The pricing in the cryptocurrency markets, particularly Bitcoin (BTC), has been significantly influenced by the recently released data concerning the US Gross Domestic Product (GDP) and Unemployment Benefits. The price of the leading cryptocurrency was severely impacted by data from the United States. In the past, the Federal Reserve’s income data and interest rates have led to a decrease in cryptocurrency prices. Furthermore, historical data suggests that a strengthening dollar generally results in a downturn in cryptocurrency markets.

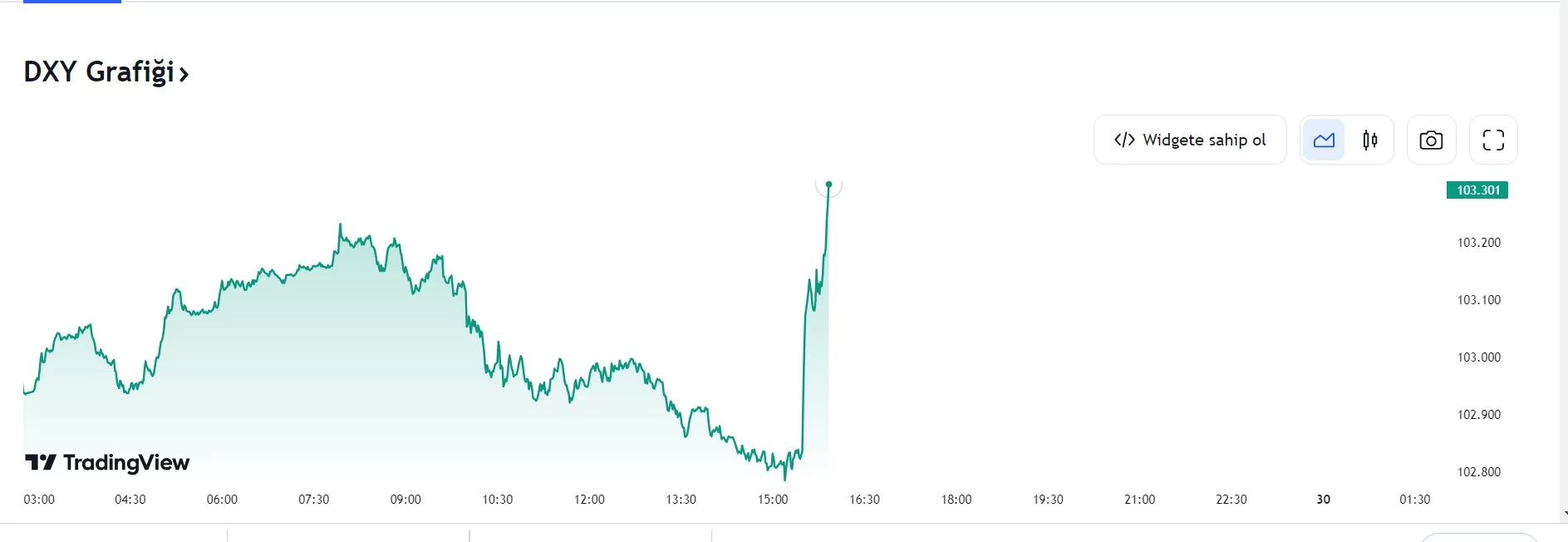

Investors in cryptocurrency and general markets have been eagerly awaiting the US GDP data, which was announced just minutes ago. While the expectation for the US GDP was at 1.4%, the previous figure being 1.3%, the recently released reports show that the figure has exceeded expectations, reaching 2%. Additionally, Unemployment Benefit Claims were at 239K (Previous: 265K, Expected: 263K). These data could indicate a strong US economy, which according to experts, could create a negative impact for cryptocurrencies. The unemployment benefits data shows the largest drop since October 2021. After the data release, DXY achieved significant gains.

Crypto market experts had stated in various remarks that in the case of data falling below expectations, it would positively impact assets such as cryptocurrencies, while marking a negative situation for the US dollar. However, meeting or exceeding expectations was suggested to instigate an upward movement in the crypto markets. Moreover, a strong US economy could support the Federal Reserve’s interest rate increases in future processes. A prolonged bull run in gold may also be affected by these data.

Over the past year, Bitcoin (BTC) has recovered following consecutive drops, exceeding the critical psychological level of $30,000 for investors in 2023. However, due to the aforementioned reasons, it again fell back into this range. Bitcoin, the flagship of the markets, is currently trading at $30,750.