As the global economy continues to recover from the cracks, inflation concerns are on the rise. As a result, governments and central banks around the world have been forced to resort to raising interest rates to curb inflation and maintain economic stability.

Bitcoin’s Guardian Angel Speaks Out!

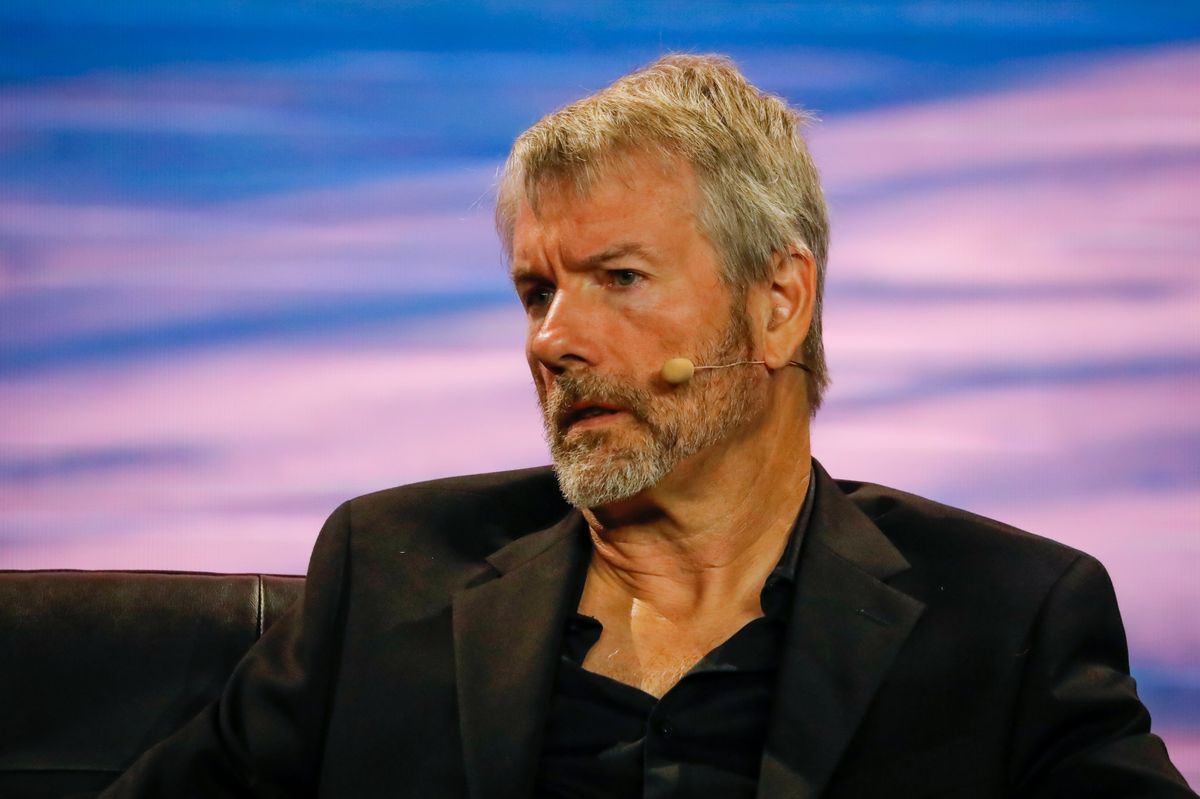

In an interview with financial journalist and market reporter David Lin on May 11, Microstrategy co-founder Michael Saylor commented on various topics including Bitcoin (BTC)  $91,967, Ordinal writings, inflation and the future of money.

$91,967, Ordinal writings, inflation and the future of money.

Among other things, the US billionaire noted that traditional currencies are dying, as highlighted by the recent “spate of currency failures.

Saylor noted that the same is true for the US dollar, which is considered the world’s strongest currency. The entrepreneur commented on Wednesday’s consumer price index (CPI) report, which showed that the annual US inflation rate is now 4.9%.

However, this also means that monetary inflation in the dollar is actually much greater than 5% because, in his view, the CPI is considered the lowest inflation figure the government will approve, not the highest.

Saylor said that monetary inflation in weaker currencies is even higher, ranging from 20% to 100%, for example in Argentina. He added that global governments are currently facing a crisis of confidence in their currencies and banks, and as a result consumers are also losing confidence in traditional economic assets as money.

Michael Saylor said the following:

So money is dying, it’s dying in Venezuela, it’s dying in Argentina, but it’s dying all over the world, even in the United States and Western Europe.

Is Bitcoin the King Currency?

Later in the interview with Lin, Saylor noted that it’s not just fiat currencies that are dying, but also commodity assets.

He then outlined the challenges that people incur when moving gold, oil, real estate, securities, and even commodities, such as the initial costs. Saylor says it costs between $500,000 and $2 million to trade $10 million in currency in the form of a painting.

This is why Bitcoin is the “king commodity,” the billionaire reiterated, because it is digital and small in quantity. He argued that Bitcoin allows traders to move millions of dollars across borders anywhere in the world, while all other forms of commodity money are either slow, hard to hold, fragile or unchangeable.