Santiment, a blockchain analytics firm, stated that XRP has seen a significant increase in on-chain volume as development activities surrounding cryptocurrencies continue to grow. Santiment’s reports make bold claims about the token.

Notable Increase in Ripple Metrics!

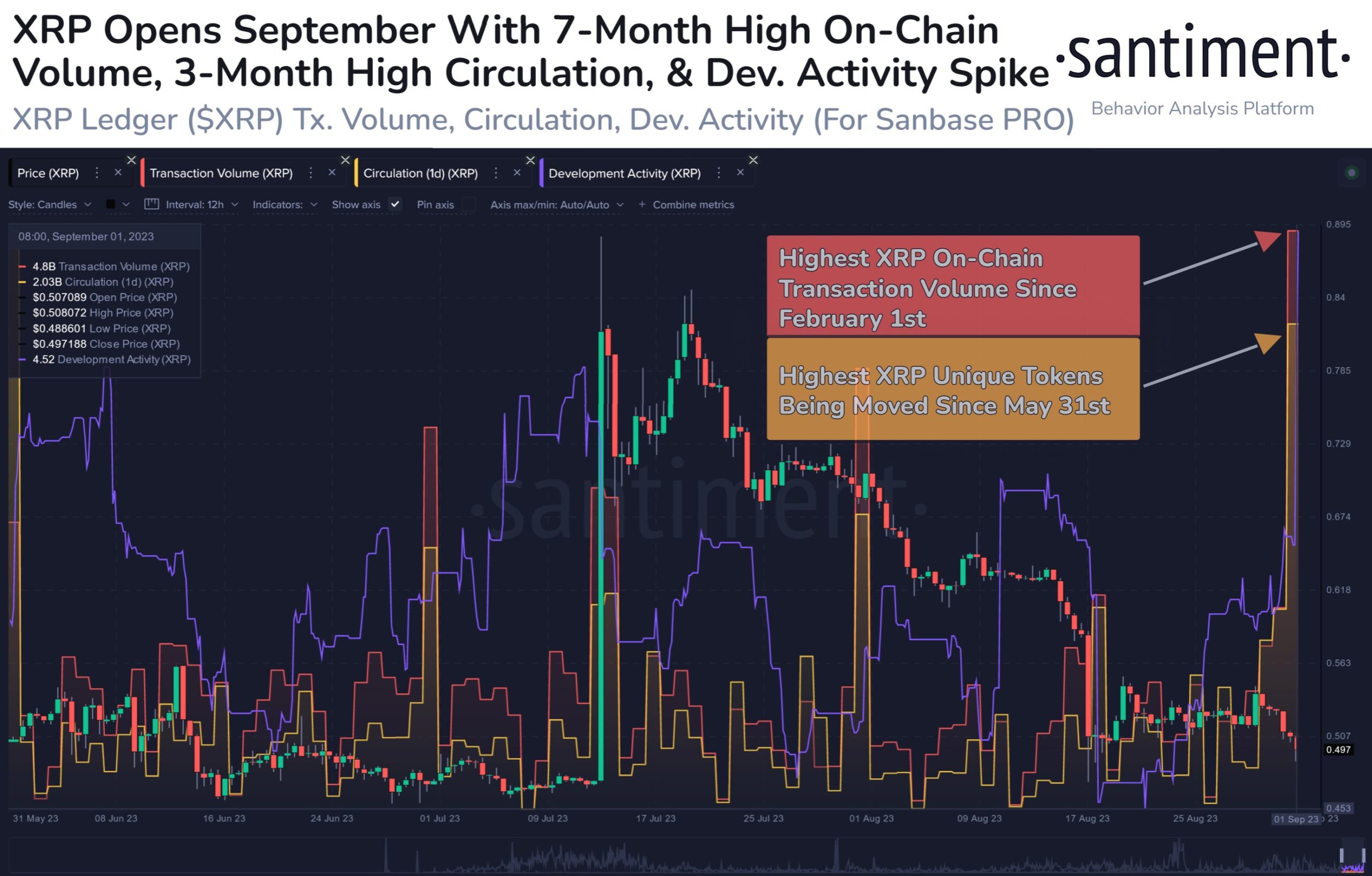

According to the market analytics platform, XRP, the token associated with Ripple Labs’ payment platform, started September with the highest on-chain volume since February 1, along with a significant increase in development activities. The analytic company stated the following:

XRP is experiencing significant growth to start the month. In addition to reaching all-time high levels of 4.8 billion XRP in on-chain transaction volume and 2.03 billion XRP in circulation, the fifth-largest asset in the crypto market also shows a significant increase in development activities.

After a lengthy legal battle with the U.S. Securities and Exchange Commission (SEC), XRP, which was deemed not a security in July, is currently trading at $0.496, representing a 1.09% increase at the time of writing. Santiment later suggested that the recent drop in Bitcoin‘s price, which has not been seen since June, was due to fear, uncertainty, and doubt (FUD) surrounding the potential rejection of spot market BTC.

Current Status of Bitcoin ETFs!

The analytics firm also notes that FUD continues even after the firm lost the lawsuit against Grayscale following SEC’s rejection of the cryptocurrency firm’s Bitcoin ETF proposal. The company stated the following:

BTC started September by dropping to $25,400, the lowest price level since June 16. Investors have growing concerns that even after Grayscale’s victory, SEC may not be willing to approve spot Bitcoin ETF. We expect FUD to dominate at least throughout the weekend.

Santiment also highlighted the accumulation of stablecoins by crypto whales, stating:

Whales are undecided about accumulating stablecoins. A tried and true method of predicting where the crypto market is headed is to analyze the percentage of stablecoins they hold in their large wallets. An increase in purchasing power will signal a surge.

Türkçe

Türkçe Español

Español