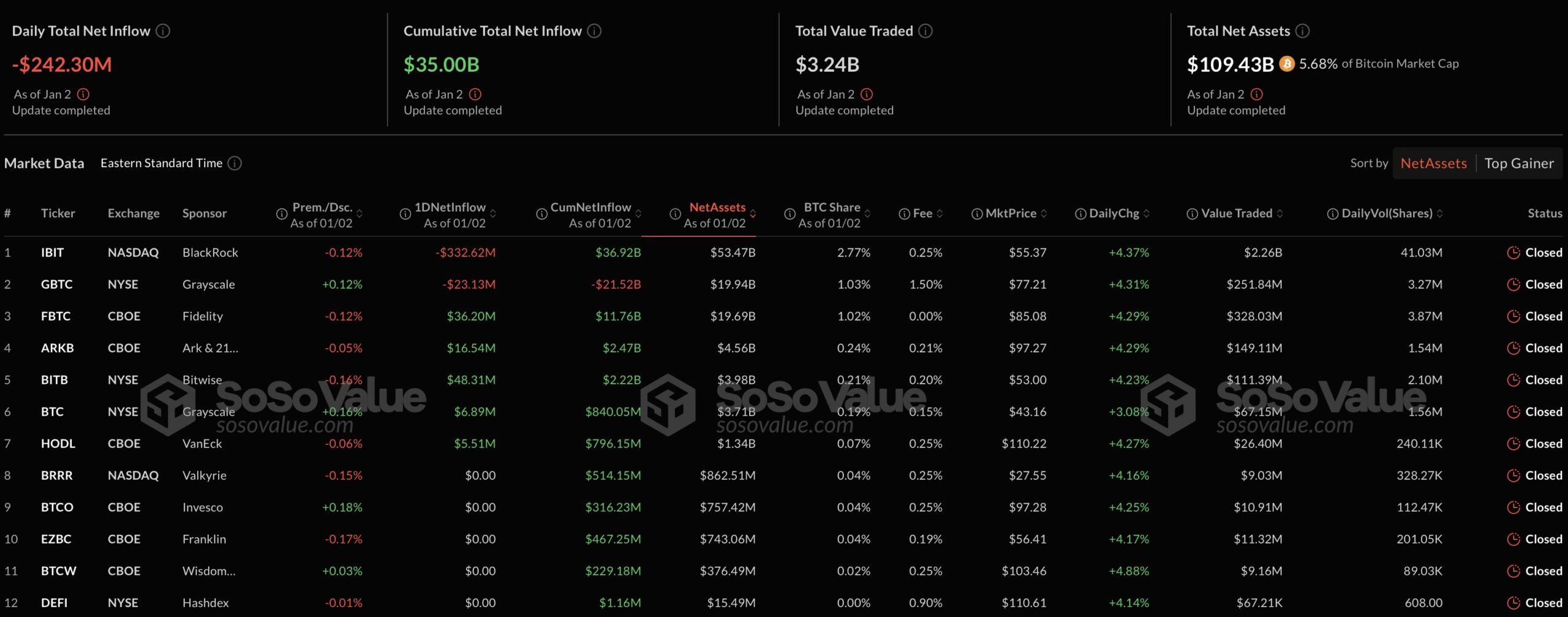

Despite not matching the high inflow figures from early December 2024, BlackRock’s IBIT continues to lead as the largest spot Bitcoin ETF, amassing a total net inflow of $36.9 billion. The fund’s total net asset value has reached $53.5 billion.

In contrast, Bitwise’s BITB fund saw a net inflow of $48.3 million, while Fidelity’s FBTC fund attracted $36.2 million. Other funds, including those from VanEck, Ark Invest, and Grayscale, also witnessed inflows, although Grayscale’s GBTC fund recorded a net outflow of $23.1 million.

Data revealed that total net outflows from spot Bitcoin ETFs in the U.S. amounted to $242.3 million on Thursday, indicating a broader trend across the sector.

Spot Ethereum ETFs Also Experience Increased Outflows

On the same day, spot Ethereum  $3,094 ETFs recorded net outflows totaling $77.5 million, with Bitwise’s ETHW fund responsible for $56.1 million of this amount. Grayscale’s ETHE fund also experienced an outflow of $21.4 million.

$3,094 ETFs recorded net outflows totaling $77.5 million, with Bitwise’s ETHW fund responsible for $56.1 million of this amount. Grayscale’s ETHE fund also experienced an outflow of $21.4 million.

While trading volume for spot Ethereum ETFs climbed to $397.2 million, the total net inflow remained at $2.58 billion.

At the time of this report, Bitcoin’s price had risen by 1.3%, trading at $96,690, while Ethereum saw an increase of 1.44%, reaching $3,457.