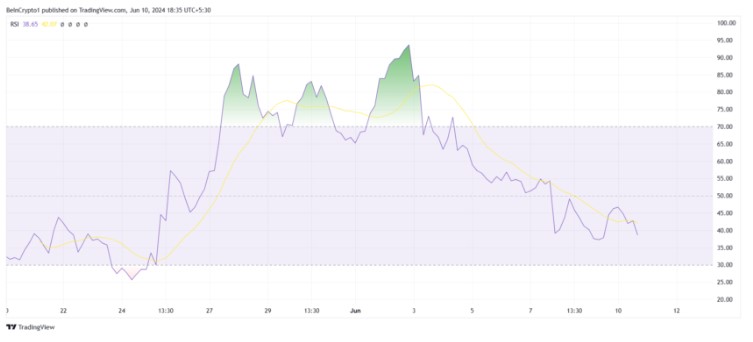

Notcoin (NOT) appears to be stabilizing on the daily chart after a significant rise. Notcoin’s price has been declining since last month’s surge, where many investors took profits. The increasing bearish trend in the short-term timeframe indicates potential signs of a downtrend. The Relative Strength Index (RSI) is moving towards the bearish zone, well below the neutral line.

Technical Indicators in NOT

The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions in a token. Readings above 70 generally indicate overbought conditions, while readings below 30 indicate oversold conditions. Since the RSI is in a downtrend, the price may also show a bearish trend.

Secondly, investors prefer to liquidate their risky assets. The Telegram-based token indicates that millions have withdrawn from open positions in the futures market. Open interest refers to the total number of outstanding derivative contracts, such as options or futures, that have not yet been settled.

80 Million Dollar Transaction in NOT

Increasing open positions generally indicate rising market participation, providing insights into market liquidity and the strength of price trends. Over the past three days, more than 80 million dollars have been traded from open positions, and this amount has dropped to 209 million dollars. Considering the above data, it is likely that Notcoin will witness a price drop. The Telegram-based token has already fallen from $0.023 to $0.018 at the time of writing.

The altcoin stands above the critical support of $0.017, but a drop below this level seems likely. This subsequent drop could potentially send NOT to $0.013. This situation could erase almost all of the 94% increase recorded during the rise at the beginning of June. However, if Notcoin’s price prevents a collapse and rebounds from $0.017, it could recover recent losses. A possible rise could send NOT to $0.020, and surpassing the $0.023 resistance could invalidate the bearish thesis.

Türkçe

Türkçe Español

Español