Polygon’s token MATIC stands on the verge of a potential decline, with its price at risk of dropping to $0.68 before a possible recovery. Despite short-term market dynamics, recent developments within the Polygon ecosystem highlight a transformative stage with integration into Celestia Org. It is suggested that two developments for the cryptocurrency MATIC could point to a parabolic rally. Here are those developments.

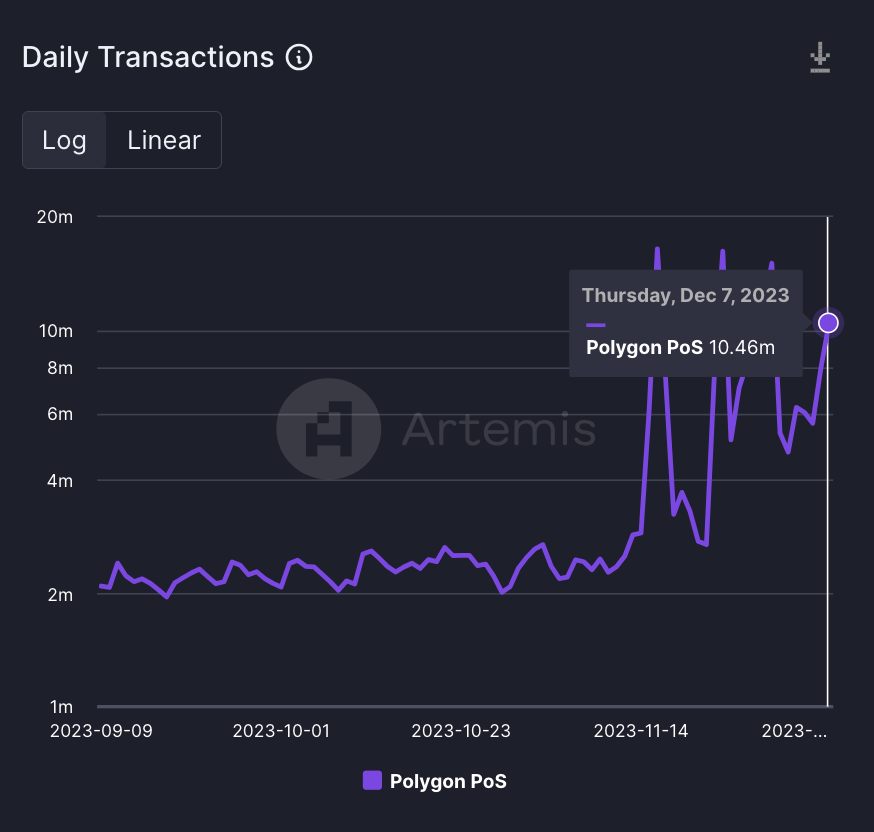

Daily Transactions Exceeding 10 Million

As an indicator of bullish adoption for MATIC, Polygon’s Proof-of-Stake chain is currently processing more than 10 million transactions per day, as reported by corporate analytics platform Artemis. This high transaction volume reflects a robust level of adoption and strengthens Polygon’s position in the scaling solutions landscape.

Polygon co-founder Mihailo Bjelic recently announced their integration with Celestia, a modular data network, through a post on X. This integration will empower developers in the Polygon ecosystem by providing modular development capabilities.

This move is expected to significantly reduce the barriers to launching high-efficiency Layer-2 chains on Ethereum and lower transaction costs by 100 times. The integration paves the way for developers to launch ZK-focused Layer-2 projects using Polygon’s Chain Development Kit (CDK) at the beginning of 2024.

MATIC Price Dip

Despite the bullish developments, MATIC is currently facing a short-term price decline. The token, trading at $0.8454 on Binance, has experienced a drop of about 5% in the last 24 hours. Expectations are leaning towards further decline for the cryptocurrency MATIC.

The prospect of the MATIC cryptocurrency price retreating to the $0.6851 level implies a decrease of 18% from the current price. However, market analysts envision a recovery scenario. The target for this recovery has been set at the November 14 peak of $0.9842.

While MATIC manages short-term fluctuations, the synergy between technological advancements and ecosystem development positions Polygon for sustainable growth and potentially affects MATIC’s long-term trajectory. Investors are closely monitoring these dynamics for clues about the token’s future performance. Let’s see if the two significant developments mentioned above will indicate a bullish position for MATIC in the coming days.

Türkçe

Türkçe Español

Español