The year 2025 was remarkable for Ripple  $2 despite being challenging for many cryptocurrencies. Ripple not only surpassed its all-time high price but also witnessed the end of a significant lawsuit and the acquisition of three major companies. These achievements contributed to XRP Coin’s resilience even during downturns. Notably, XRP has maintained an impressive streak for 19 consecutive days, signifying its strength in the market.

$2 despite being challenging for many cryptocurrencies. Ripple not only surpassed its all-time high price but also witnessed the end of a significant lawsuit and the acquisition of three major companies. These achievements contributed to XRP Coin’s resilience even during downturns. Notably, XRP has maintained an impressive streak for 19 consecutive days, signifying its strength in the market.

Resilient Performance of Ripple (XRP)

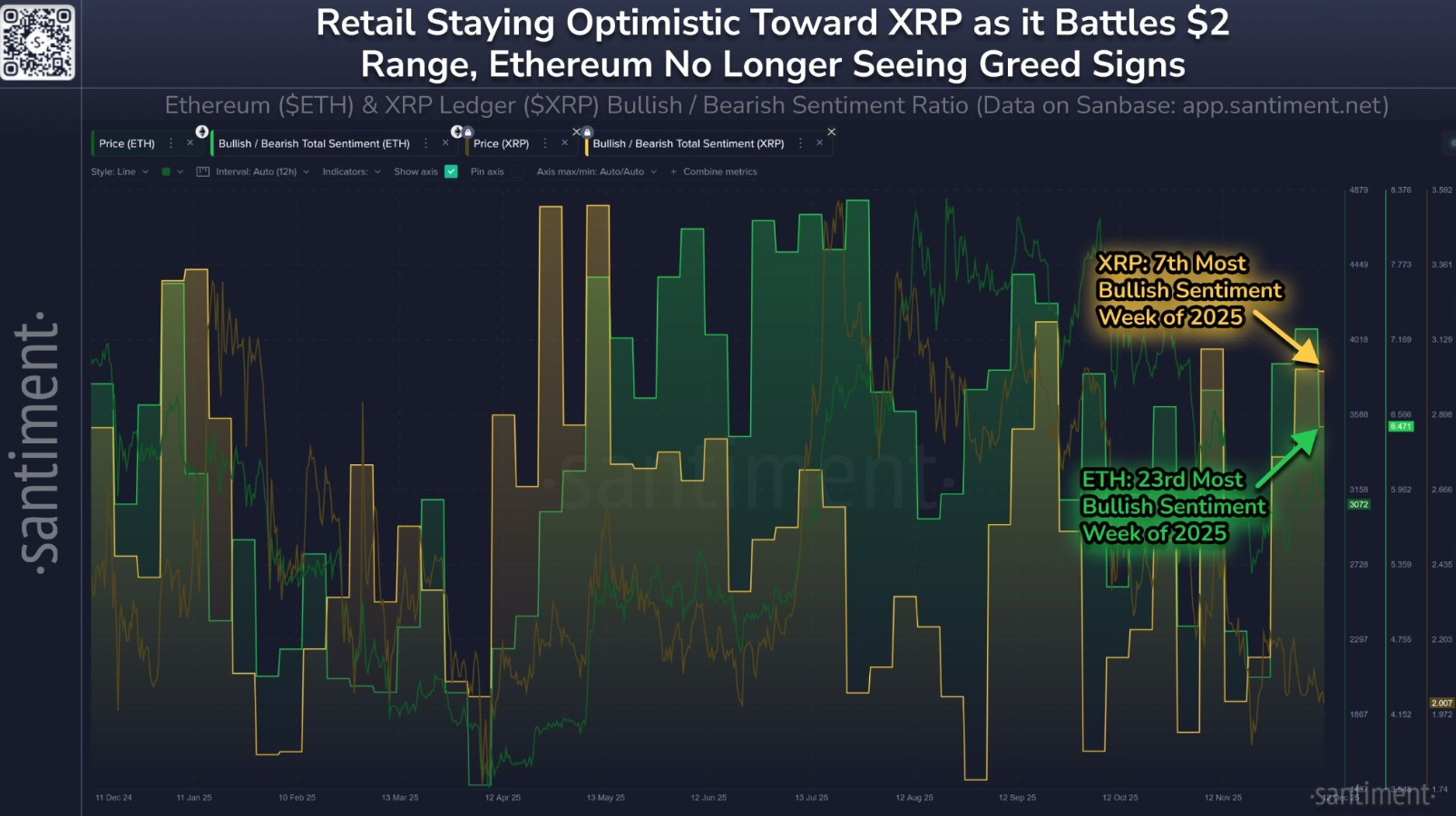

According to Santiment data, individual investor interest in XRP is making a comeback, with the sentiment improving. Although XRP Coin is struggling to maintain the $1.98 support level, the data from Santiment on Friday indicated potential changes. As Ripple continues battling between bulls and bears, the altcoin‘s fight to sustain the $2 mark reflects positive sentiment and optimism in social media discussions.

