On June 13, the crypto-focused venture capital firm Paradigm announced that it had successfully raised $850 million for its third fund. This fund targets early-stage projects, reflecting Paradigm’s belief in the transformative potential of the crypto industry. Paradigm emphasized its belief in the significant technical and economic change represented by cryptocurrency, which has strengthened over the past six years.

Major Step by the Paradigm Team

The team highlighted that Bitcoin’s market capitalization has surpassed $1 trillion and that blockchain networks like Ethereum and Solana are scaling. They also noted the global adoption of stablecoin projects. Additionally, the firm emphasized the rapid progress in frontier research and the emergence of new infrastructure enabling consumer applications. They stated that hundreds of millions of people now own crypto, making this segment a significant player on the global political stage.

Bloomberg reported that discussions about Paradigm’s third fund had been circulating since April. At that time, Paradigm was reportedly discussing the possibility of raising between $750 million and $850 million with investors. This development signifies a recovery in the crypto market and positions Paradigm’s fund as one of the largest since the previous downturn in the crypto market.

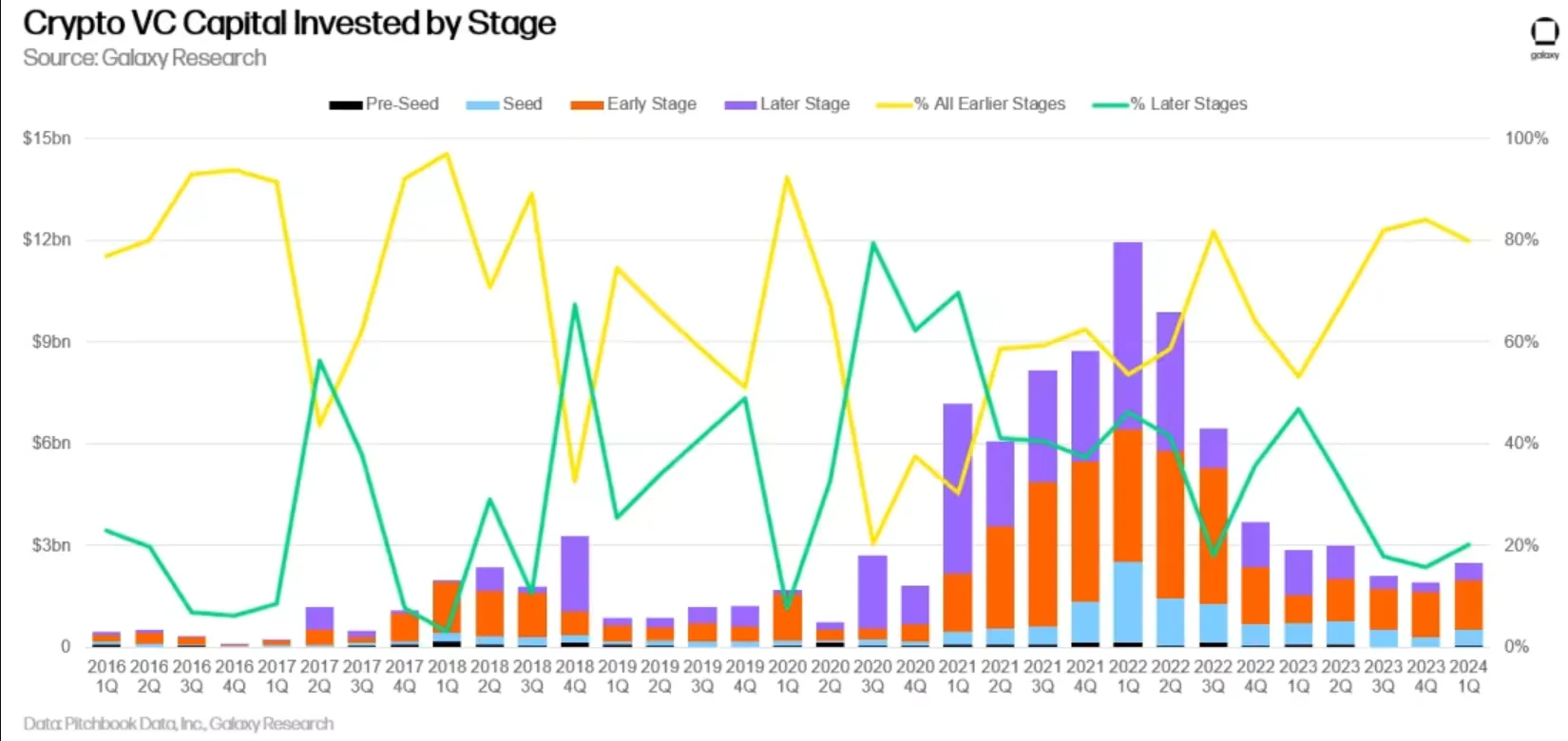

The latest move by the Paradigm team aligns with a broader trend among venture capitalists. A recent report by Galaxy Digital Research revealed that approximately 80% of the capital in the first quarter of 2024 went to early-stage companies. Meanwhile, the remaining 20% went to later-stage companies.

Noteworthy Details

The report noted that crypto-focused early-stage venture funds remained active, with many still holding dry powder from fundraising in 2021 and 2022. This allows compelling early-stage firms to still find sources of funding.

However, many large general venture capital firms have exited the sector or significantly reduced their risks. This has made it challenging for later-stage ventures to raise funds. Additionally, the share of pre-seed deals showed a moderate increase in the first quarter, indicating some growth in newly established ventures.