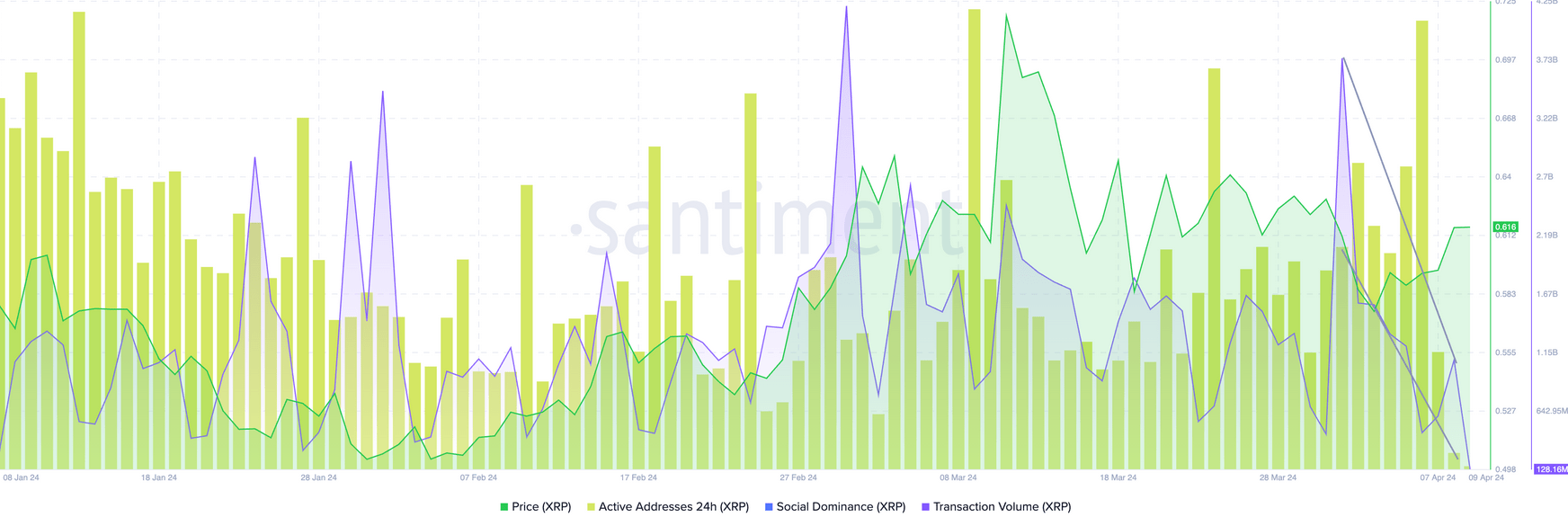

Cryptocurrency Ripple (XRP), one of the leading names in the crypto world, has been drawing attention with recent developments. The price of XRP, for the first time in a week, surpassed the $0.60 level on Monday and has risen to $0.61 today. However, XRP’s market-related activities indicate a generally sideways trend throughout April, which is concerning for investors.

Ripple (XRP) Trading Volume Decreases

Metrics reflecting Ripple’s on-chain activities and interest among traders, such as active addresses and trading volume, have seen a significant decrease recently. According to Santiment’s data, between April 1-8, the cryptocurrency XRP experienced a 36% reduction in active addresses and a 70% contraction in trading volume. This suggests a waning interest from market participants and a possible decline in demand for the altcoin XRP.

According to technical analysis, the cryptocurrency XRP’s price entered an uptrend after dipping to $0.5623 on April 4th. The rise observed in the 4-hour charts supported the breakthrough above the $0.60 level. As of Tuesday, the price of XRP reached $0.61.

When examining indicators, the green bars above the neutral line in the Awesome Oscillator and the Relative Strength Index (RSI) being above 50 support the recent gains of XRP, the sixth-ranked crypto asset, and indicate an increase in upward momentum.

What’s the Next Target in the Uptrend?

In the uptrend, the first target for the cryptocurrency XRP is Monday’s high of $0.6265. However, if it surpasses this level, it could encounter resistance at $0.65. The XRP price has not been able to break this resistance since mid-March 2024.

Nevertheless, the downside risks for XRP should not be overlooked. A candlestick close below the $0.60 level could weaken the bullish expectations and indicate a potential retracement towards the $0.5944 level.

Cryptocurrency XRP’s price could find support at its lowest level on April 4th, which was $0.5623. In light of all this data, how XRP will perform in the coming days is a matter that market participants will closely monitor. However, the decrease in trading volumes is a concerning situation for investors.

Türkçe

Türkçe Español

Español