Over the past week, XRP has mostly upheld the $2 mark, but it faced a drop to its support level due to Bitcoin  $90,533‘s losses as it approached the weekly close. With XRP experiencing losses nearly equivalent to Bitcoin’s, its current battle is around maintaining the $1.98 level, with a potential fallback to $1.93 if unsuccessful.

$90,533‘s losses as it approached the weekly close. With XRP experiencing losses nearly equivalent to Bitcoin’s, its current battle is around maintaining the $1.98 level, with a potential fallback to $1.93 if unsuccessful.

XRP Coin ETFs Thrive

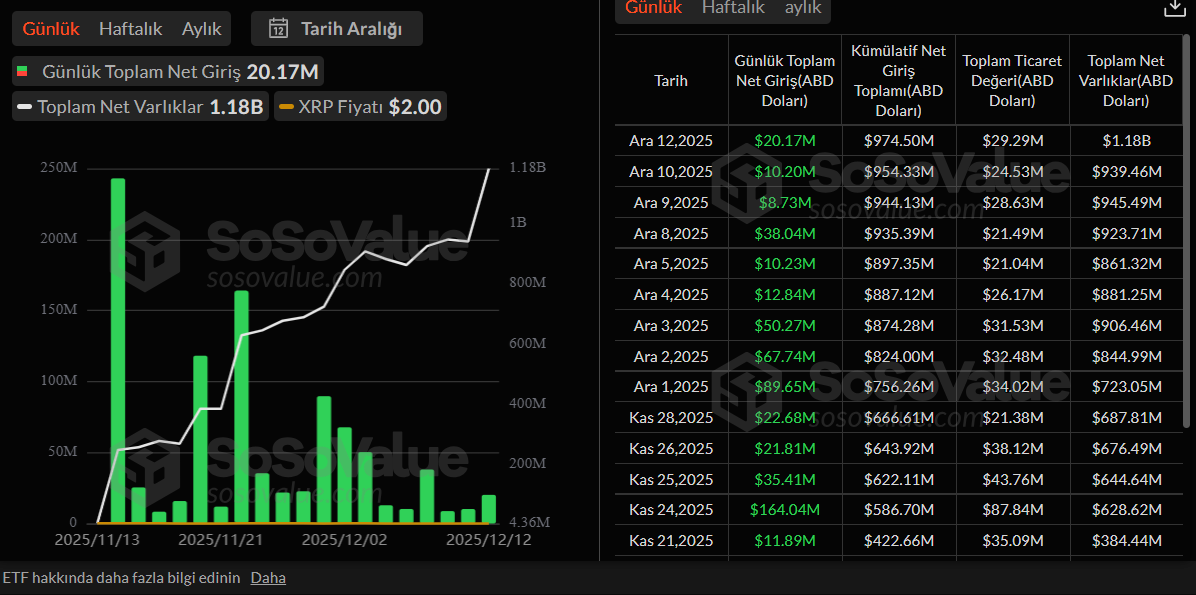

Regardless of the prevailing market sentiment for 19 days, XRP Coin ETFs have witnessed robust inflows. This trend indicates significant institutional interest in Ripple. According to data from SoSoValue, there was a total net inflow of $20.1 million on Friday, with overall inflows nearing the $1 billion threshold, and assets under the management of ETF products reaching $1.18 billion.

While the inflows haven’t matched the $243 million recorded on November 14, the stable inflow series is seen as encouraging. Giannis Andreou, founder and CEO of Bitmern Mining, remarked on the continuous inflows, noting that “Wall Street doesn’t stop,” which is a positive indication.

A recent announcement revealed that Ripple finally secured a banking license from the OCC. Ripple was among five brands including giants like Fidelity and Circle, pursuing a banking license after venturing into the crypto business. On Friday, the OCC granted the necessary licenses to them all.

Moreover, RLUSD surpassed the $1 billion mark this month, accelerating its growth. Bullish remains the leading platform for RLUSD usage, with Uniswap and Bybit following in popularity. The absence of Binance‘s support for RLUSD indicates further growth potential in this domain.