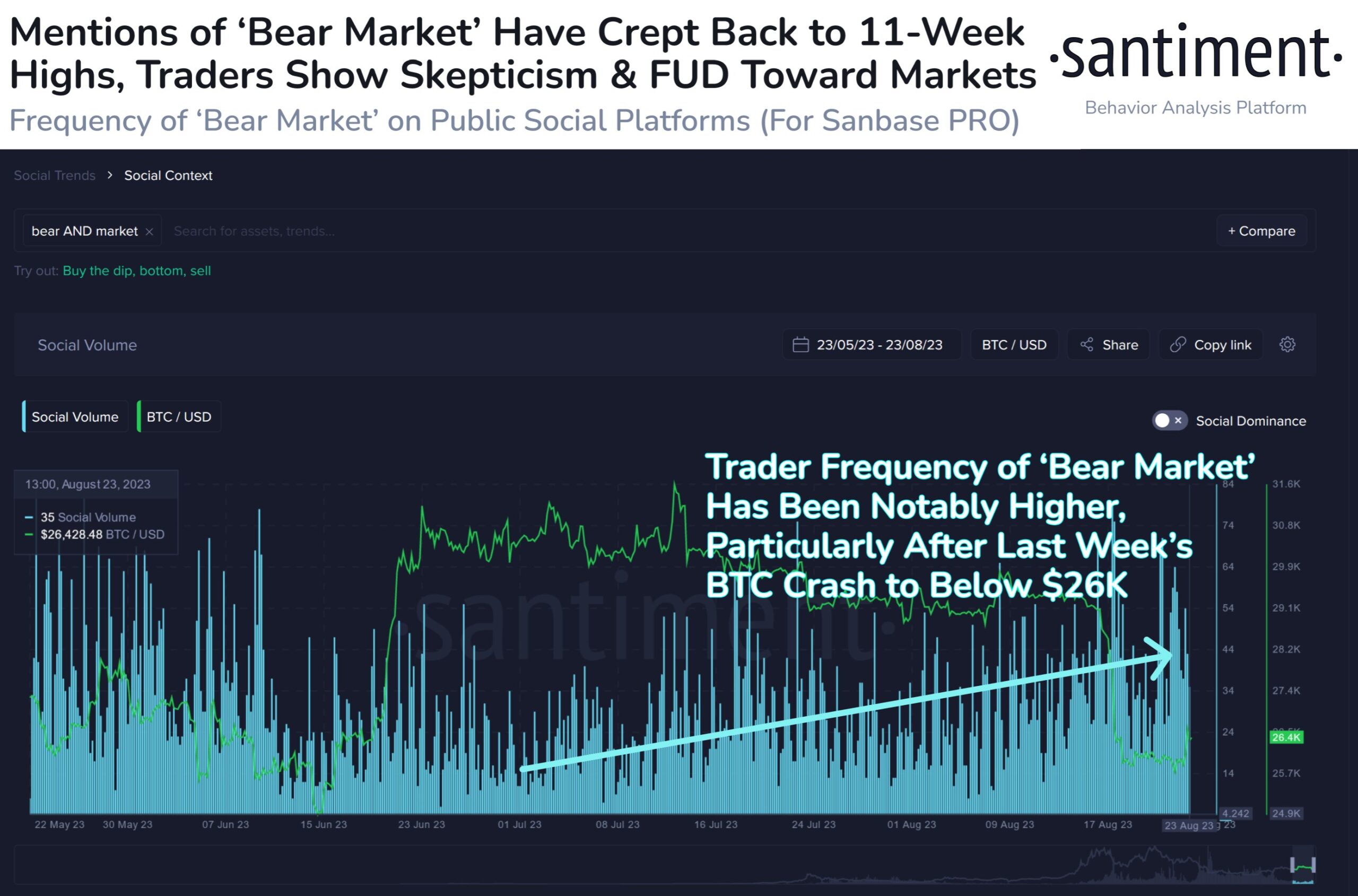

Blockchain analysis platform Santiment announced that an important social metric indicates a possible recovery in the crypto markets following the collapse. Leading analytics firm Santiment revealed its critical reports on Bitcoin and altcoins.

Santiment Reports!

Santiment claimed that the usage of the term “bear market” on social media platforms reached the highest level in 11 weeks, indicating a rise after Bitcoin’s sudden drop below $26,000. Santiment stated:

A positive sign that crypto markets will recover is the fact that investors increasingly refer to the current market conditions as a bear market. Historically, when investors show FUD (fear, uncertainty, and doubt), the likelihood of price increase significantly rises. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

According to the analytics firm, large-scale investors have started accumulating Bitcoin again, contributing to Wednesday’s rally.

Bitcoin surged up to $26,800 on Wednesday as significant whale and shark addresses added to their stacks once again. Currently, there are 156,660 wallets holding 10 to 10,000 BTC, accumulating $308.6 million since August 17.

Bitcoin is currently trading at $26,042, down 0.4% in the last 24 hours.

Santiment’s Altcoin Report!

Santiment also claimed that there are increasing concerns regarding the situation of the world’s largest crypto exchange Binance, including rumors of market manipulation that could affect Bitcoin’s price. The company stated:

Binance and BNB are currently the first and third fastest-rising topics in crypto. The main allegations suggest that Binance CEO Changpeng Zhao is actively selling his Bitcoin holdings to support his native tokens and keep it above key support levels.

Meanwhile, Bitcoin, which initiated a bullish momentum since the beginning of 2023, experienced a decline in recent weeks. The possible effects of the drop in the leading cryptocurrency are attributed to the United States’ interest rate decisions and efforts to combat inflation.

Türkçe

Türkçe Español

Español