QCP Capital, in its latest market report published on September 4, indicated that the Volatility Momentum Index (VMI) for Bitcoin and Ethereum surged early in the day, signaling that the market has entered a period of high volatility. Although the company’s analysts do not predict whether prices will rise or fall, they suggest that significant price movements could be seen in the short term.

VMI Signals Significant Price Movements

Historically, similar signals from the VMI have been associated with notable changes in market volatility. VMI is a technical indicator used by investors to assess the momentum of price volatility in the market. A trigger in the index is often seen as a precursor to high price movements, and investors may be caught off guard by significant price changes if they are not adequately prepared.

QCP Capital emphasized the importance of adjusting trading strategies in response to these signals. Specifically, QCP highlighted that shifting from strategies focused on gains to those involving long convexity (call options), such as buying options, can help optimize portfolio gains during periods of increased volatility.

This approach allows investors to benefit from significant market movements regardless of the market direction by leveraging the potential for larger price movements.

Acting Early and Taking Positions is Crucial

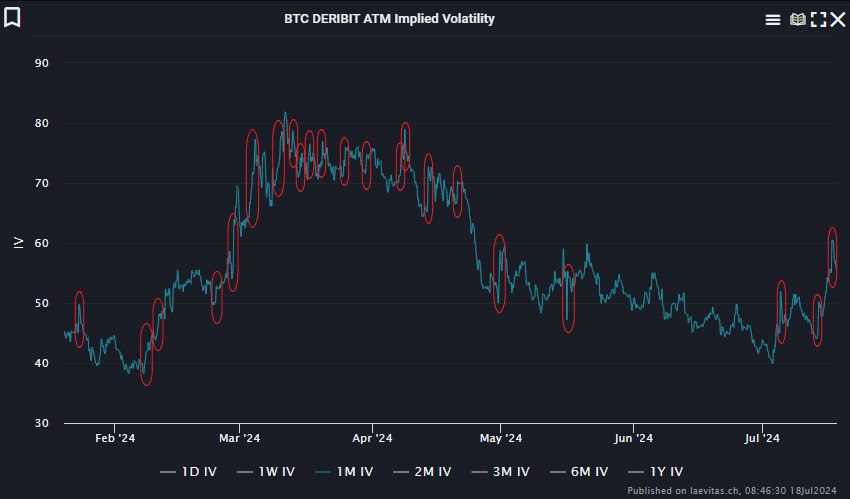

QCP Capital’s analysis also included a historical chart showing the implied volatility for Bitcoin during past VMI signals, highlighting the potential for significant price volatility. As volatility increases, the cost of options typically rises, making it crucial for investors aiming to capitalize on market movements to take early positions in these instruments.

At the time of the report, Bitcoin was trading at $56,782, up 0.42% in the last 24 hours, while Ethereum was priced at $2,405, up 0.77% over the same period.