Michael Saylor has purchased an additional 12,000 Bitcoin using the net proceeds from a $800 million convertible note offering. Crypto investors should expect the first significant entries into Bitcoin ETF funds from major brokerages, institutional advisors, and large consultants in the upcoming quarter. Meanwhile, Coinbase shares have shown an increase of over 60% this year, surpassing the public offering price for the first time in two years.

MicroStrategy Announces New Convertible Bond Round Amid Bitcoin’s Record Highs

MicroStrategy, announced the process of offering a new convertible bond round on March 6 as Bitcoin reached all-time highs. The company completed the private offering on March 8 with a total principal amount of $800 million sold. The firm’s founder and chairman of the board, Michael Saylor, confirmed via social media platform X that the net proceeds from the bond offering and excess cash were used to purchase an additional 12,000 Bitcoin at an average price of $68,477 each.

Before its latest Bitcoin purchase, MicroStrategy owned approximately 193,000 Bitcoins at an average price of $31,544, representing an investment of $12.9 billion and a return of 112% since its inception. Saylor confirmed that MicroStrategy now holds 205,000 Bitcoins, which were acquired at an average price of $31,500 per token for $6.91 billion.

Bitwise Executive Makes Significant Statements

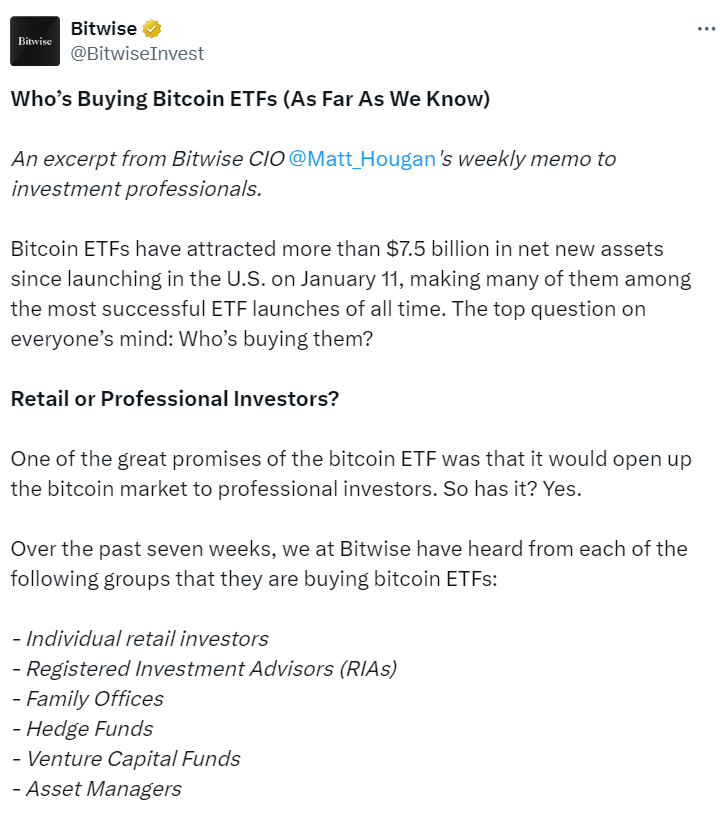

Crypto asset manager Bitwise, stated that institutions representing trillions of dollars in assets are preparing to purchase spot Bitcoin exchange-traded funds by the end of June. In an investment note sent to investors on March 9, Bitwise’s chief investment officer Matt Hougan said that Bitwise is involved in serious due diligence discussions with large companies, major brokerages, and institutional advisors looking to increase their investments in Bitcoin in the coming months.

Hougan confirmed that a wide variety of individual investors, hedge funds, and venture capital firms want to allocate more to spot Bitcoin ETF funds:

“Who is buying today is as important as who will buy tomorrow.”

