Daily trading volumes for areas such as options and futures, including crypto futures, reached record levels this week on several exchanges. The crypto futures exchange Deribit announced in a February 29 post that its 24-hour trading volume hit an all-time high of $12.4 billion during the day.

New Record in Open Interest

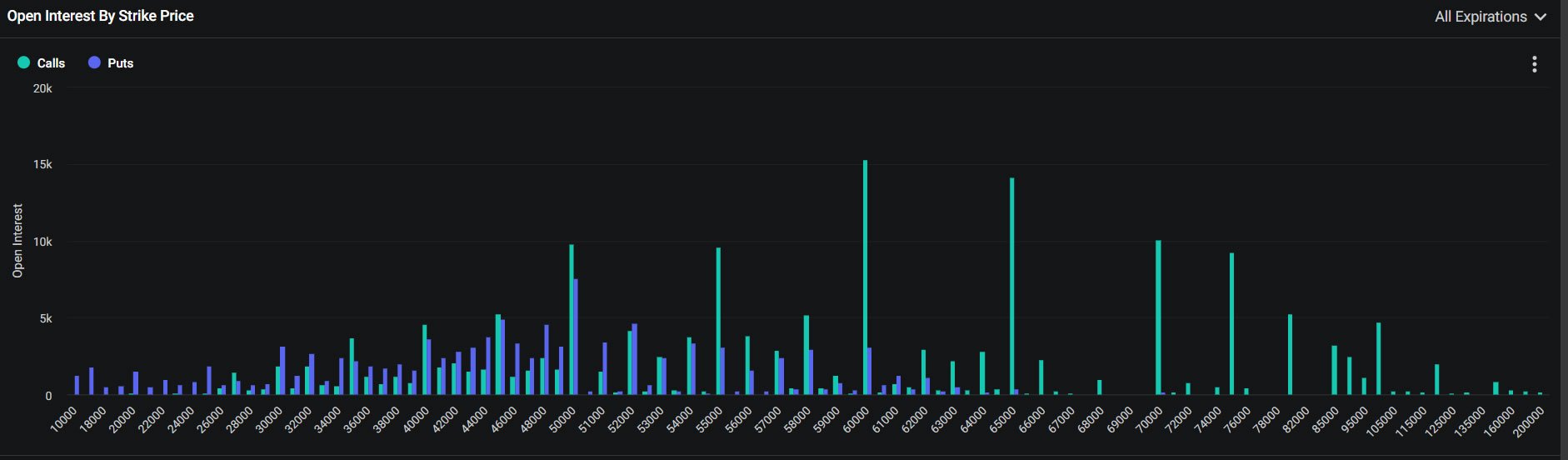

The platform also added that open interest, the number of futures contracts that have not yet been settled or closed, exceeded $29 billion, marking an all-time high. It was noted that Deribit’s third record was customer assets reaching $4 billion.

On March 1st, Coinbase Institutional, a regulated futures exchange in the United States, announced that it had its second-best day ever on February 29th, reaching 850 unique end-users and trading $380 million in nominal volume in Bitcoin and Ethereum contracts.

Greeks Live, a professional option investor tool platform, also reported a historic high in 24-hour option trading volume at $620 million. Greeks Live indicated on March 1st that US spot Bitcoin exchange-traded funds (ETFs) were driving the spot bull market, reaching record volumes as the Bitcoin price rose to $64,000 this week. However, it was noted that option volume positions modestly increased:

“Robust entries are creating a very healthy market structure.”

Striking Statements from the Deribit Team

Every Friday is the expiration day for crypto options, and Deribit reported that there were about 32,000 Bitcoin options set to expire on March 1st, with a nominal value of $1.9 billion. In addition, approximately 235,000 Ethereum option contracts were also expiring with a nominal value of $793 million.

Spot Bitcoin ETF funds also had a strong week with record trading volumes exceeding $2 billion. However, on February 29th, there was an outflow of nearly $600 million from Grayscale’s ETF fund, which, according to preliminary data from Farside Investors, caused the net inflow for all ten ETF funds to drop to $93.8 million since February 6th, the lowest level.

BlackRock’s Bitcoin fund saw net inflows of $604 million on February 29th, surpassing Grayscale’s net outflows and providing more inflows than all other ETF funds combined for the day.

Türkçe

Türkçe Español

Español