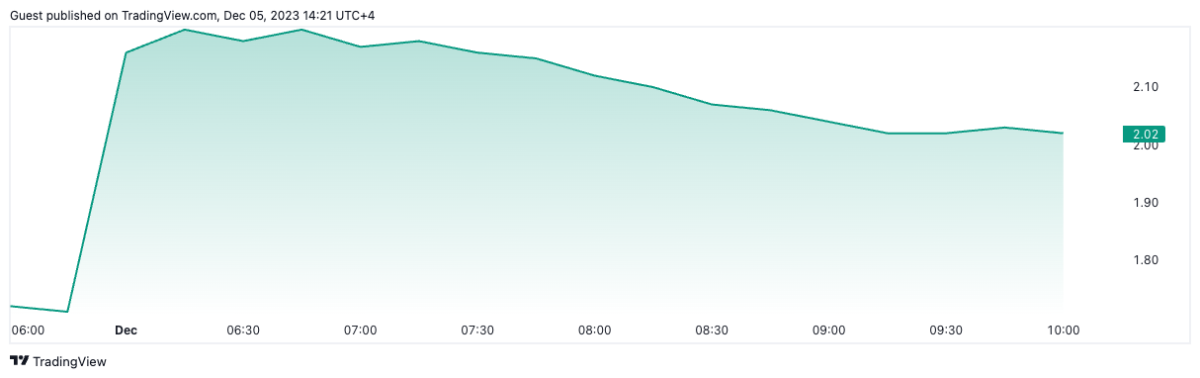

Cryptocurrency mining and blockchain technology company Phoenix Group’s stock value attracted attention as it increased by approximately 50% on the first day of trading on the Abu Dhabi Securities Exchange (ADX) after its initial public offering (IPO), which raised $370 million. The price of Phoenix (PHX) rose from the IPO price of $0.41, equivalent to 1.50 dirhams, to 2.20 dirhams, or $0.60, in early trading.

Noteworthy Details of Phoenix’s IPO

Phoenix’s IPO marked the first public offering of a cryptocurrency-related company in the Middle East and saw approximately 33 times more demand than expected during the subscription process. This indicates a demand of approximately $12 billion. Phoenix offered 907,323,529 shares, equivalent to 17.6% of the company’s capital, for sale at a price of 1.50 dirhams per share. The company’s post-IPO value is estimated to be around $2.5 billion.

Following the United Arab Emirates Ministry of Human Resources and Emiratization’s designation of December 2nd to December 4th as an official holiday for the private sector, the listing was one day postponed and carried out.

In its statement, Phoenix Group stated that its strategic initiatives, including a joint venture with the Abu Dhabi government, address the combination of public policy and private sector innovation. It was also noted that there is a commitment to environmental sustainability, such as the launch of the largest hydroelectric mining farm in Abu Dhabi. Bijan Alizadehfard, Phoenix’s co-founder and Group CEO, commented on the matter:

“In bitcoin mining, this IPO, which is based on four elements: innovation, renewable energy initiatives, advanced production capabilities, and strategic acquisitions, is more than just a success; it is a launch pad for Phoenix Group’s global ambitions.”

Steps Towards the Crypto Market in the UAE

International Holding Company, the largest holding company in Abu Dhabi and managed by the royal family of the Emirates, took a significant step in this field by acquiring 10% of Phoenix’s shares at the beginning of October.

In May, the Central Bank of the UAE published a guide summarizing the risks of dealing with crypto assets and service providers. This guide came along with the efforts of officials in the UAE to attract crypto businesses to the region and embrace the legal framework.

In March, Dubai introduced a new agency tasked with regulating cryptocurrency assets. Many major crypto companies, including Coinbase, praised the approach adopted by regulators in the region.

Türkçe

Türkçe Español

Español