On August 7, Ripple’s price rose to $0.63, leading to speculation that the cryptocurrency might be on the verge of a significant breakout. However, this did not materialize as the price dropped to $0.59 at the time of writing. The previous price increase led investors to raise their predictions for contracts tied to the token, aiming to profit from the movement.

What’s Happening on the XRP Front?

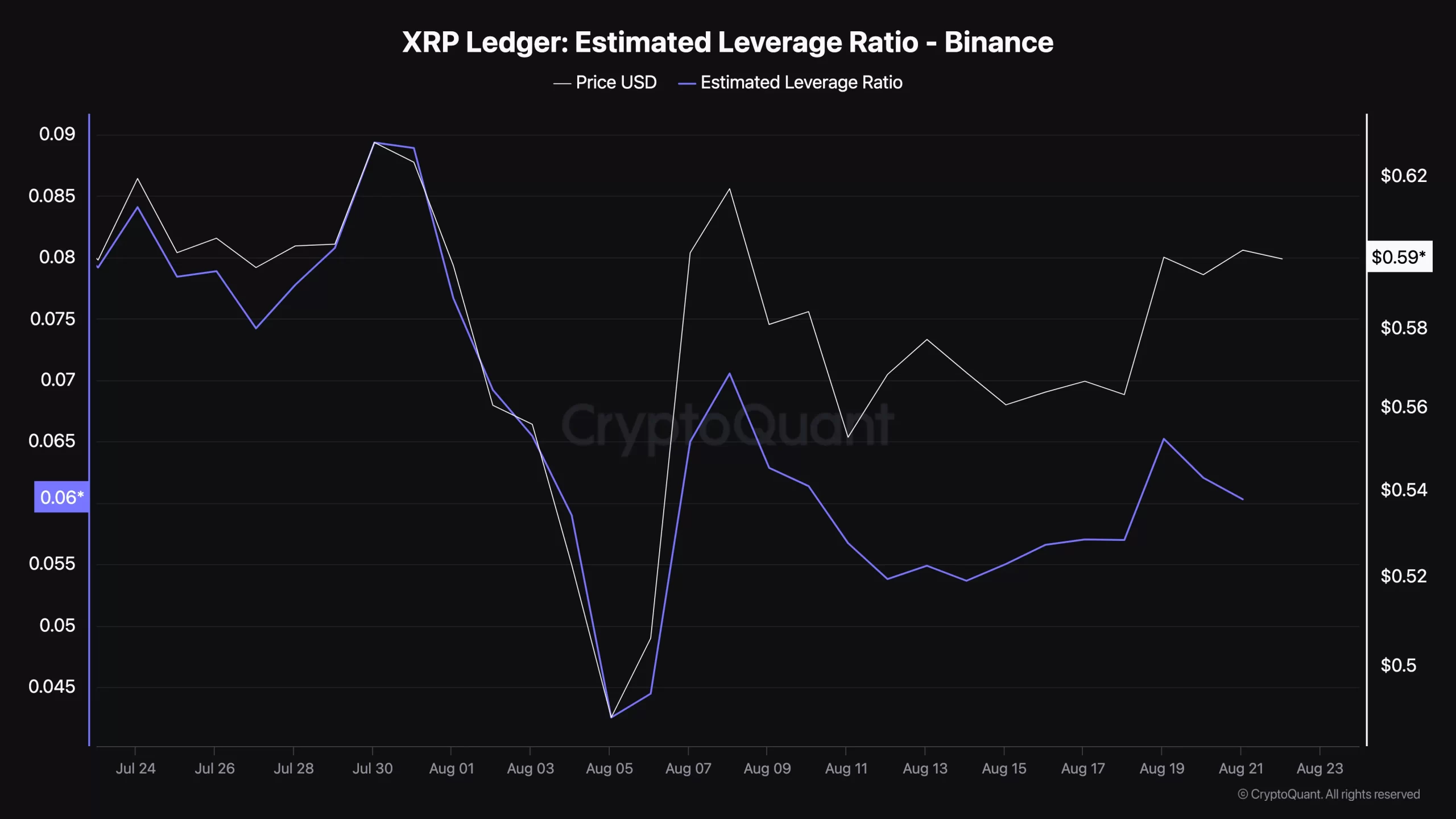

According to CryptoQuant, the XRP ELR ratio fell to 0.060. As the name suggests, ELR shows how much leverage investors use to speculate on their positions in the market. An increasing leverage ratio indicates that investors are making high-risk predictions in the market. This generally means confidence that the price will move in a certain direction.

