Crypto market analysts herald a positive development as the leading analysis firm IntoTheBlock reports a significant increase in the market value of stablecoins, suggesting an increase in purchasing power for crypto market participants. This development could reflect in the market as increased investments in Bitcoin and altcoins in the coming period.

Stablecoin Surge Indicates Increase in Crypto Liquidity

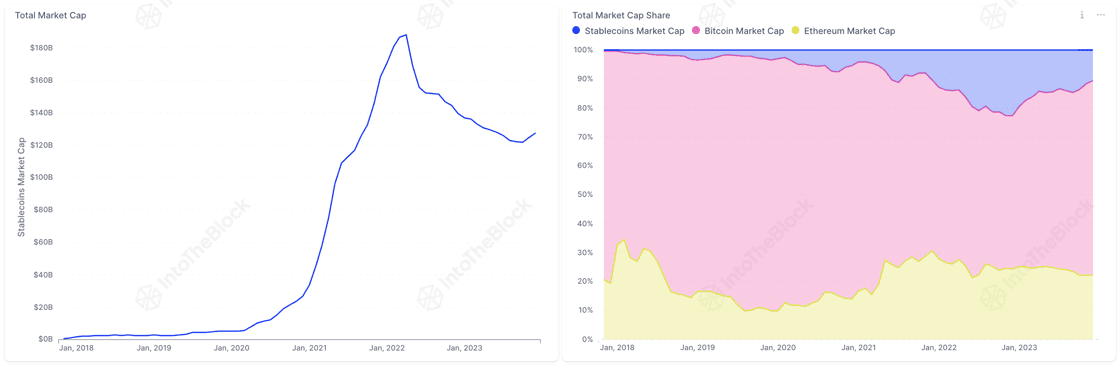

After a year and a half of decline, the total value of all stablecoins is preparing to rise for the second consecutive month in December. IntoTheBlock sees this trend as a positive sign for crypto liquidity and indicates that the capacity of market participants to transact with stable and predictable assets is increasing.

IntoTheBlock is examining Bitcoin’s exchange net flows, a metric that tracks Bitcoin’s inflows and outflows from centralized exchanges. Notably, Bitcoin witnessed a net inflow worth $860 million this week, reaching the highest figure in the last nine months.

Despite historical correlations that suggest a 5% price drop following large exchange inflows, the analysis firm points out that whales accumulated 22,000 BTC during the same week when Bitcoin’s price dropped to $41,000. This accumulation underscores the confidence of significant asset holders in Bitcoin’s long-term value, even amidst short-term market fluctuations.

Bitcoin and Ethereum Price Updates

As of the latest data, Bitcoin is trading at $42,248, experiencing a 1.70% decrease in the last 24 hours. Meanwhile, Ethereum (ETH) has been facing consistently high fees throughout the week, affecting the supply of the second-largest cryptocurrency.

With over 35,000 ETH burned in the past seven days, Ethereum continues its trend of negative net issuance that started in early November. Ethereum’s current trading value is $2,251, showing a 1.80% decline over the past day.

In summary, the rise in stablecoin market value points to a positive change in crypto liquidity, providing market participants with increased purchasing power. Despite the recent exchange net flows for Bitcoin and Ethereum’s fee-driven supply dynamics, the crypto market continues to be dynamic, and whales express their confidence in the long-term potential of significant assets.

Türkçe

Türkçe Español

Español