Bitcoin price recently started to climb again following relatively positive comments from the Fed Chairman. Altcoins found strength from this and turned their direction upward, but the situation is more complicated for some. For example, at the time of writing, the price of DOGE increased by 10% and reached $0.147. So, what’s happening?

Is Ethereum a Security?

Before the transition to PoS, that is, before the Merge took place, SEC Chairman Gensler seemed much more flexible on this issue. He even explicitly mentioned in his MIT lectures in 2018 that Ether was not a security.

However, after the Merge, the network transitioned from the Proof-of-Work (PoW) mechanism to Proof-of-Stake, which now leads him to view it as a security. The problem is that no matter what crypto projects do, they seem to attract ire. PoW altcoins were also being criticized for high energy waste. According to a recent report by Fortune, the SEC has already started a campaign asserting that Ether is a security, and we had written about the details a few hours ago.

Cardano founder Hoskinson wrote the following;

“The investigation is not about the historical facts and circumstances surrounding the 2014 ICO. It’s rather about the position that with the transition from proof of work to proof of stake in 2022, there’s a new set of facts and circumstances, and Ethereum 2 is essentially a new cryptocurrency. This will be consistent with the statements made during the testimony and the subpoenas received by organizations around the Ethereum Foundation, as reported by Fortune.”

“This means that Ethereum 2 has essentially reset the clock and has a blank slate of legal interpretation. The only issue will be whether Ethereum was a security at the moment PoS was launched and who is the issuer of this asset.”

XRP, DOGE, LTC, and BCH

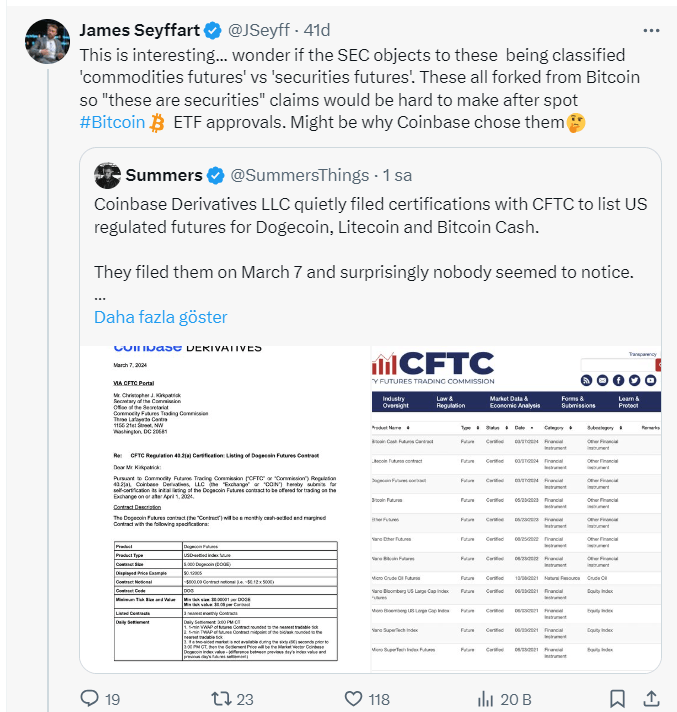

The SEC took action against Ether and almost simultaneously, Coinbase did something else. It applied to the CFTC for certificates for DOGE, LTC, and BCH futures. If approved, this could mean that while Ether is in trouble, DOGE, LTC, and BCH could be officially recognized as commodities on April 1st and could experience further increases. XRP Coin is not on the list and therefore did not see as much of an increase as the others.

Dogecoin price increased by 12%, LTC by 5%, and BHC once again surpassed $400. A Bloomberg ETF analyst commented on Coinbase’s recent move;

“This is interesting… I wonder if the SEC will object to these being classified as ‘commodity futures’. All of them forked from Bitcoin, so it will be difficult to claim ‘these are securities’ after spot Bitcoin ETF approvals. This might be why Coinbase chose them.

To be honest, if the SEC had worked together with the industry to set some rules in this area, we wouldn’t be seeing these kinds of moves. But at the same time, my job would be less interesting.”

Türkçe

Türkçe Español

Español