Bitcoin‘s (BTC) recent price increase has become a beacon of hope for many investors. Meanwhile, as the cryptocurrency community awaits the potential introduction of exchange-traded funds (ETFs), an increasing number of investors are taking strategic measures to mitigate risks in the evolving market environment.

Market Dynamics in BTC

The rise in sell orders poses a significant challenge for buyers, making it increasingly difficult for buyer bids to effectively surpass this critical range. The main question is whether this concentration of sell orders indicates a resistance level in the market. In response to this market dynamic, analysts are adopting cautious strategies to navigate the evolving environment.

Moreover, the mounting difficulty caused by the accumulation of sell orders may lead to a reassessment of Bitcoin’s potential impact on its growth trajectory. Investors are actively adjusting their positions to adapt to the current challenges by anticipating evolving market conditions. A significant indicator of market sentiment is the put-call ratio surrounding Bitcoin. In recent days, this ratio has seen a slight decrease from 0.48 to 0.46. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Critical Metrics in Bitcoin

More information about the market dynamics of the leading cryptocurrency can be obtained from the significant decrease in the 25-day delta skew over the past few weeks. In the context of financial markets, the 25 delta skew refers to the volatility skew for options with a 25% delta. Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset. A negative 25 delta skew indicates a higher probability of downward price movements. As of the latest market update, Bitcoin is trading at $42,544.09, reflecting a slight decrease of -1.13% over the past 24 hours.

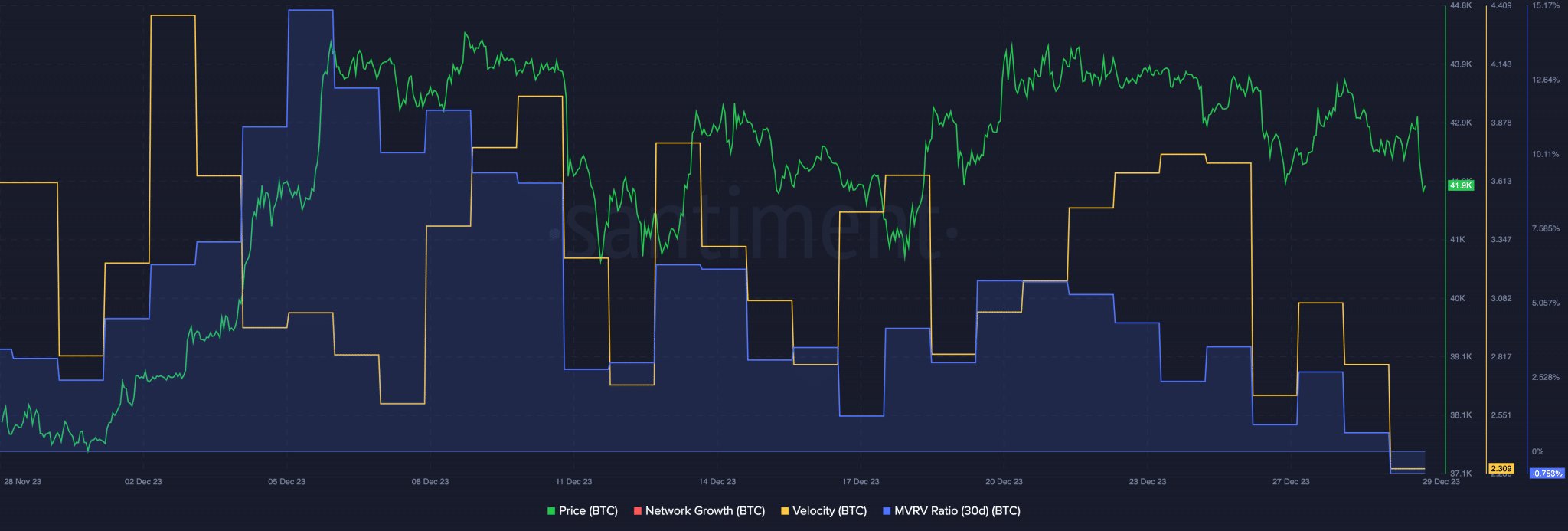

Looking at on-chain metrics, Bitcoin’s MVRV ratio had fallen despite remaining relatively high. This suggests that the market is experiencing some degree of profit-taking, yet a significant number of addresses still hold Bitcoin at profitable levels. Additionally, the growth in daily active addresses indicates ongoing interest and participation in the Bitcoin network, which could contribute to its overall resilience.

Türkçe

Türkçe Español

Español