Crypto-focused investment products witnessed a surprising period last week. Small outflows exceeding $126 million seemed to boost the pulse of this world, yet a halt in positive price momentum caused a wave of hesitation among investors. The increase in volumes might be notable, but the decline in ETP/ETF activities offers a significant clue about the uncertainty investors are facing.

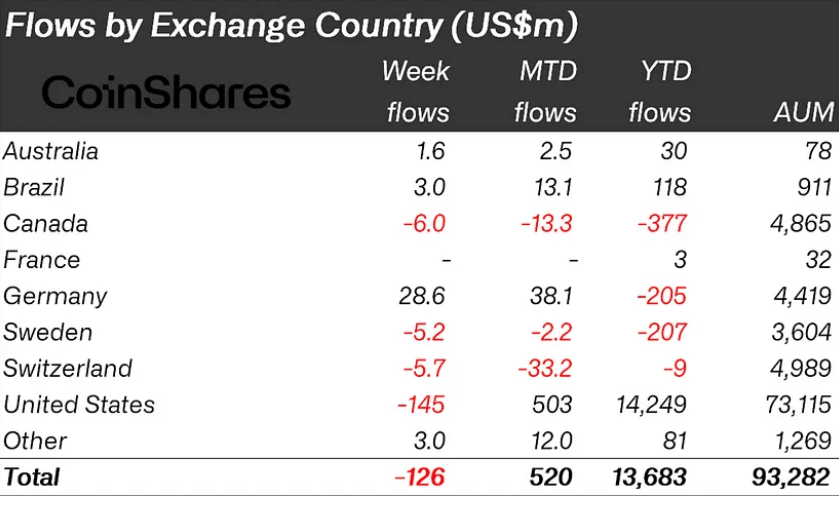

How is the Situation Geographically?

Geographically, the US experienced the largest outflow during this journey. This $145 million outflow appears to reflect the declines in cryptocurrency values last week.

Following the US, Switzerland and Canada recorded outflows of $5.7 million and $6 million, respectively. Investors in Germany, on the other hand, saw the price weakness as an opportunity and made an entry of $29 million.

Despite Outflows, Bitcoin Remains Strong

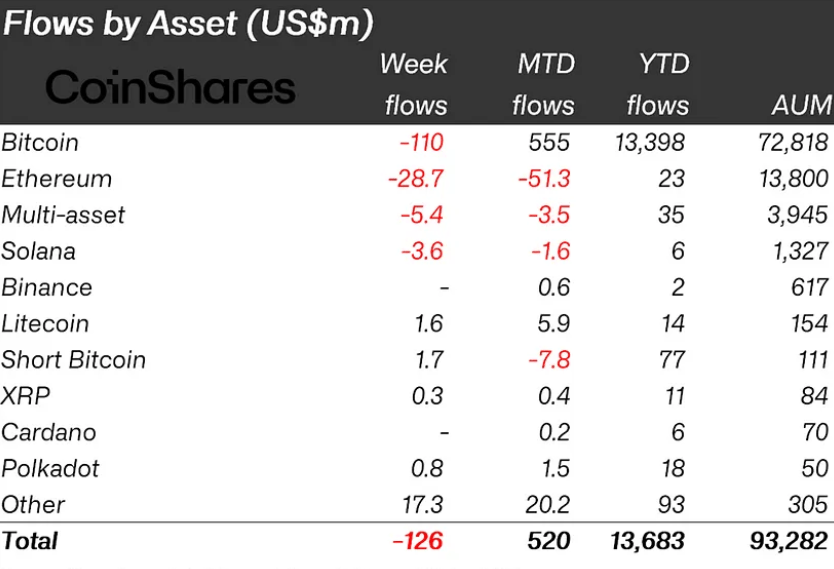

Bitcoin saw an outflow of $110 million, which might have surprised some of us. However, a positive inflow of $555 million since the beginning of the month still shows strong institutional interest in BTC.

Bitcoin focused on short positions, was perhaps one of the most affected by the recent price drops, ending a 3-week outflow streak with small entries totaling $1.7 million.

While Ethereum and Solana Continue to See Outflows, These 3 Altcoins Attract Attention

Ethereum was the biggest loser in this area last week, with an outflow of $29 million, continuing its losses for the fifth consecutive week. On the other hand, Solana also saw an outflow of $3.6 million.

Last week’s interesting data came from lesser-known but still notable altcoins. Decentraland, Basic Attention Token, and LIDO attracted attention in the crypto space with inflows of $4.9 million, $2.9 million, and $1.8 million, respectively.

Türkçe

Türkçe Español

Español