Ethereum increased by approximately 4.5% in the last 24 hours, reaching $3,550 on June 19. Surprisingly, the main driving factor behind this rise was the decision by the U.S. Securities and Exchange Commission (SEC) to end its investigation into Ethereum. Today’s price increase comes in response to the SEC’s decision to conclude its investigation into whether Ethereum should be classified as a security.

Why is Ethereum Rising?

Ethereum developer ConsenSys announced in a post on X on June 19 that the SEC’s Enforcement Division had closed its investigation into Ethereum 2.0, adding that this was a significant win for Ethereum developers, technology providers, and industry participants.

Interestingly, the SEC’s decision allowed firms like VanEck, BlackRock, and Fidelity to approve their 19b-4 applications, enabling spot Ethereum ETF funds to be listed and traded on relevant exchanges.

Bloomberg analyst Eric Balchunas predicts that Ethereum ETF funds will open for trading on July 2. K33 Research also forecasts that these investment products will attract $4 billion in inflows within the first five months of their launch, indicating strong demand for Ethereum soon.

Key Data Points

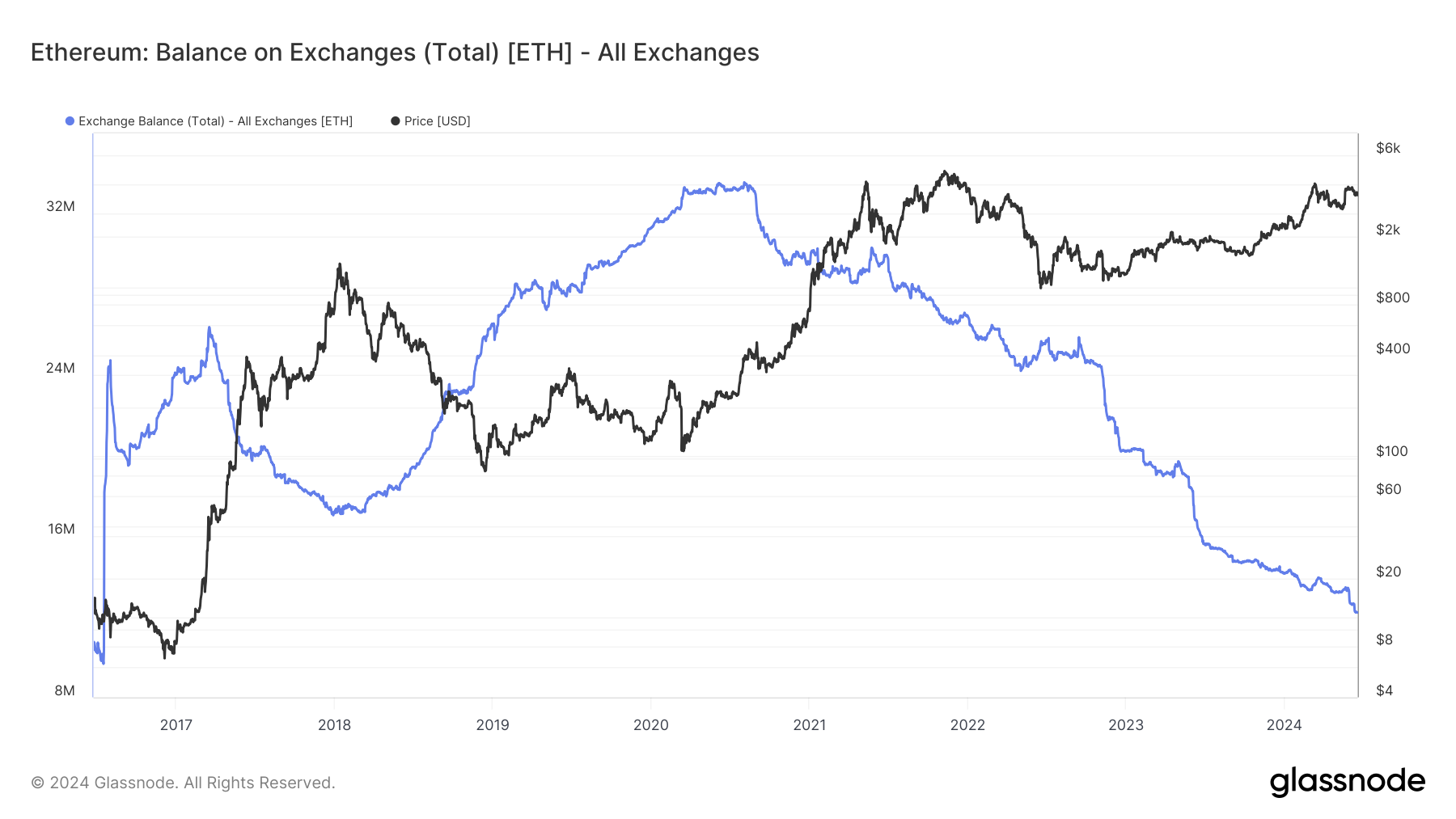

According to blockchain data analysis platform Glassnode, the total number of Ethereum held by all crypto exchanges fell below 12.20 million on June 18, reaching its lowest level since July 2016.

