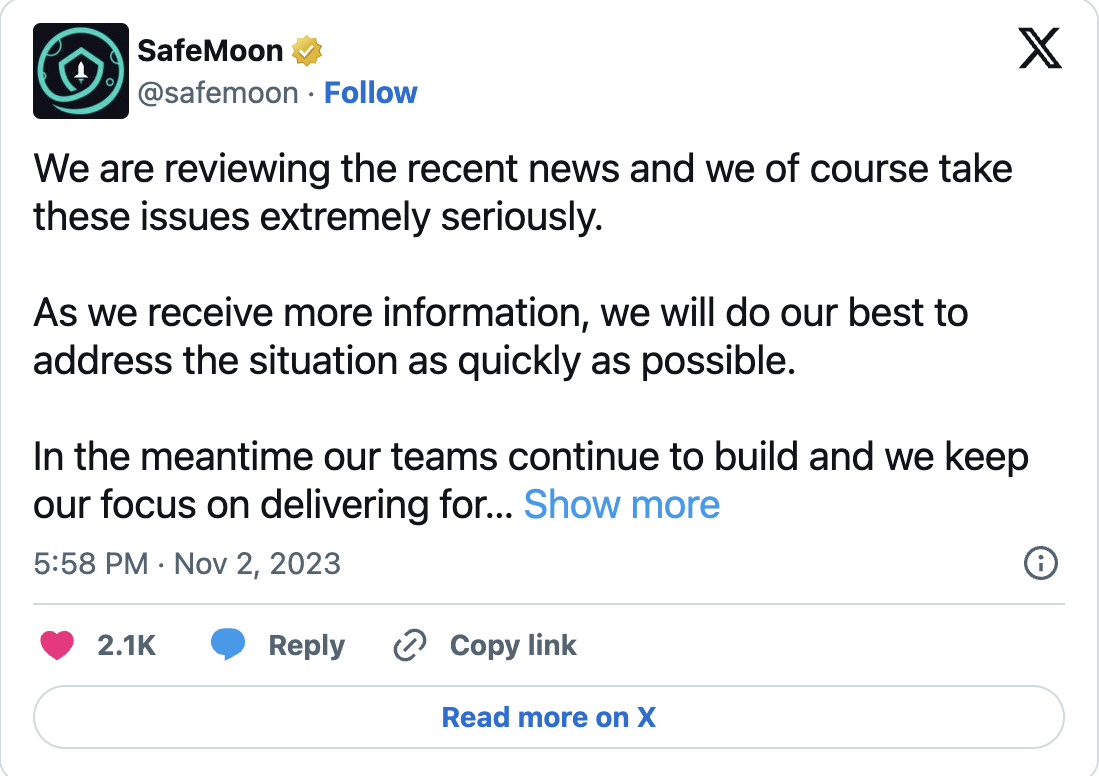

Decentralized finance project SafeMoon is being accused of security rule violations and fraud by the United States Securities and Exchange Commission (SEC). SafeMoon officials have stated that they are closely examining the recent developments and working to resolve these violations immediately. According to the officials, the platform developers are actively working and continuing to provide services to users.

What is Happening with SafeMoon?

SafeMoon was targeted in March, resulting in a net loss of $8.9 million in crypto assets on the BNB network. The lost crypto assets related to the security breach continue to be exchanged through centralized exchanges (CEXs). Blockchain analysis company Match Systems claims that these transactions carried out by the attackers could provide a significant clue for law enforcement.

According to an analysis by Match Systems analysts, the attack occurred through the smart contract on the SafeMoon platform. The hacker took advantage of a security vulnerability in SafeMoon’s contract related to the “Bridge Burn” feature, enabling the “burn” function for SafeMoon (SFM) tokens to be actively functional at any address.

Possible Developments through Centralized Exchanges

The actions of the hackers resulted in a rapid increase in the SFM token by transferring 32 billion SFM tokens from SafeMoon’s liquidity pool address to the distributor address. The hacker, taking advantage of the price increase, exchanged some SFM tokens for BNB at a volatile rate. This move ended with the hacker receiving 27,380 BNB in their address.

The analysis shared by Match Systems revealed that there were no security vulnerabilities in the previous version of the smart contract and that the attack occurred with the new update released on March 28. This development raised suspicions that someone from within the platform may have been involved in the incident.

Initially, the hacker claimed to have mistakenly targeted the protocol and expressed a request to establish communication to return 80% of the funds. Subsequently, the crypto assets associated with the attacks were subject to multiple transfers through centralized exchanges like Binance. Match Systems believes that these transfers could be crucial for law enforcement to track and apprehend the attackers.

Türkçe

Türkçe Español

Español