The acceleration of Bitcoin in the cryptocurrency market is driving significant developments in various fields. Accordingly, MicroStrategy, the world’s largest corporate Bitcoin investor founded by Michael Saylor, has managed to reach an unrealized profit just under $4 billion. However, the company has no plans to sell Bitcoin at this stage.

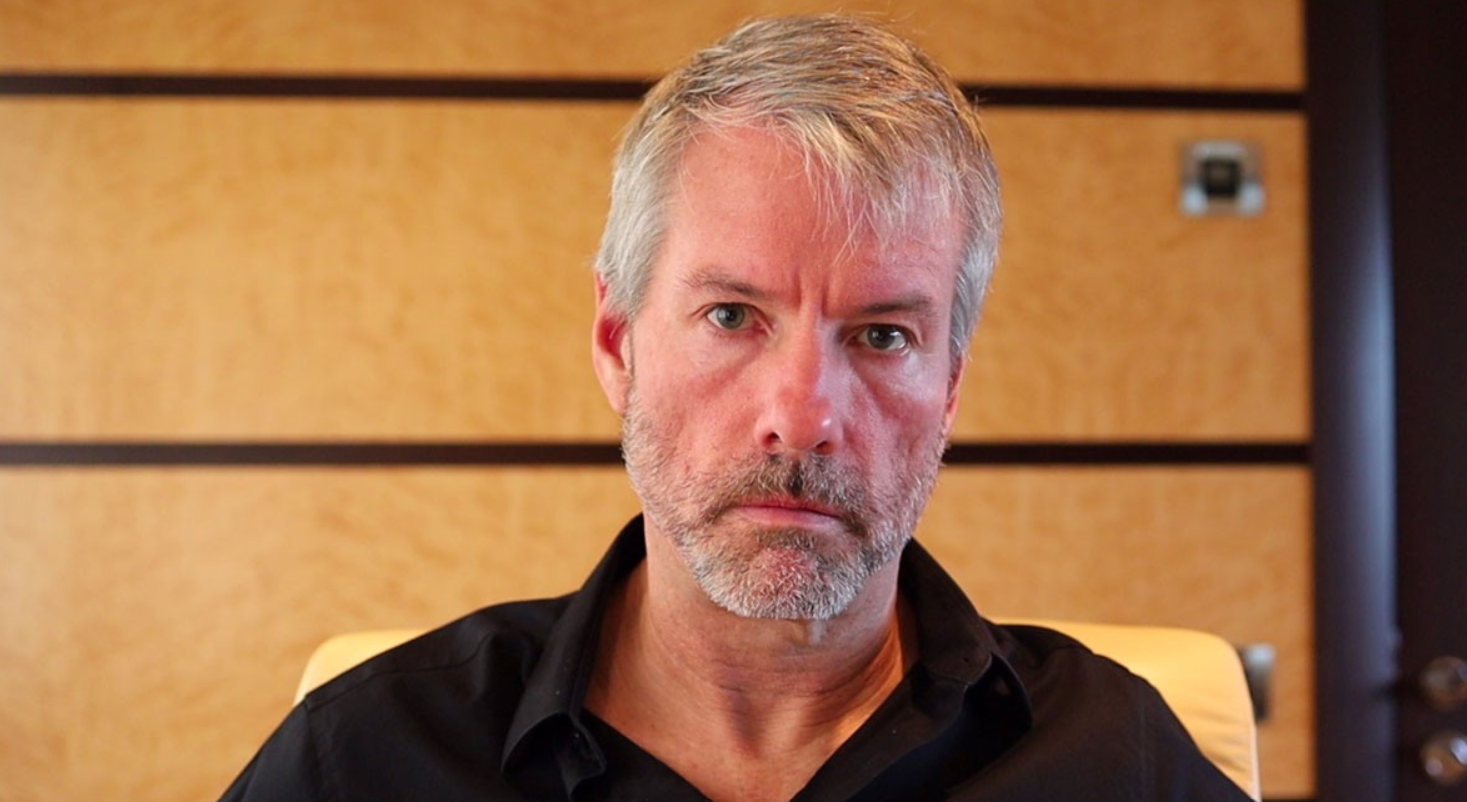

Michael Saylor’s Striking Statements

“I will always buy the peak. Bitcoin is an exit strategy,” said Saylor, who made striking comments when asked by Bloomberg on February 20 whether his company would sell its holdings of 190,000 Bitcoins, valued at $9.88 billion.

Summarizing his bullish view on Bitcoin, Saylor claimed that despite gold, the S&P 500, and real estate having much larger market values compared to Bitcoin’s $1 trillion market cap, the cryptocurrency is technically superior to these asset classes and added the following statement: Crypto Traders Are Rushing to This App – Here’s Why You Should Too

“We believe capital will continue to flow from these asset classes into Bitcoin. Bitcoin is technically superior to these asset classes. There is no reason to sell the winner and buy the loser.”

MicroStrategy and Bitcoin

MicroStrategy, a business intelligence software company, became the first publicly traded company to start investing in Bitcoin in 2020. As of the fourth quarter of 2023, the 190,000 Bitcoins it holds cost an average of $31,224 each, with the company’s total cost amounting to $5.93 billion.

Excluding Grayscale Bitcoin Trust (GBTC) based in the United States, as of Friday, February 16, HODL15Capital data indicates an estimated holding of 270,000 Bitcoins. Saylor mentioned that the increasing appetite for ETF products has created a demand for Bitcoin that far exceeds the supply from miners, sometimes by up to tenfold.

Furthermore, Saylor dismissed concerns that ETF funds would make it more difficult for MicroStrategy to purchase Bitcoin, stating that they use a leveraged business strategy for investing in the crypto asset:

“Spot ETF funds have opened a gateway for corporate capital to flow into the Bitcoin ecosystem. They facilitate the capital’s digital transformation and every day, hundreds of millions of dollars are moving from the traditional ecosystem to the digital economy.”

Türkçe

Türkçe Español

Español