The short-term expectations for Polygon (MATIC) continue to look brutal as concerns about being classified as a security by the U.S. Securities and Exchange Commission (SEC) impact its price chart. Any potential reversal opportunity for MATIC could be hindered as Bitcoin (BTC) fails to make significant gains even after reclaiming the $26,000 price level.

Polygon (MATIC) Price

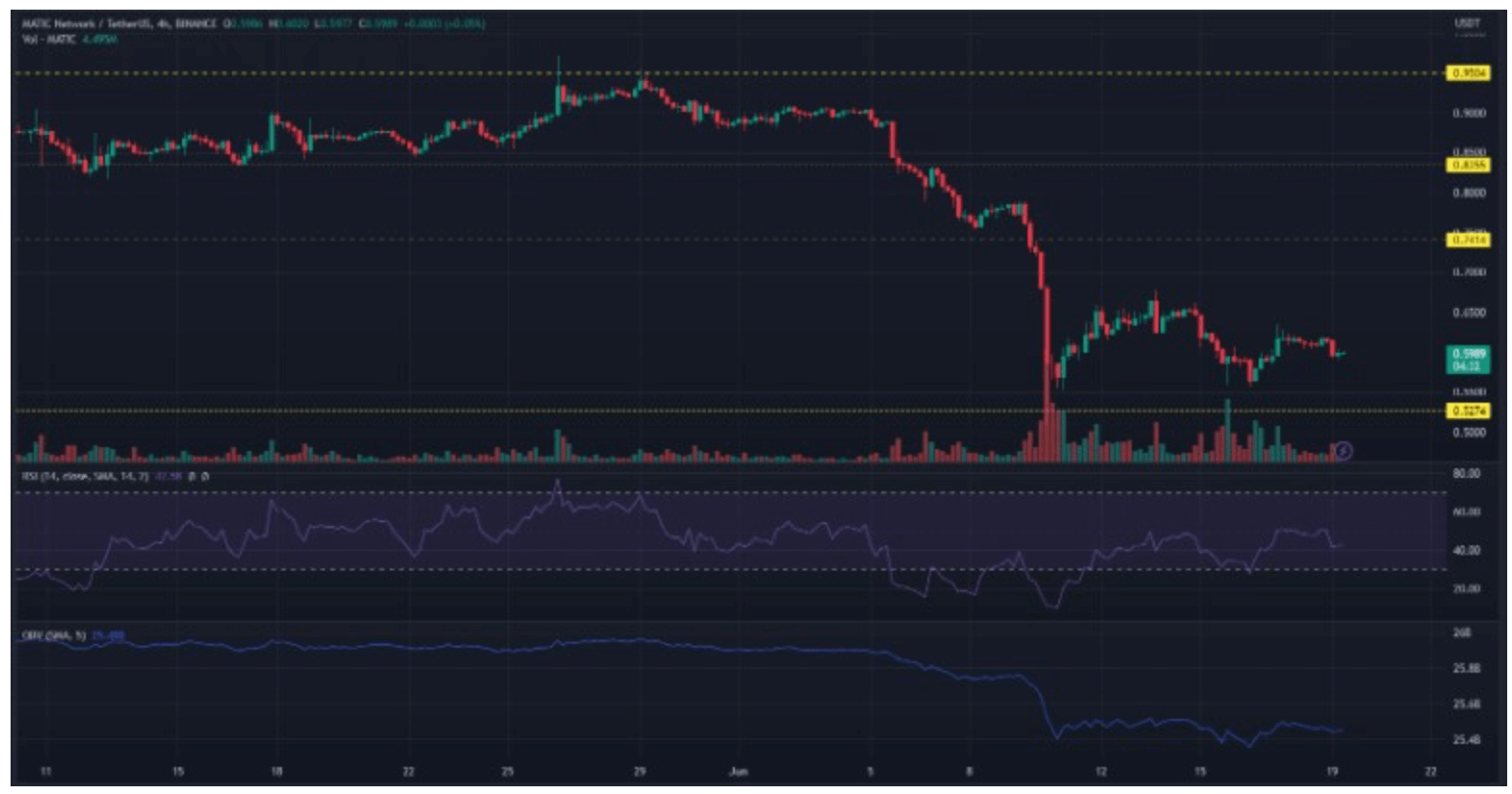

The drop of MATIC to $0.5274 in July 2022 signified the lowest point for the altcoin for the year. Sellers capitalized on the persistent bearish pressure since mid-April and uncertainty surrounding MATIC, leading to significant losses.

Despite a rise from $0.5274 to $0.6500 between June 10 and June 13, selling pressure obstructed a sustained rally. The RSI remained below the neutral 50, and the OBV decreased by 96 million in the last two days. Both indicators highlighted the significant bearish trend in the market.

Trading at $0.5988, a retest of the $0.5274 support level could provoke more aggressive selling, pushing MATIC towards the $0.5000 price area. Conversely, an increase in volume could trigger a pullback, aiming for the area between $0.6500 and $0.7000, serving as a target for the bulls.

Is It Time for a Bigger Drop in Polygon?

On the other hand, looking at Open Interest (OI) from Coinalyze in the four-hour time frame, a significant drop was observed on June 10. It had a slight increase on June 16 before falling again, which had given investors some hope. This situation showed that market speculators hesitated to open new positions until clarity emerges regarding regulatory concerns.

Similarly, Spot CVD, which tracks trading volumes over time, showed a sharp drop. This indicated that the selling volume significantly outweighed buying volume, signifying a severe lack of demand for MATIC in the futures market.