Cryptocurrency markets continue to show a positive outlook, with many altcoins following suit. However, Polygon (MATIC), a significant part of the blockchain scalability challenge, seems to have found itself in an interesting position. Despite the positive appearance in the market, it is stated that MATIC is in a different structure and warnings are being issued to both investors and traders to be cautious.

What Does Polygon’s Performance Indicate?

Currently trading at $1.05 and with a total volume exceeding $10 billion, MATIC’s stagnant structure compared to the broader market trend seems to have created an inverse correlation.

This inconsistency is also reflected in the Weighted Sentiment Indicator, which shows a negative trend among investors, indicating a noticeable decline in market sentiment towards the token. Although there is an increasing expectation of a downturn among investors, MATIC’s price movement appears to be fueling expectations of an uptrend.

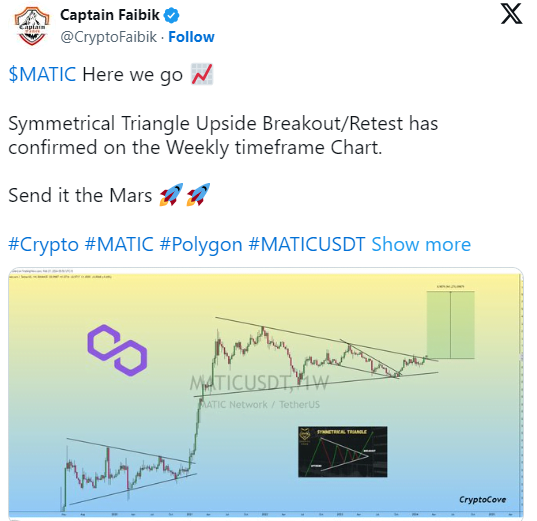

Captain Faibik, a name frequently mentioned in recent cryptocurrency analysis, commented in a recent analysis that MATIC is very close to breaking out of an ascending triangle formation.

A potential breakout in price, coupled with a positive outlook in market dynamics, could lead to MATIC reaching the eagerly anticipated $2 level in the coming weeks.

The Future of MATIC

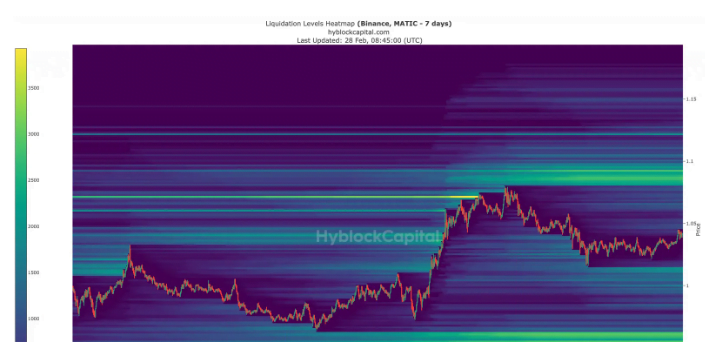

However, there are challenges on the way to the $2 mark. Resistance levels seen on the charts are considered a significant barrier for the token. Data provided by Hyblock Capital suggests that liquidations could be high at the $1.08 level, which is seen as a significant resistance.

Such liquidation zones could bring about a correction in price and hinder MATIC’s progress.

Looking at MATIC’s daily chart, a volatile structure is evident, as shown by the Bollinger Bands. However, the appearance of the MACD indicates a strong buying market, paving the way for investor optimism.

While all this is happening, MATIC’s price was trading at $1.04, with a rise of less than 1%. On the other hand, there was also an increase in MATIC’s 24-hour trading volume and overall volume.

MATIC’s total volume increased by 0.4%, rising above $10 billion. The 24-hour volume saw an 86% increase, exceeding $1 billion.