The popular memecoin Shiba Inu (SHIB) has witnessed a significant surge in coin burn activities, with approximately 34 million SHIB coins burned as of April 9. This development has reignited expectations that a decrease in supply could positively impact prices. However, market reactions remain uncertain, and investors are approaching the situation with caution.

Coin Burn Rate Soars as Supply Decreases

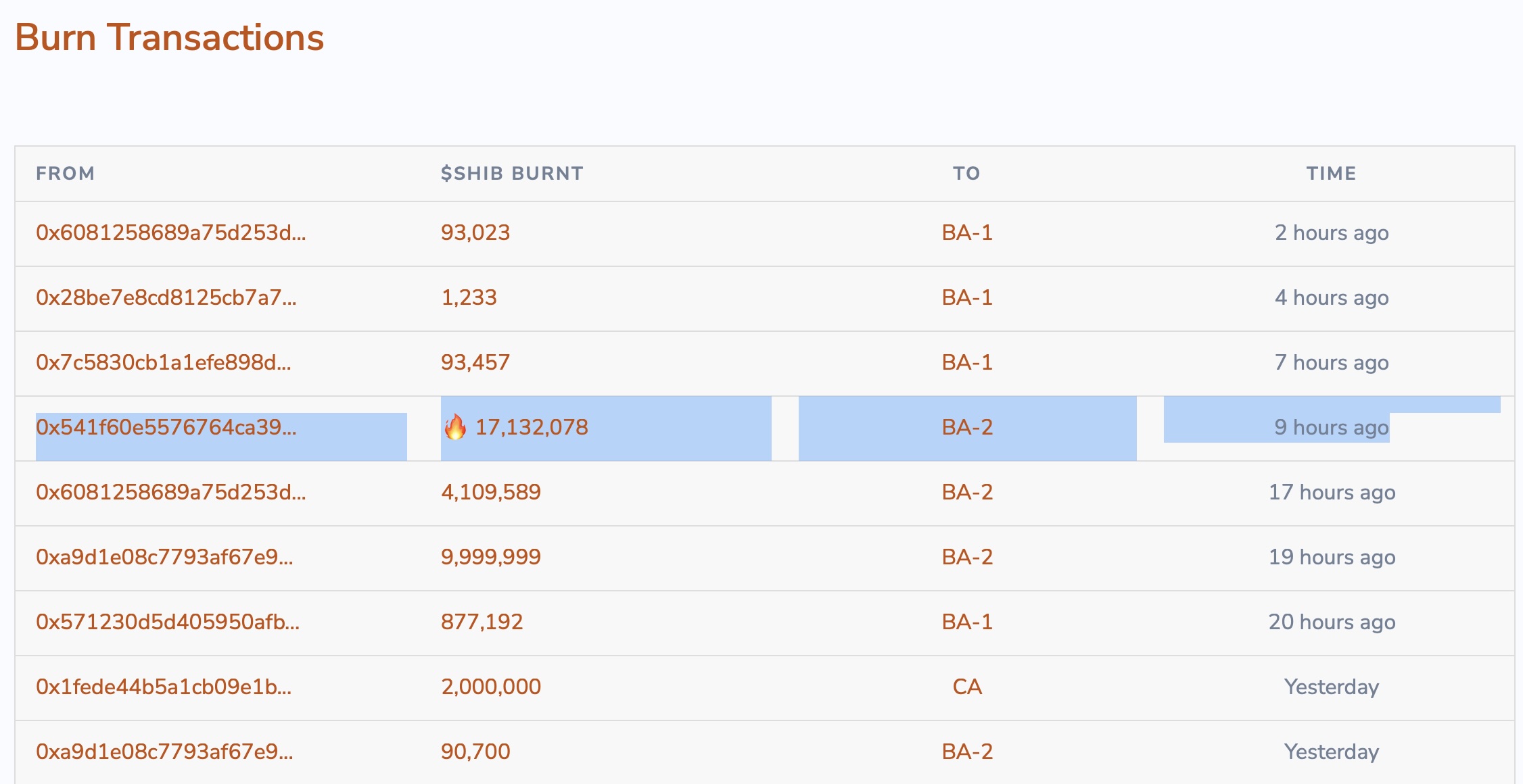

According to Shibburn data tracking the coin burn processes for Shiba Inu, a total of 34.21 million SHIB coins were burned in the last 24 hours. This move has resulted in a staggering 1,538% increase in the hourly coin burn rate. The rising coin burn volume, especially in recent days, is being closely monitored by investors for its effects on supply-demand dynamics. Experts suggest that such coin burning actions could exert upward pressure on the altcoin‘s price in the long term.

Shiba Inu began with a total supply of 999 trillion coins, of which 410.73 trillion have been burned to date. Currently, there are 584.36 trillion coins in circulation. Notably, the recent coin burn transactions highlighted the wallet address “0x541f60e5576,” which alone burned 17.13 million SHIB coins, significantly contributing to the process.

While Prices Drop, Optimism Grows

Despite the increase in the coin burn rate, Shiba Inu’s price has seen a notable decline. The altcoin has lost over 50% of its value since the beginning of the year, dropping from $0.00002 to $0.00001. Currently, SHIB is trading with a daily drop of 5%, a weekly drop of 10%, and a monthly drop of 12%. Some market analysts believe this downward trend might be temporary.

Crypto analyst Javon Marks predicts that SHIB’s price could potentially rise by up to 550% in the long term, projecting a target level of $0.000081. Marks’ forecast is viewed as a beacon of hope for investors amidst the ongoing reduction in supply. However, external factors significantly influencing the price targets are critical.

Amid macroeconomic uncertainties, international trade tensions, and vulnerabilities in the global financial system, there is a heightened perception of risk across the cryptocurrency markets. While developments like coin burns are welcomed for limiting supply, they do not provide sufficient confidence regarding price movements. Most SHIB investors maintain a cautiously optimistic view of potential price increases.

Experts agree that the steady decrease in the circulating supply of the coin may create upward momentum in the medium to long term. However, short-term price fluctuations and investor behavior can directly impact the speed and effectiveness of this process. Therefore, analysts emphasize the importance for investors to monitor both technical data and global developments simultaneously.

Türkçe

Türkçe Español

Español