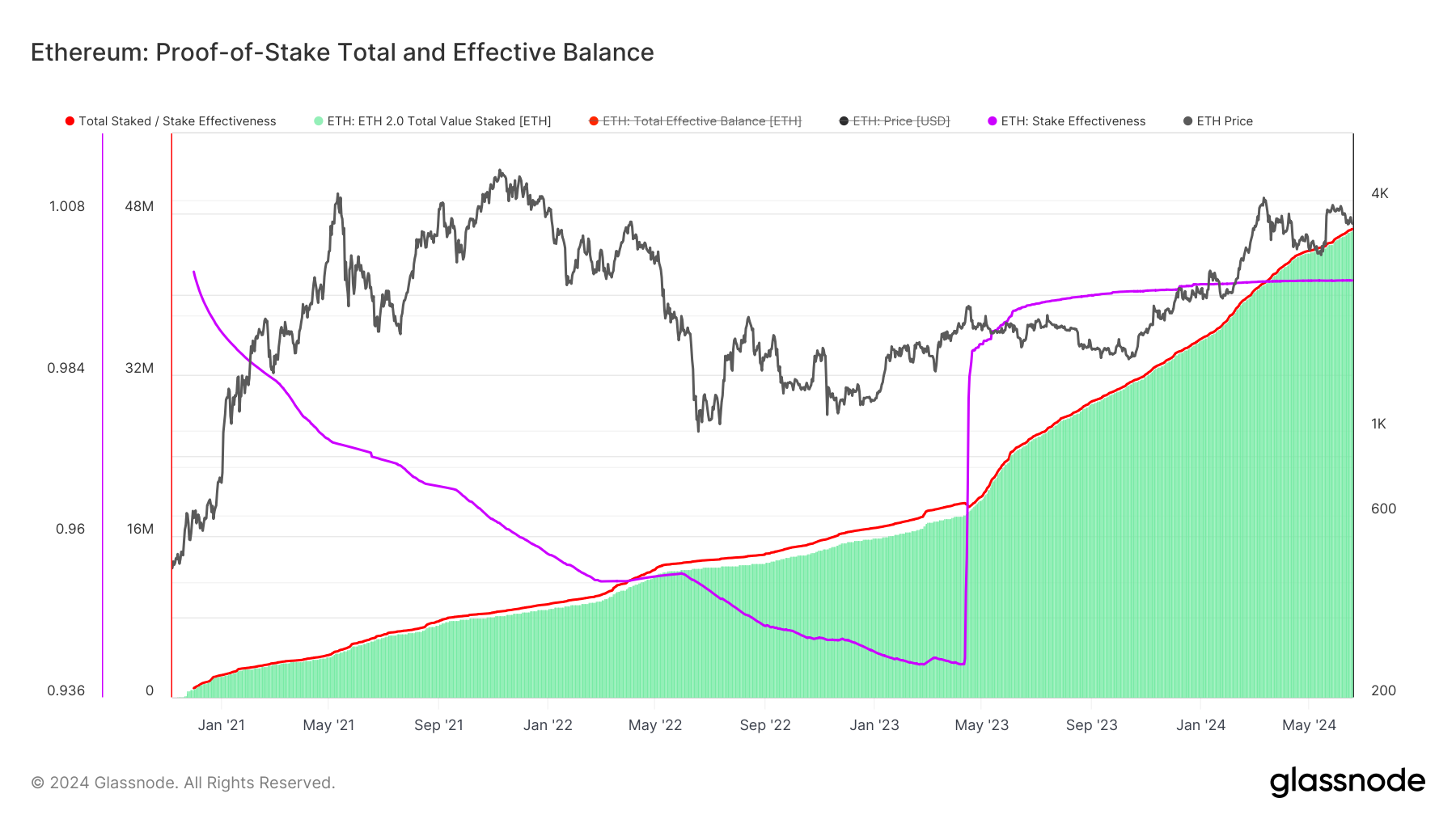

The increase in Ethereum withdrawals from crypto exchanges aligns with the cryptocurrency’s price rise, indicating reduced selling pressure and a preference for holding Ethereum in private wallets or decentralized protocols. For example, the official Ethereum staking address has steadily increased its holdings since its launch in December 2020, surpassing 46.418 million Ethereum as of June 19, nearly four times the amount held by exchanges.

Despite having the option, most users have not withdrawn their staked Ethereum, indicating that they prefer the stability and rewards of staking over selling. This suggests a bullish trend for Ethereum prices in the coming weeks.