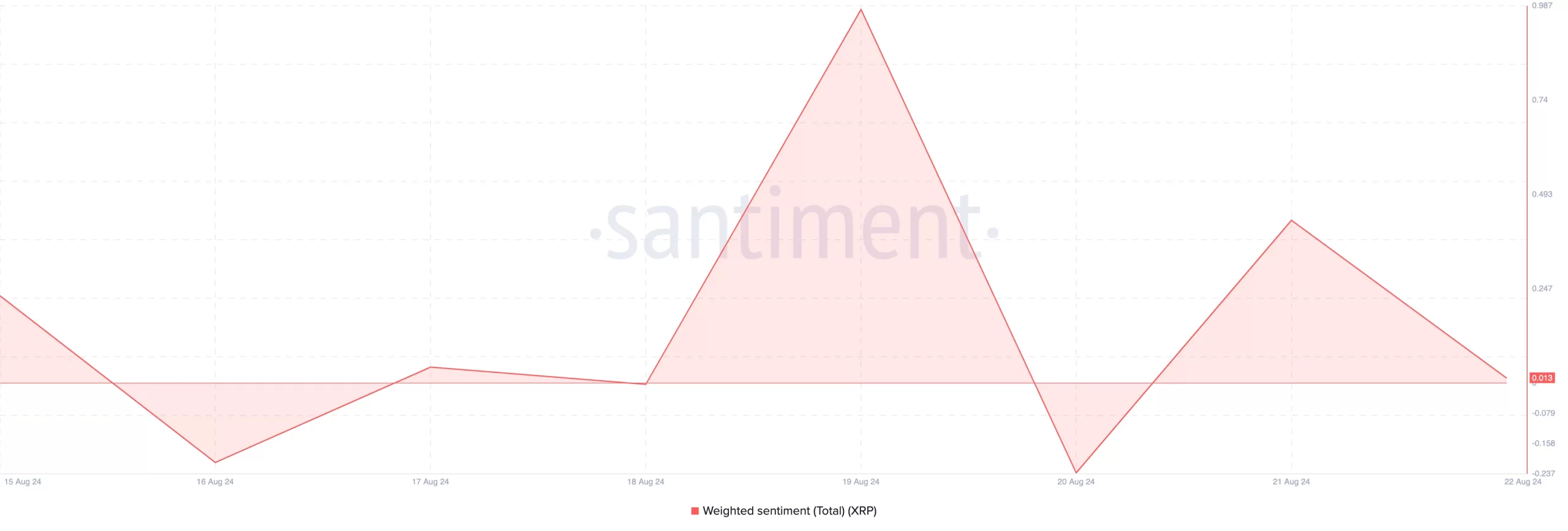

However, a decrease shows that investors are skeptical about the price movement. Instead of opening contracts with 25x, 50x, and 100x leverage, recent data shows they are being cautious to avoid liquidation. Weighted Sentiment measures how positive or negative market participants feel about a cryptocurrency.

When this data rises and remains positive, it indicates high confidence that the price will increase. Conversely, a negative reading shows pessimism in market sentiment. Currently, the data is approaching the negative zone, indicating a decline in bullish sentiment. If it falls further, demand for XRP may weaken, potentially leading to a price drop below $0.59.

XRP Chart Analysis

XRP’s price rise to $0.63 coincided with the partial resolution of the Ripple-SEC lawsuit. However, while market participants expected further increases, the cryptocurrency faced a failed breakout. As seen in the chart below, bulls managed to prevent XRP from falling below $0.55. However, the token may encounter resistance at $0.60, a critical psychological level. Interestingly, the Stochastic Relative Strength Index (Stoch RSI) showed an upward trend.

Stoch RSI measures a cryptocurrency’s momentum based on the speed and magnitude of price changes. The indicator typically signals overbought conditions when reading reaches 80.00 and oversold conditions when it falls below 20.00. For XRP, the Stoch RSI currently reads 87.24, indicating overbought conditions. This could potentially lead to a pullback, pushing the price back to $0.55. However, if buying pressure increases or the broader altcoin market rises, XRP’s price could climb towards $0.63.

Türkçe

Türkçe Español

Español