Coinbase Shares Gain Momentum

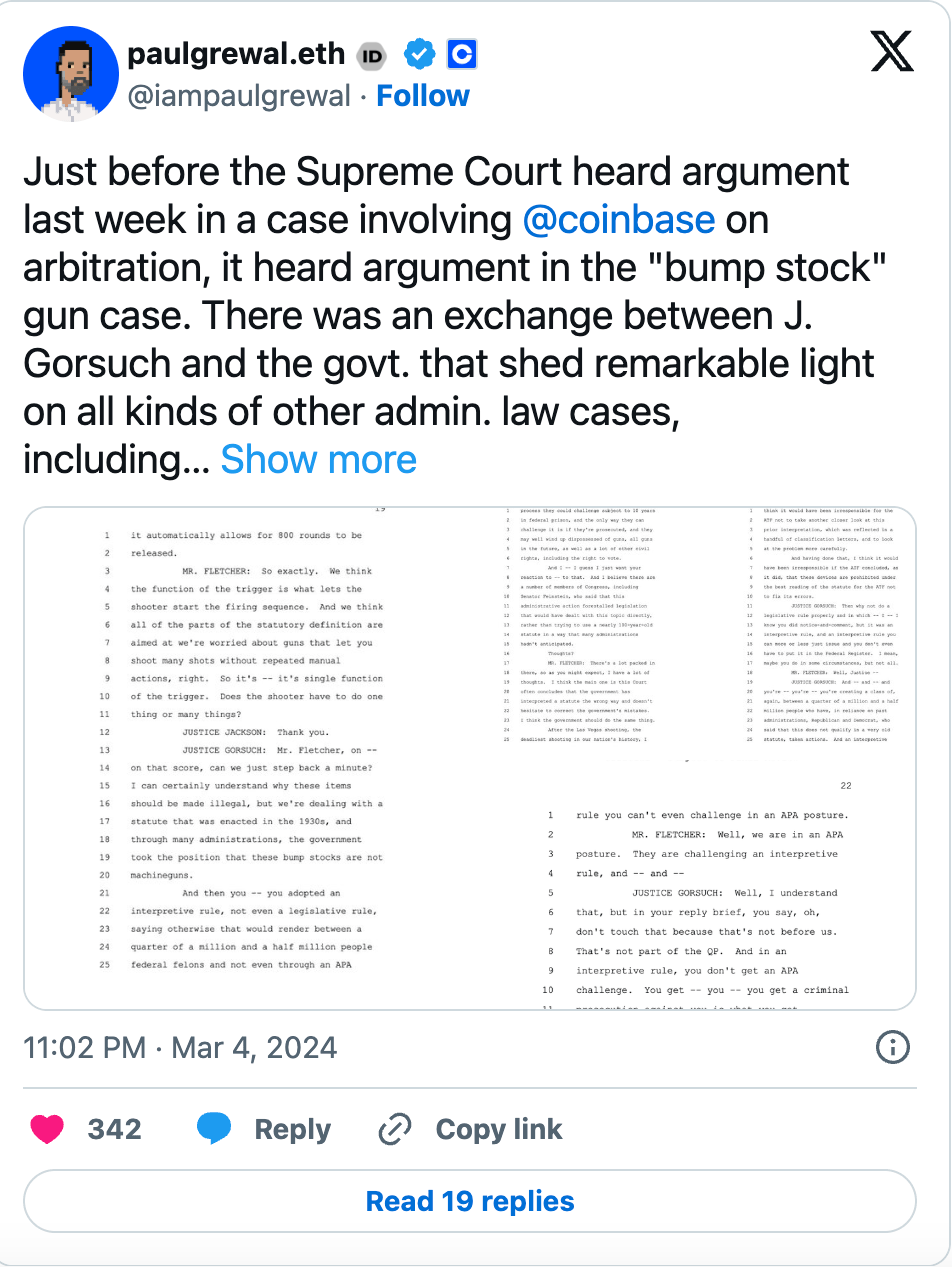

Coinbase shares have climbed above $250, regaining their IPO price for the first time in two years, thanks to the recovering crypto market. COIN shares rose up to 11.5% on March 8 before paring gains in later sessions. The stock last traded around $255, surpassing the $250 listing price.

It has been a rollercoaster journey for the cryptocurrency exchange since it went public two years ago. COIN dropped to as low as $33 when entering the crypto bear market in 2023. Now, the stock is experiencing the momentum of rising Bitcoin and crypto prices, largely triggered by the approval of spot Bitcoin exchange-traded funds in the United States. Coinbase is coming from a solid financial fourth quarter with a net revenue of $905 million and a net income of $263 million.