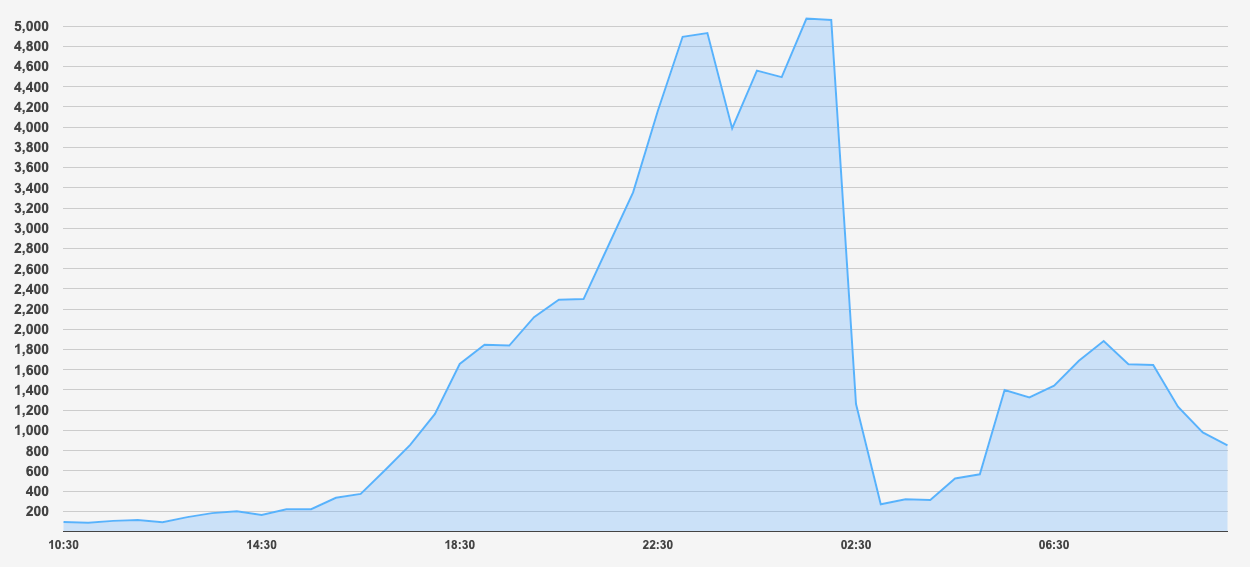

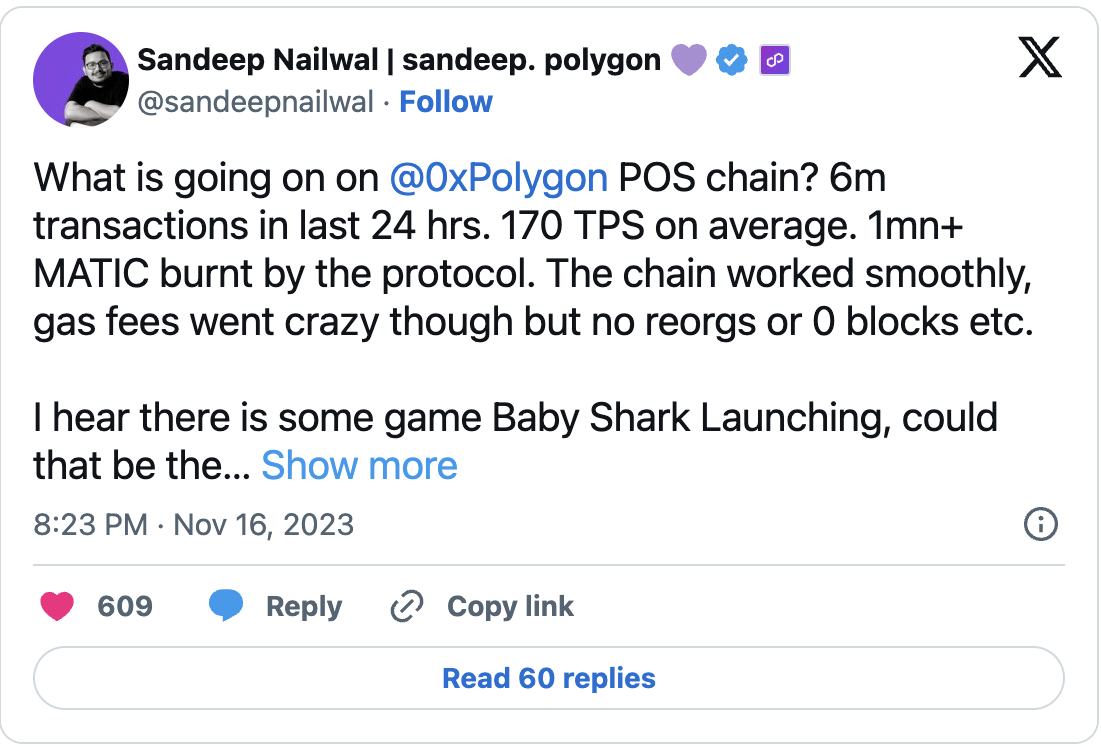

Commission fees in the Polygon ecosystem, one of the leading Ethereum Layer-2 scalable solution networks, have skyrocketed by over 1,000% and reached a peak of $0.10 after users showed intense interest in the network following the release of tokens called POLS, inspired by the Ordinals platform. Sandeep Nailwal, the founder of Polygon, shared his astonishment with his followers in a tweet on November 16, regarding the high transaction activity on the network.

Insane Surge on Polygon Network

According to the founder of Polygon, this surge could be attributed to the introduction of a new NFT collection based on Polygon, which was well received by users. The increase in network activity and gas fees may primarily be due to the excitement surrounding the launch of the new POLS token.

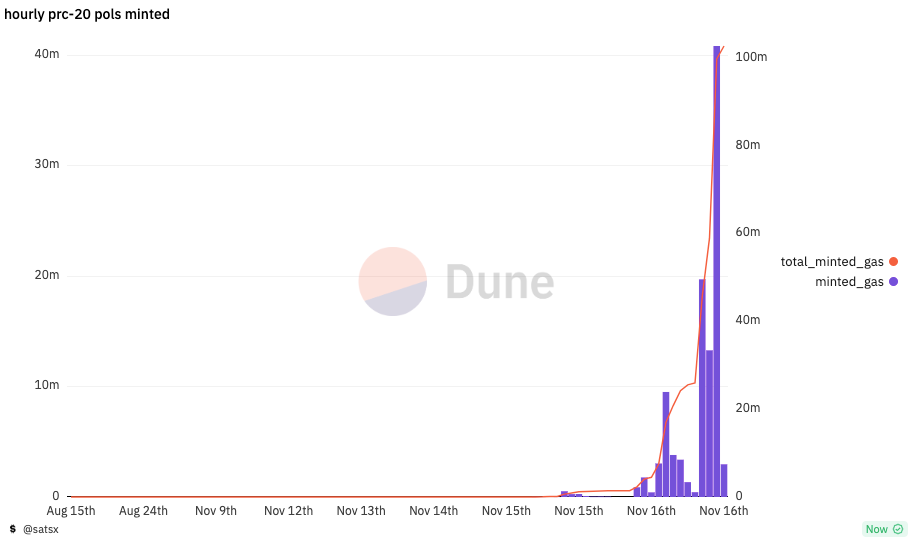

According to blockchain data analytics platform Dune Analytics, the spike in minting activity for POLS coincided with the use of over 102 million MATIC tokens as commission fees. The total value of the commission fees exceeded $86 million, which is noteworthy.

The POLS token is built on a protocol called PRC-20, which operates similarly to the BRC-20 token standard introduced with Bitcoin Ordinals. According to Ethereum Virtual Machine data, only 8.7% of the total POLS supply has been minted, and there are over 18,100 investors holding the token.

The Process Starting with Ordinals

Since reaching its highest level since the time Polygon gas fees hit their peak, the daily commission levels have returned and settled at approximately 882 gwei. Gas fees measure the amount of computational intensity required to perform a transaction on a specific blockchain network, with 1 gwei being equivalent to approximately 0.000000001 MATIC in the ecosystem.

The Bitcoin network also experienced a similar surge in activity, although for a longer period, after the introduction of the Ordinals protocol, which allows users to mint NFTs directly on the Bitcoin blockchain network.

The hype surrounding Ordinals NFTs and BRC-20 tokens led to unprecedented levels of commission fees on the Bitcoin network since April 2021, and it also sparked a process where commodity-focused Bitcoin hodlers like Samson Mow and Adam Back criticized the NFT protocol and token standard as wasteful.