Ripple (XRP) and the U.S. Securities and Exchange Commission (SEC) potential settlement rumors caused a significant stir in the cryptocurrency market. XRP reaching a three-month high of $0.61 increased excitement among investors. This rise created great optimism among market participants, although some are skeptical about the likelihood of these rumors coming true.

Secret Meeting and Market Speculations

The secret meeting planned between the SEC and Ripple on July 18, 2024, generated significant excitement in the market. This meeting attracted investors’ attention as it has the potential to resolve the legal dispute between the two entities. The anticipation of the meeting further boosted XRP’s price and led to speculation among market participants that a settlement might be near.

Former SEC attorney Marc Fagel noted that such rumors have surfaced before without reaching a conclusion. Fagel emphasized that the current speculations are no different from past instances and advised investors to be cautious. However, the market responded positively to these rumors, continuing to increase XRP’s price.

XRP’s Price Movements

XRP reclaimed the 38.6% Fibonacci level at $0.61 and set its next target at the 23.6% Fibonacci level of $0.66. However, this upward momentum faces challenges as XRP entered a significant sell order block. Indicators like the Relative Strength Index (RSI) show strong buying pressure but also suggest a risk of pullback.

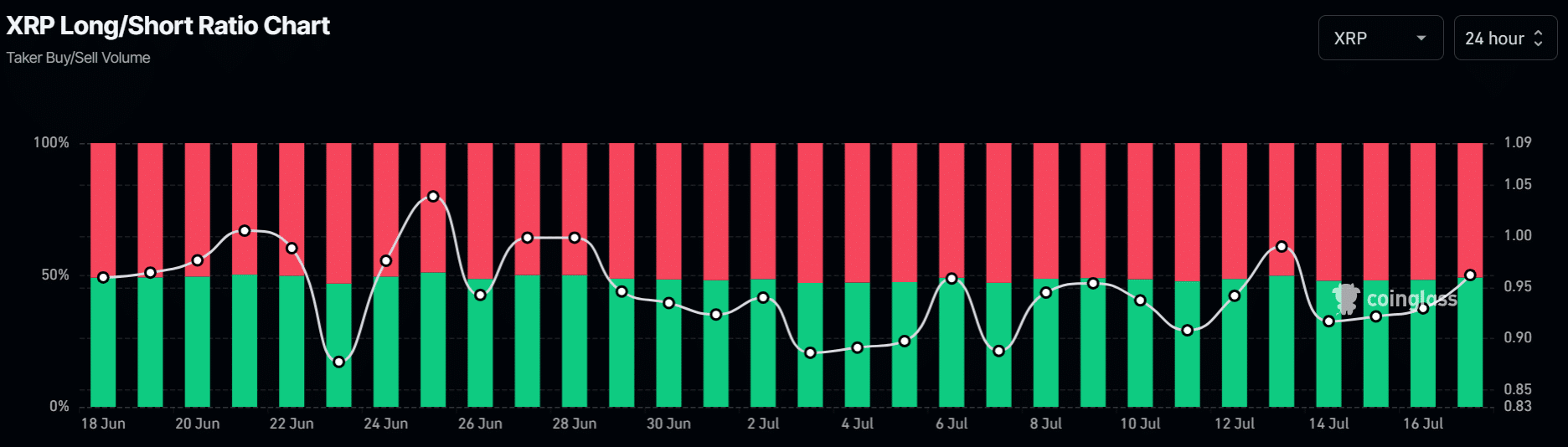

Spot market data from Binance shows that selling pressure has decreased and capital inflows have significantly dropped over the past week. This situation creates a more optimistic outlook among market participants. Investors’ confidence in XRP has also increased, with futures long positions rising from 47% to 49% since the beginning of the week.

The outcome of the July 18 meeting will be a critical moment determining whether XRP’s recent rally will continue. The cryptocurrency community closely follows these developments, which could shape Ripple‘s future and its position in the market. As the date approaches, excitement and speculation in the market will continue to rise.

Türkçe

Türkçe Español

Español