As the election approaches, cryptocurrencies have gained significant attention among politicians. While Kamala Harris made a few minor statements regarding cryptocurrency, Donald Trump placed the topic at the forefront of his campaign agenda. This shift prompted Harris to make more moderate comments about cryptocurrencies.

Election and Cryptocurrencies

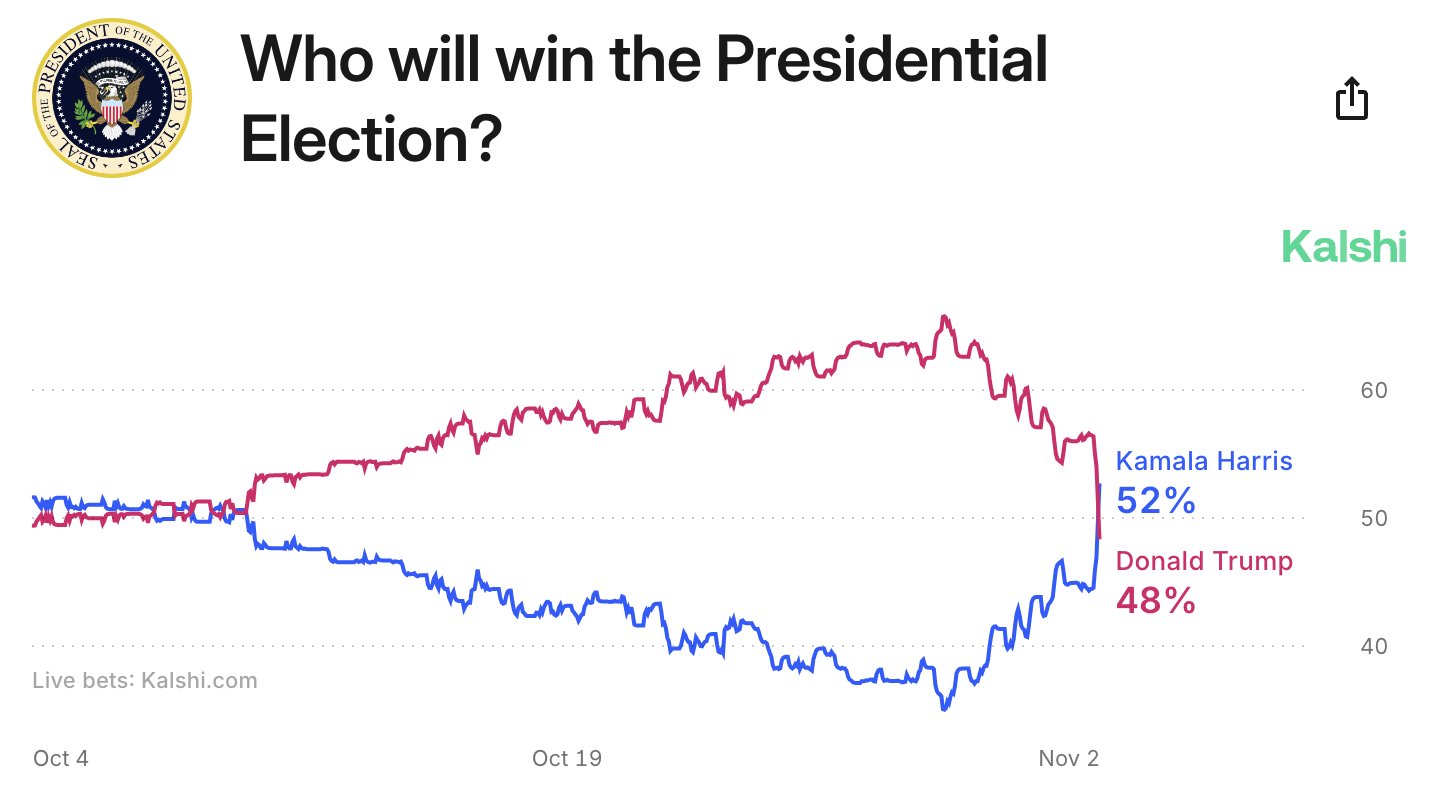

Prediction markets indicate a 4-point increase in Kamala Harris’s chances of winning against Donald Trump in the 2024 elections. Just days ago, Trump had a 30-point lead over Harris according to Kalshi. This development coincided with Harris taking the lead in three crucial states: Wisconsin, Pennsylvania, and Michigan.

Only two weeks ago, Trump was ahead in all states. Current polls show a tight race, with Trump at 48% and Harris at 47%. If millions of cryptocurrency investors, as reported by Coinbase and Ripple  $2, are among the voters and choose to support Trump motivated by innovation and profit, it could lead to an intriguing election.

$2, are among the voters and choose to support Trump motivated by innovation and profit, it could lead to an intriguing election.

There is even a possibility of legal challenges arising from the elections. Past victories for Trump led to accusations against Cambridge Analytica. This time, allegations regarding foreign interference, possibly involving cryptocurrencies from countries like Russia and North Korea, might surface.

Bitcoin Expert Opinions

The Altcoin Sherpa shared insights on the prevailing uncertainty regarding Bitcoin  $105,019. With BTC dropping to $68,720, it could rebound to $55,000 again, which may be distressing for investors who have grown impatient since March.

$105,019. With BTC dropping to $68,720, it could rebound to $55,000 again, which may be distressing for investors who have grown impatient since March.

“BTC seems quite uncertain at this level; I’ve reduced leveraged longs. While I still hold a giga Long position, I will remain patient with active positions. I anticipate significant volatility until after the election, although I maintain a bullish outlook in the medium term.”

Kyle reported that short-term Bitcoin investors sold $2.3 billion worth of Bitcoin on Thursday.

“This major sale, the largest since August, underscores the market’s quick reaction to uncertainties. Over 54,000 BTC changed hands, reaching a record level since March.”

Türkçe

Türkçe Español

Español