Millions of people worldwide draw inspiration for investment and financial strategies from famous entrepreneur and author Robert Kiyosaki, who has recently made headlines again. Known for his work “Rich Dad Poor Dad,” Kiyosaki attracts attention with his bold stance and investment philosophy, especially during market crashes. His latest approach concerns what he would do if Bitcoin were to collapse.

What Will Robert Kiyosaki Do If Bitcoin Crashes?

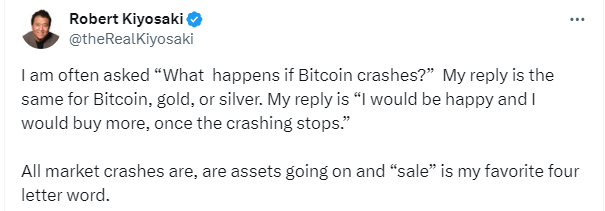

Kiyosaki recently clarified his stance on the cryptocurrency Bitcoin and potential crash scenarios through a post on social media platform X. His bold and unconventional approach turns the classic thought patterns of the investment world upside down.

In the event of a decline in the value of Bitcoin, the flagship of cryptocurrencies, Kiyosaki’s approach is quite interesting. He sees such a scenario not as a crash but as an opportunity. While other investors panic during market downturns, Kiyosaki looks for the advantage of acquiring assets at lower prices. For him, market crashes are actually the best times to apply the “buy low, sell high” philosophy.

Not Just BTC, Altcoins and Silver Too

It’s important to note that Kiyosaki’s strategy is not limited to Bitcoin. Other valuable assets like gold and silver are also on his radar. He views market downturns as suitable opportunities for buying and encourages investors to be courageous rather than fearful during these periods.

Kiyosaki’s perspective on crashes and Bitcoin not only reflects his investment strategies but also includes his criticisms of the current financial systems. He particularly levels harsh criticisms at the US Federal Reserve system, accusing it of deepening wealth inequality and protecting the interests of financial elites.

Approach May Spark New Debates

The forecasts and viewpoints of Kiyosaki could potentially spark debate in the financial world. While some see his warnings as alarmist predictions, others accept them as reflections of the current economic conditions.

However, Kiyosaki continues to move forward steadfastly in his beliefs, advocating that market crashes should be seen as investment opportunities. This stance also leads to him being referred to as a crisis prophet.

Türkçe

Türkçe Español

Español