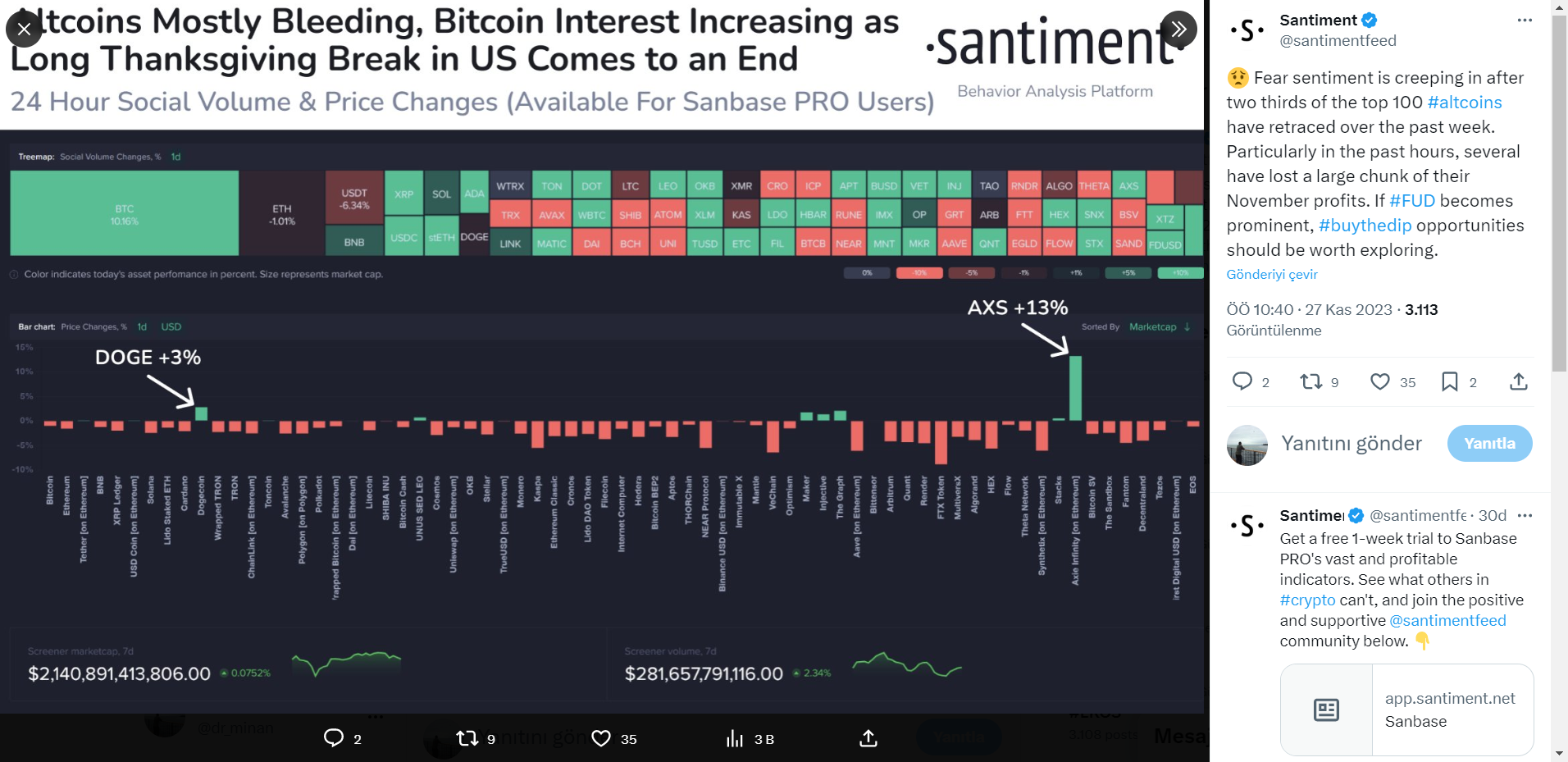

In the constantly fluctuating environment of cryptocurrencies, the sentiment of fear is gaining ground as two-thirds of the top 100 altcoins experienced pullbacks over the past week. Recently, many assets have seen significant losses of their November gains. In this volatile market, knowledgeable investors are monitoring potential “buy the dip” opportunities and acknowledge that strategic moves during fear-driven moments can yield valuable returns.

Capturing Buy-the-Dip Opportunities Amid Altcoin Volatility

Comments on the matter came today from Santiment. According to Santiment, as fear sentiment permeates the cryptocurrency market, it brings both challenges and opportunities. Altcoins, which have recently witnessed pullbacks, offer attractive entry points for investors looking to benefit from short-term market fluctuations.

Mastering the art of successfully buying the dip involves identifying fundamentally strong assets that are experiencing temporary price declines and are poised for recovery. Santiment’s mention of Fear, Uncertainty, and Doubt (FUD) indicates a sense of caution among market participants.

While feelings of fear can trigger panic selling and market downturns, experienced investors see this as a potential opportunity for strategic moves. By distinguishing between short-term market noise and long-term value, investors can position themselves to benefit from the inherent volatility in the crypto space.

Key Considerations for Investors Amid Fear-Driven Trends

During times when fear sentiment prevails, it is very important for investors to conduct thorough research by assessing the underlying strength of the assets in question. Santiment indeed emphasizes this point.

When fundamental analysis is combined with understanding market dynamics, it enables investors to make informed decisions in turbulent conditions. Additionally, setting predefined entry points and risk management strategies is crucial to overcoming uncertainties in the market.

In the world of cryptocurrencies, fear is an integral part of the market cycle. While this situation brings challenges, it also opens the door for resilient investors to benefit from opportunities that arise during pullbacks. As Santiment highlights the fear-driven narrative, those with a strategic perspective during potential downtrends will position themselves well to navigate current fluctuations and reap rewards in the evolving crypto landscape.