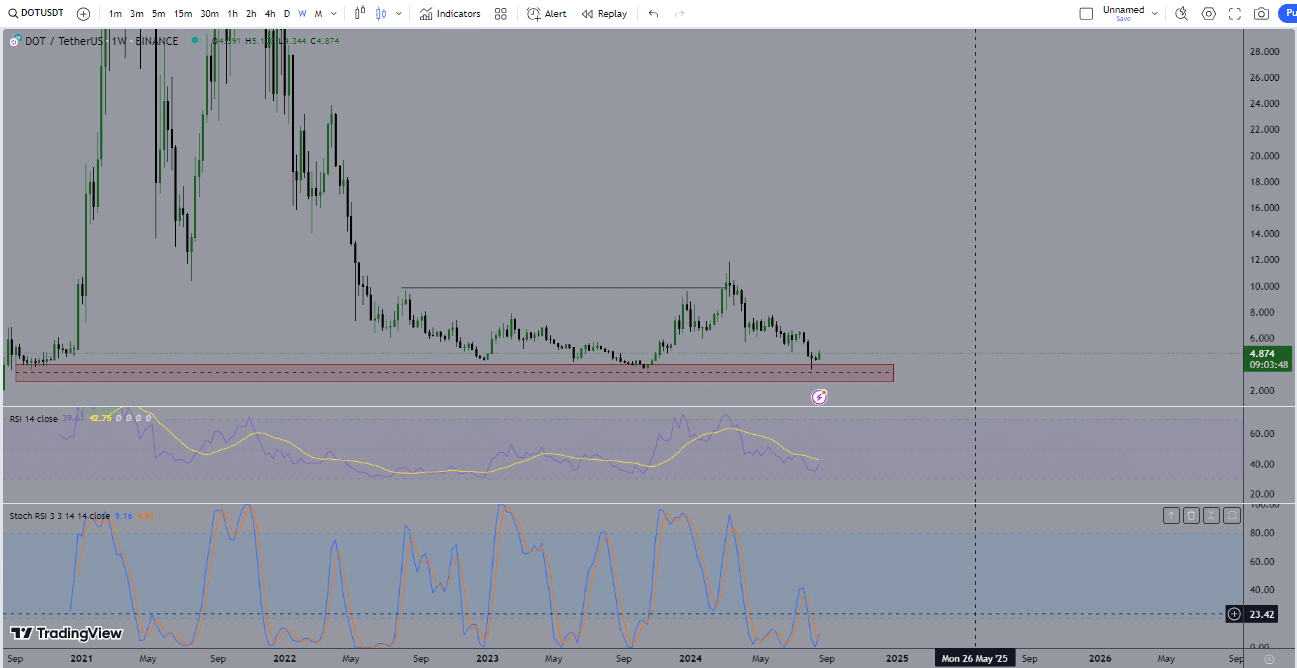

Altcoin Polkadot (DOT) has recently been in a significant position in the cryptocurrency market. Although the DOT/USDT pair managed to break the $5 resistance level, it faced a strong rejection at this level. The resistance clearly shows that DOT is struggling at $5.

What to Expect for DOT?

DOT is stuck between the $2.5 and $4 range, facing strong resistance on daily and weekly timeframes. Currently, the pair is showing an upward trend within a parallel channel, signaling recovery with support from the weekly support level. This support level has rejected DOT’s price downward five times. This resistance plays a significant role in the current market conditions.

DOT is seen consolidating within a falling wedge formation on the daily chart. Such a formation usually indicates a potential bull market reversal. The price movements of the DOT/USDT pair may have formed a bottom, signaling a possible upward trend. The anticipated altcoin season in the fourth quarter of 2024 could particularly support this rise.

The weekly support level and stochastic RSI (Relative Strength Index) also provide positive signs for DOT’s potential future rise. The stochastic RSI of DOT/USDT is currently oversold, indicating that this week’s gains could be the beginning of a larger trend. Additionally, expected interest rate cuts are predicted to have a positive impact on altcoins.

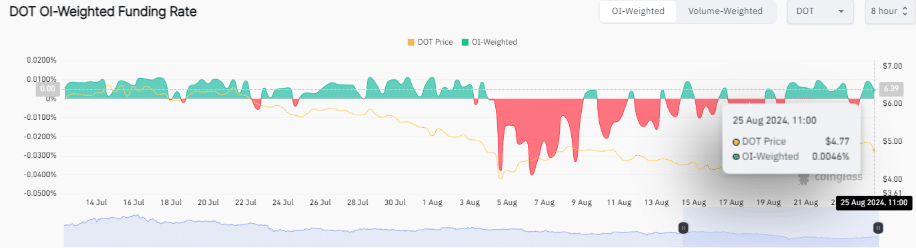

Polkadot’s Open Interest Supports the Rise

Polkadot’s open data also supports the bullish trend. DOT‘s open interest currently shows a positive OI-weighted funding rate. The rate reflects investors’ confidence in rising prices. DOT’s market value is currently at $7.2 billion, with a 24-hour trading volume recorded at $143 million. The figures indicate a 15.13% increase, showing market stability with minimal price fluctuations.

Despite testing the resistance at the $5 level, from a broader perspective, Polkadot’s bullish signals remain strong. Polkadot is well-positioned for potential gains, supported by strong technical formations, positive market sentiment, and stable market data.

Türkçe

Türkçe Español

Español