The effort to adapt past market cycles to today’s landscape is in demand in the crypto market. A notable trader did just that for altcoin investors. Ignoring past data is not right, as investor trends can potentially reflect in the future. So, what happened in 2018? Will altcoins rise in July?

July Altcoin Commentary

June is almost over, and this month we saw the best and worst developments together. That’s why the BTC price fell below $25,000 and climbed up to $31,400. The volatility exceeding $6,000 boosted investors’ hopes after last month’s sideways price movement. Investors had largely retreated from the markets due to both the entrance into the summer months and the lack of volume in bear markets. However, the news this month shows that the coming months will continue with high volatility.

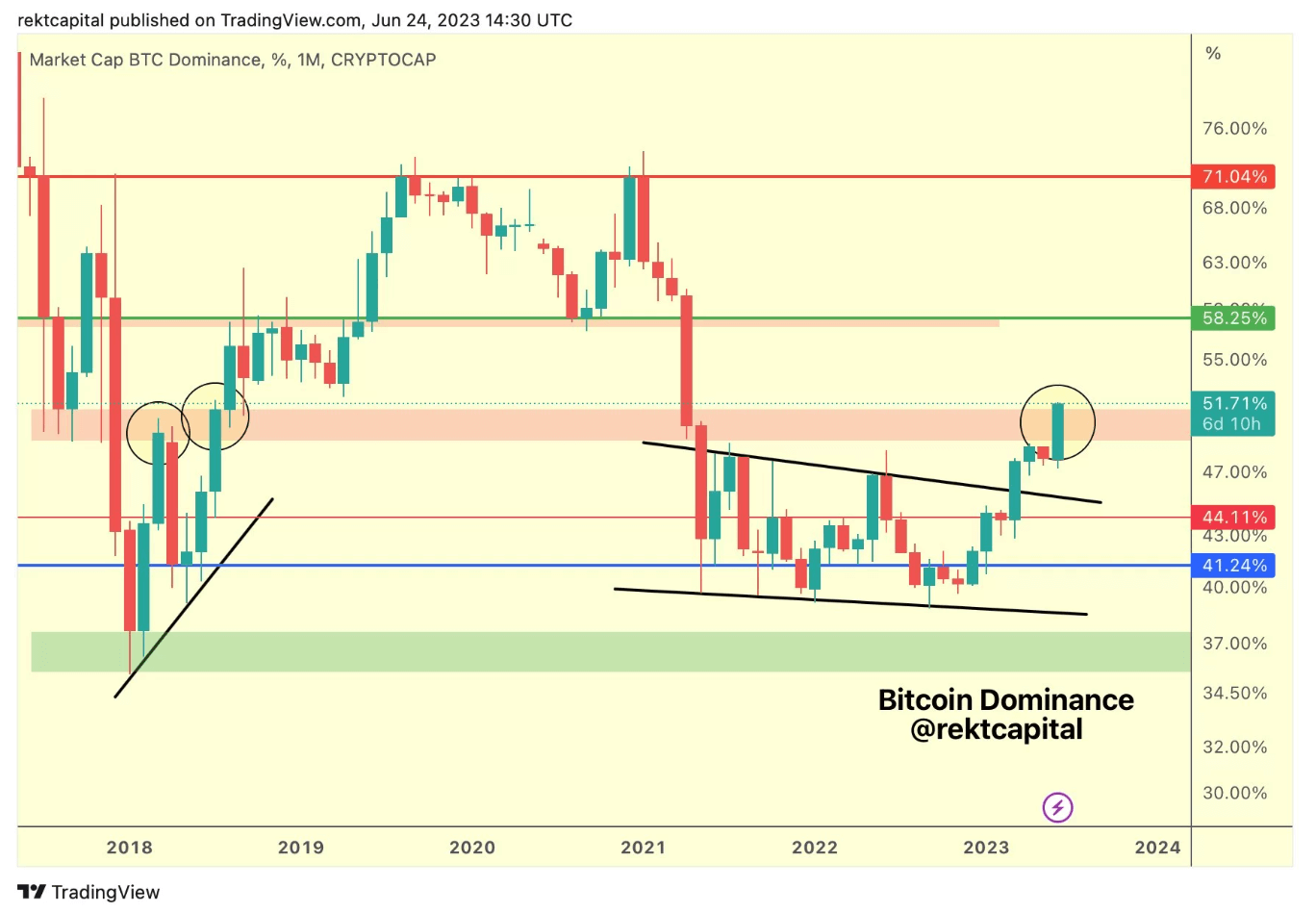

On the other hand, popular analyst Rekt Capital answered the question altcoin investors are curious about. The expert analyst says that investors, disturbed by the feeble rises in altcoins, may be a little more disappointed in July. He makes this statement by drawing attention to the 2018 Bitcoin Dominance (BTCD) chart.

But prices won’t keep falling, he said precisely;

If mid-2018 is an indicator… Then it seems Bitcoin Dominance will significantly increase this July. Altcoins might struggle to keep up, but Bitcoin Dominance will slow down after this strong, initial rise. This could open the way for money flow into altcoins.

Altcoins and BTCD

We calculate the market value of BTC in the cumulative value of cryptocurrencies, and the Bitcoin Dominance Ratio emerges. During the beginnings of bull seasons and the tough days of the bear, it was seen that this ratio rose to 70% and even a little higher. If investors don’t trust and invest in altcoins while BTC is rising, this increases BTCD as altcoins remain the same/decline while BTC market value increases.

For now, the 50% level seems to be a support for BTCD, and the rise may continue. However, at one point, Bitcoin starting to consolidate at a higher level will pave the way for the altcoin rise mentioned by Rekt Capital.

Türkçe

Türkçe Español

Español