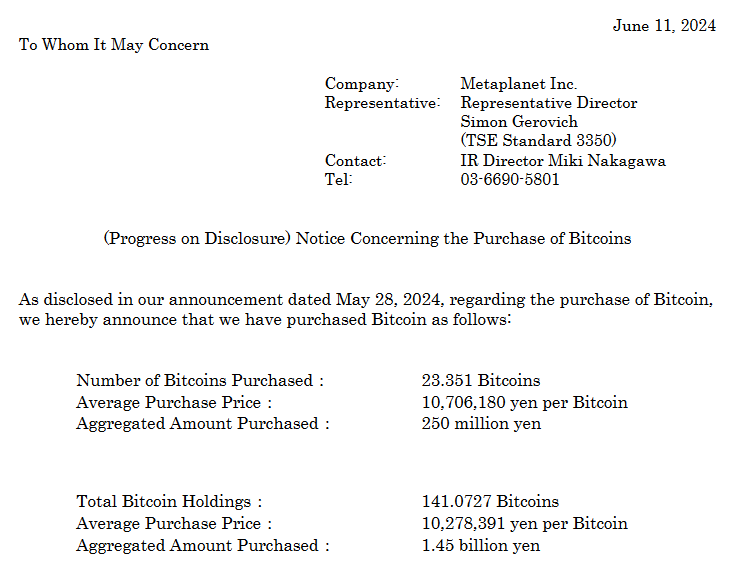

Described as Asia’s MicroStrategy, Metaplanet’s shares experienced double-digit growth on June 11 after the company announced its third million-dollar Bitcoin purchase in seven weeks. The company’s June 11 announcement revealed that it had purchased approximately $1.59 million worth of 23.25 Bitcoin, raising its total holdings to 141.07 Bitcoin at an average price of $65,365 per Bitcoin.

Metaplanet Continues Buying Bitcoin

This development allowed Metaplanet to gain 4.5% on its Bitcoin investment based on Bitcoin’s current price of $68,313, according to CoinGecko.

According to Google Finance data, Metaplanet shares rose 10.8% to 92 Japanese Yen, equivalent to $0.59, before falling to 89 Japanese Yen, or $0.57, at midday on June 11 on the Tokyo Stock Exchange. The firm has seen its shares increase nearly fivefold since announcing its Bitcoin investment strategy on April 9, 2024.

According to Bitcoin Treasuries, the first Bitcoin purchase occurred on April 23 with 97.85 Bitcoin, followed by an additional 19.87 Bitcoin on May 10. Metaplanet is currently the 30th largest institutional Bitcoin holder globally. Similar to the largest institutional Bitcoin holder MicroStrategy, Metaplanet reiterated on May 13 that it would adopt all capital market instruments to support its Bitcoin reserves.

Japan and Macroeconomic Issues

The firm adopts a hedging strategy against Japan’s worsening debt burden and rapidly depreciating Japanese Yen. Metaplanet stated that Japan’s debt-to-GDP ratio of 261% is the worst among developed countries.

The Japanese Yen has fallen nearly 35% against the US dollar since January 2021, while Bitcoin has risen almost 200% against the Yen in the last 12 months. However, this is still far below the 214,400 Bitcoin held by the firm operated by Michael Saylor, representing 1.02% of the approximately 21 million Bitcoin that will be in circulation.

Metaplanet is currently only available on the Tokyo Stock Exchange, restricting access for US investors, but efforts are being made to change this.