Cryptocurrency investors continue to face challenging times. While Bitcoin remains relatively stable, altcoins are experiencing losses. However, there are a few exceptions. Over the weekend, a few altcoins brought smiles to investors’ faces, and the trend remained intact. Price movements in less popular altcoins with low trading volumes can be triggered by double-digit price swings with minimal buying interest. If investors fail to take profits during these opportunities, they may witness a rapid reversal in price.

Loom Network (LOOM)

The LOOM price has been following an ascending support line since June 14th. This line has been confirmed three times in August and September. After the last jump on September 10th, the price started a sharp upward movement. Loom surged by 25% during the day, reaching a horizontal resistance zone at $0.047. However, as feared, red candles followed. This selling pressure indicates that investors are now waking up to the weak rallies of the weekend.

A successful breakout could lead to a 40% increase towards the $0.062 resistance zone, while a rejection could cause a drop towards the ascending support line. The support line is currently at $0.039. It would be beneficial for investors to formulate their strategies based on these signs.

Stellar (XLM) Price Prediction

The XLM price fell below a descending resistance line on July 13th. The decline continued until August 17th, resulting in a dip at $0.105. The price then rebounded, forming a long lower wick and confirming the support zone at $0.110. We have previously shared critical price levels with expectations of an increase in XLM coin price.

On September 4th, the price reached the expected resistance zone at $0.130 following the breakout from the resistance line. Now, it is struggling to confirm it as support. If successful, XLM could reach the $0.160 resistance level with a 22% increase.

On the downside, we may see a drop towards the well-known support zones at $0.11 and $0.105.

Should You Buy Metal (MTL)?

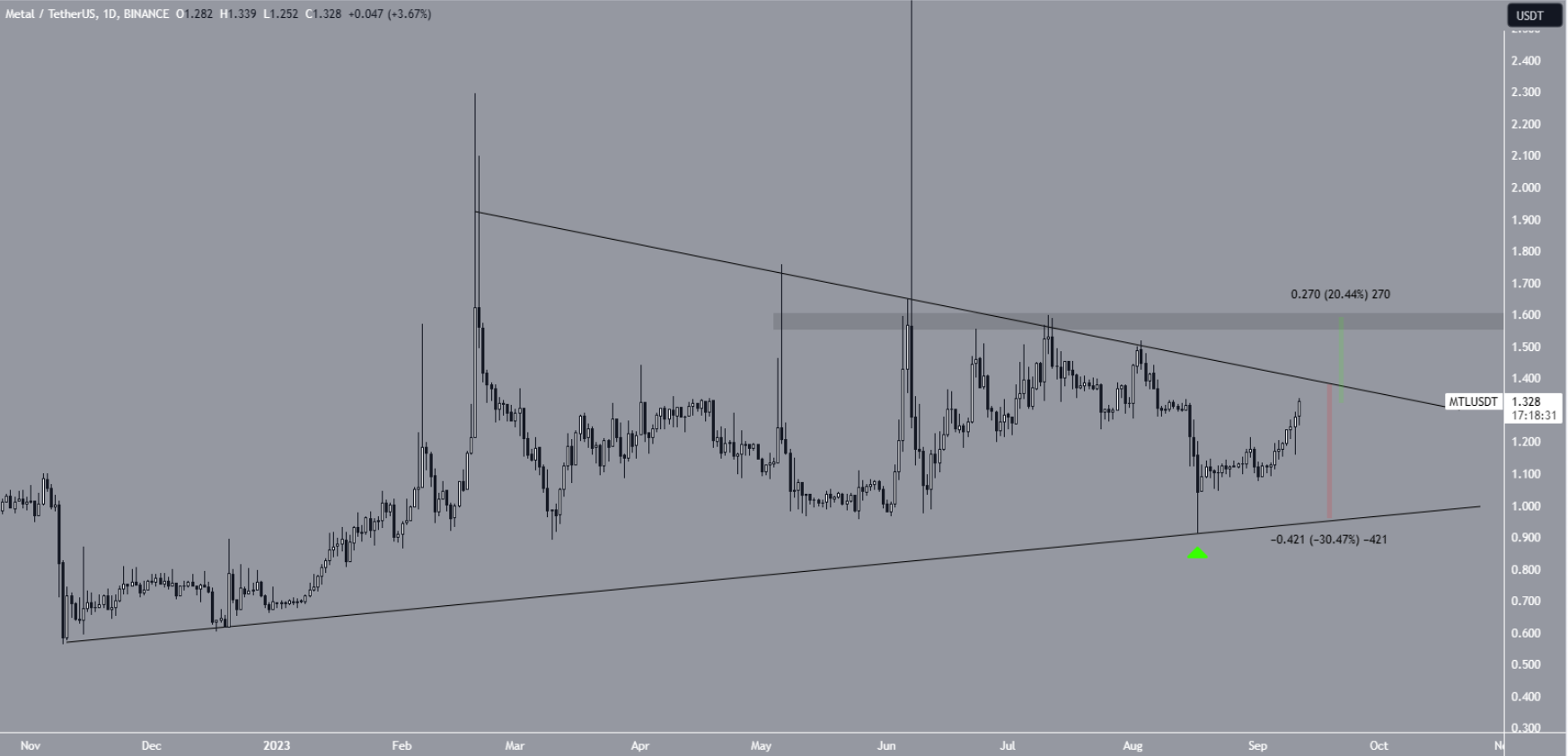

The MTL price has been rising along an ascending support line since November 2022. More recently, the price jumped on August 17th, initiating an upward movement. MTL is currently approaching a descending resistance line at $1.35. When combined with the support line, it forms a symmetrical triangle, which is considered a neutral formation.

Whether the price breaks out or gets rejected from the resistance line will determine the next move. A breakout could lead to a 20% increase towards the next resistance at $1.60. On the other hand, a test of the $1 support level could occur in a bearish scenario.

Türkçe

Türkçe Español

Español