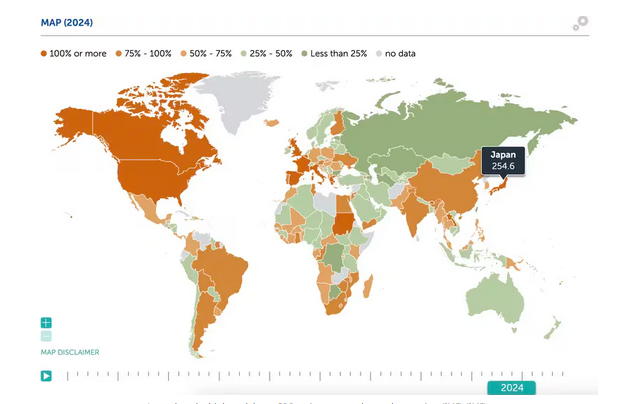

Japan’s financial outlook is once again under scrutiny with a strategic move by Metaplanet. The burden of the Yen and Japan’s increasing debt burden are countered with a measure that resonates both nationally and internationally. Metaplanet’s adoption of Bitcoin as a reserve asset, as Japan’s debt/GDP ratio exceeds 250%, is seen as a concrete example of an effort to create a shield against financial imbalances.

Metaplanet Stood Out with Bitcoin Investments

Metaplanet‘s CEO stated that Japan’s long-standing economic difficulties, especially the high level of government debt and negative real interest rates, influenced their decision to take this step. This move is characterized as a measure against Japan’s financial imbalances, while also signaling the increasing acceptance and reliability of Bitcoin as an asset.

Metaplanet’s interest in Bitcoin follows a similar strategy by US-based MicroStrategy. Since April, Metaplanet has purchased millions of dollars worth of Bitcoin, a strategy that gains importance with the declining trust in traditional financial assets and the increasing interest in cryptocurrencies.

Interest Rate Differences Affect the Yen

However, Japan’s financial crisis and the depreciation of the yen have also resonated in international financial markets. According to the International Monetary Fund, Japan’s debt/GDP ratio is among the highest in the developed world. This situation questions the Bank of Japan’s strategy of keeping interest rates low, while also paving the way for increased interest in alternative assets like Bitcoin.

The Federal Reserve has been raising interest rates to above 5% since early 2022, while in Japan, the benchmark borrowing cost remains near zero. Consequently, the yen, one of the top five global reserve currencies, has sharply depreciated. The differences in interest rates significantly affect fiat currency exchange rates.

Data shows that the Japanese yen has lost 50% of its value against the US dollar since the beginning of 2021. The yen recently surpassed 155 against the US dollar, reaching its lowest level in 34 years. Metaplanet‘s confidence in Bitcoin could have significant effects on Japan’s financial future and international money markets. However, the long-term outcomes of this move may depend somewhat on Japan’s financial condition.

Türkçe

Türkçe Español

Español