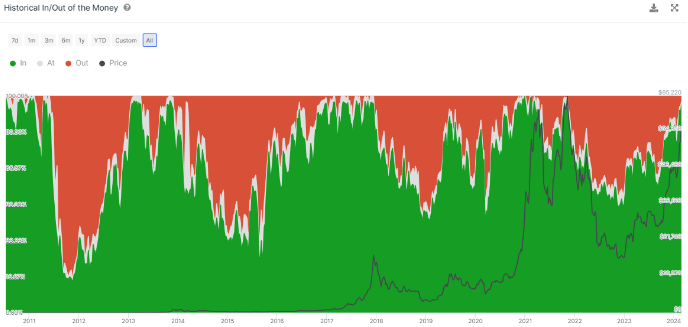

According to data from the on-chain data platform IntoTheBlock, the recent surge in momentum for Bitcoin (BTC) has led to a significant increase in the number of wallet addresses holding unrealized gains. According to the platform, the proportion of these wallet addresses has exceeded 97%, reaching a record level.

More Than 97% of Wallet Addresses Are in Profit

Recent data indicates that more than 97% of Bitcoin wallet addresses are currently in profit. Being “in profit” means that the average purchase cost of the wallet addresses is below the current market price of around $65,000. This rate corresponds to the highest level seen since November 2021, when Bitcoin reached its all-time high of approximately $69,000.

For a wallet address to be in profit, the market price of BTC must exceed the average purchase price of that wallet address. When this occurs, the wallet address is considered “in profit.” This indicates that the majority of Bitcoin investors have purchased their coins at prices below the current market price. IntoTheBlock also noted that this data suggests reduced selling pressure due to a significant percentage of wallet addresses now being in profit.

In a bulletin published during a period when BTC was trading around $62,000, IntoTheBlock shed light on the effects of a significant number of wallet addresses being in profit and the market dynamics. The platform mentioned that newcomers to the market buying BTC are essentially purchasing from existing users who have already made gains on their investments. According to the platform, this dynamic could contribute to strengthening the current positive market sentiment and continue the ongoing upward trend in Bitcoin’s price.

Rally Gains Momentum from Spot ETFs

Bitcoin has made a notable ascent this year, adding a 54% increase on top of the 154% rise recorded in 2023. Market observers attribute the price increase largely to strong inflows into spot exchange-traded funds (ETFs) approved in the US in January. The adoption of approved spot ETFs by Wall Street has shifted supply-demand dynamics in favor of the bulls and potentially opened the way for more rallies that could take Bitcoin to new record levels.

Along with Bitcoin, the overall cryptocurrency market has also captured a positive momentum. Many altcoins have risen by rates of up to 50% and even exceeding 100% since the beginning of the year.

Türkçe

Türkçe Español

Español